List of online sweepstakes casinos in November 2025

- More details

- Show less

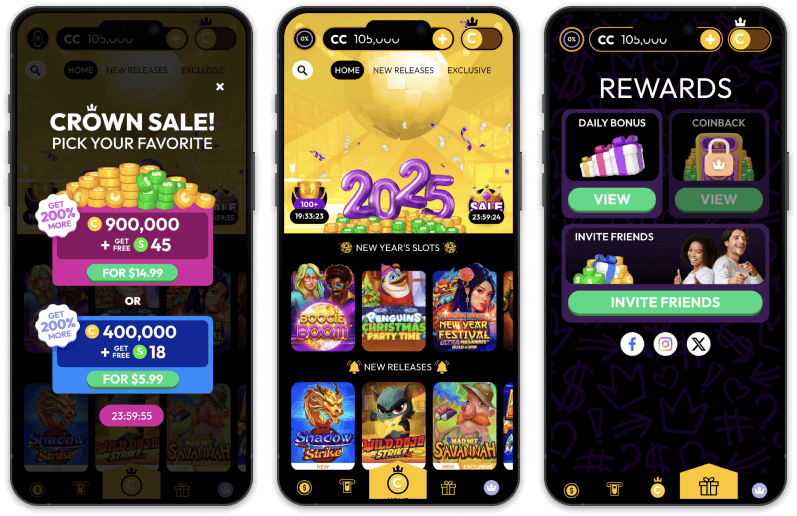

- Crown Coins Benefits

- Over 100K+ reviews on Trustpilot

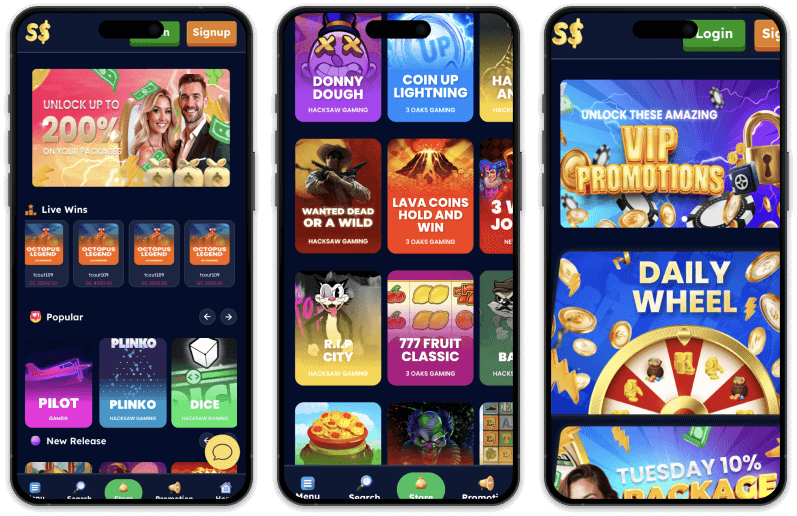

- Best sweepstakes iOS app

- 100K CC + 2 SC sign-up bonus

- Crown Coins Review

- More details

- Show less

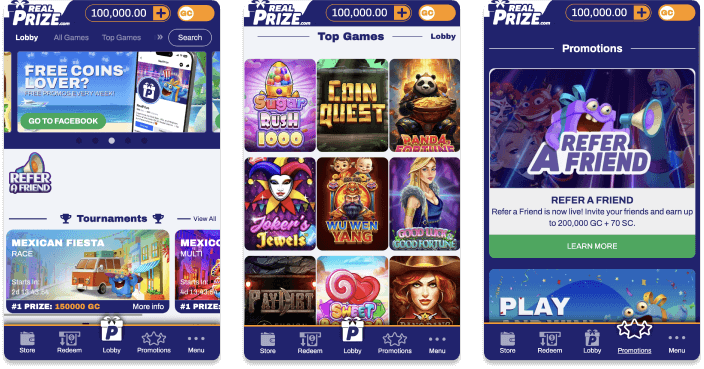

- RealPrize Benefits

- Enjoy over 700 games

- Excellent loyalty cards program

- Free SC in daily login bonus

- RealPrize Review

- More details

- Show less

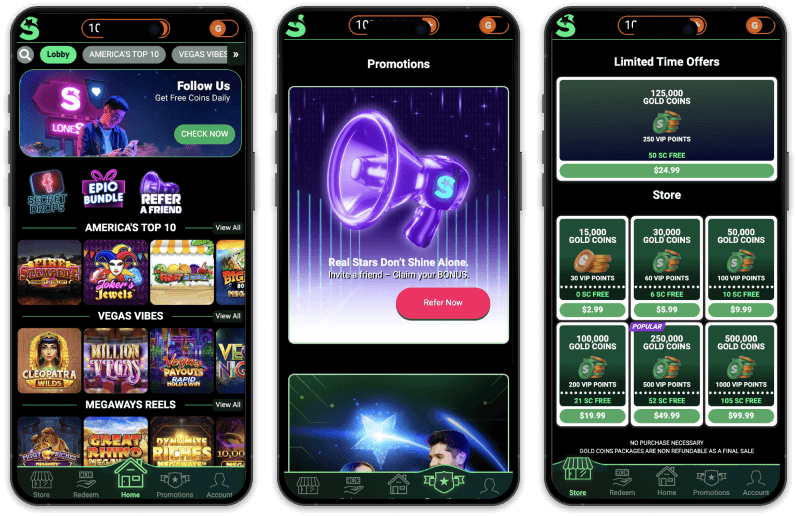

- LoneStar Casino Benefits

- Social media daily bonus drops

- 100K GC + 2.5 SC sign-up bonus

- Excellent VIP program

- LoneStar Casino Review

- More details

- Show less

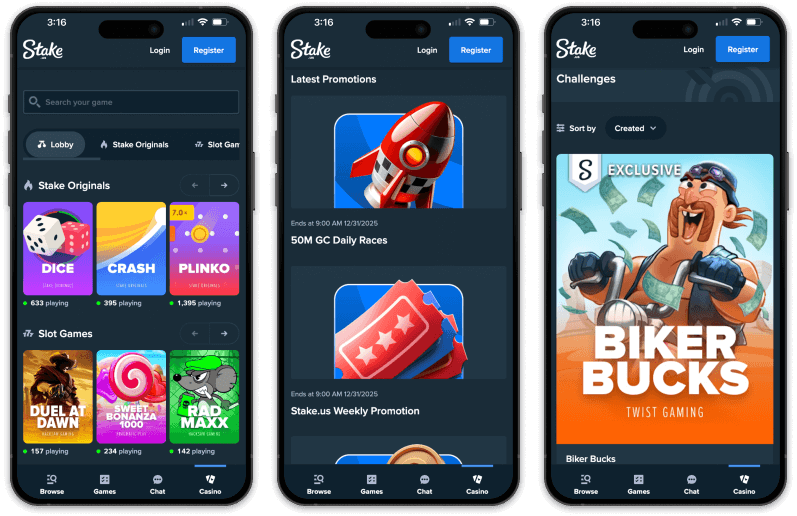

- Stake US Benefits

- 2,000+ games from 20 providers

- Stake Original + Exclusive games

- Instant redemptions

- Stake US Review

- More details

- Show less

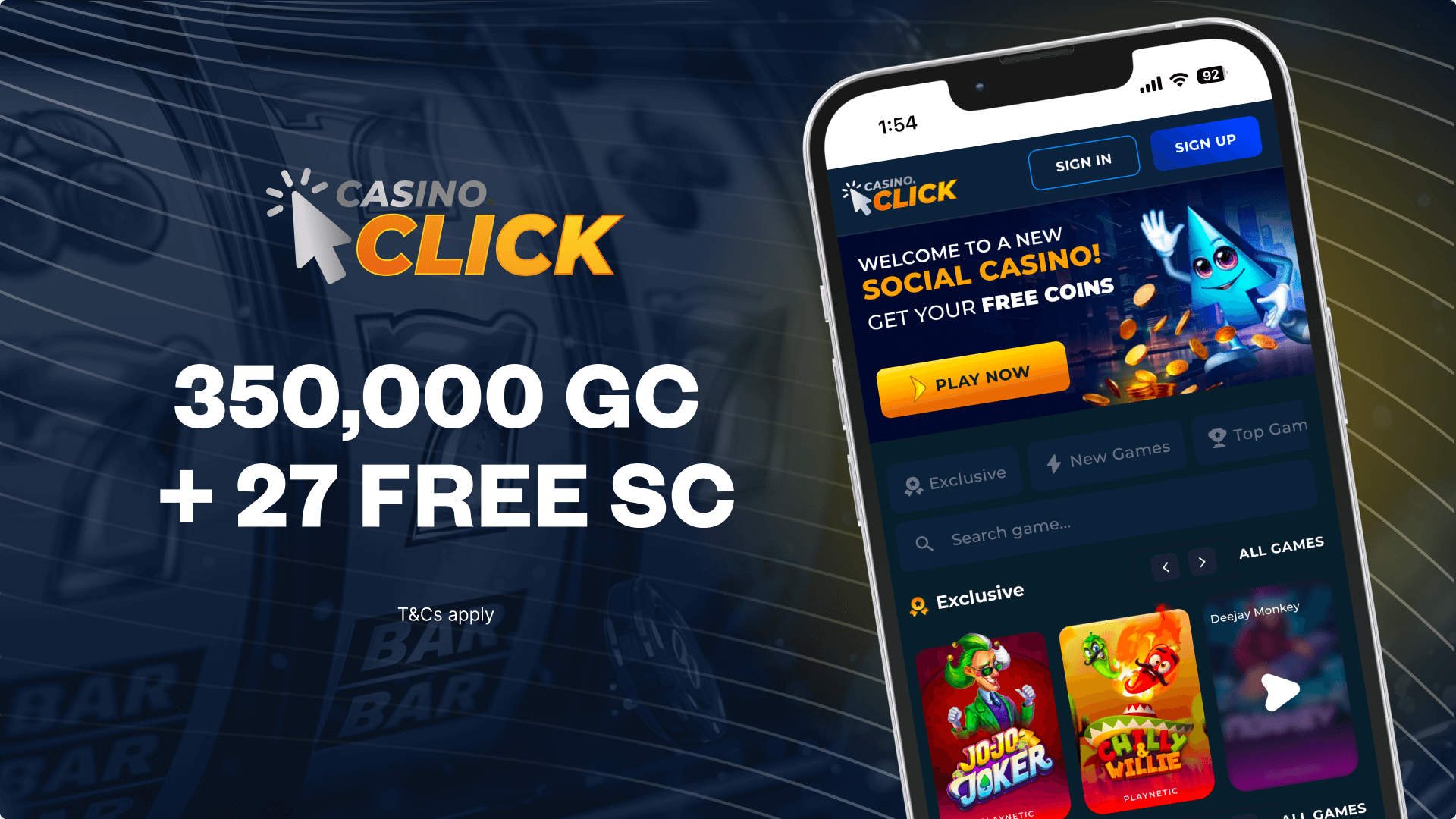

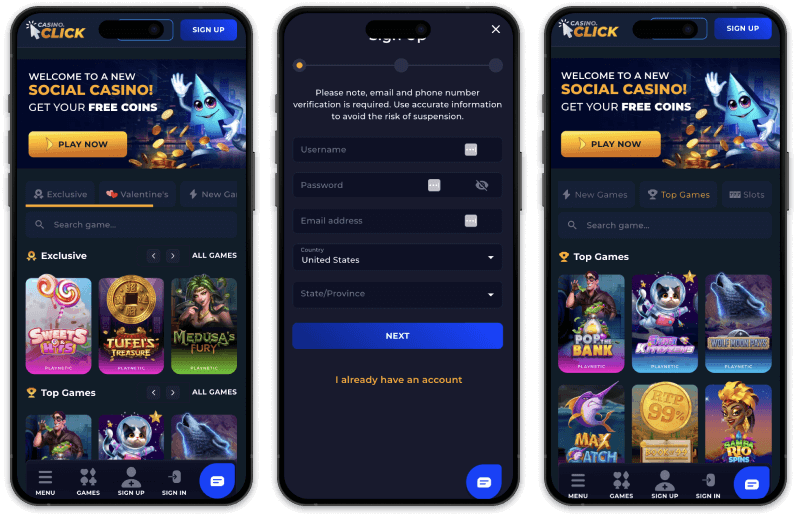

- Casino.click Benefits

- Accepts crypto and fiat currency

- Available in 45 U.S. states

- 3 FREE SC with mail-in bonus

- Casino.click Review

- More details

- Show less

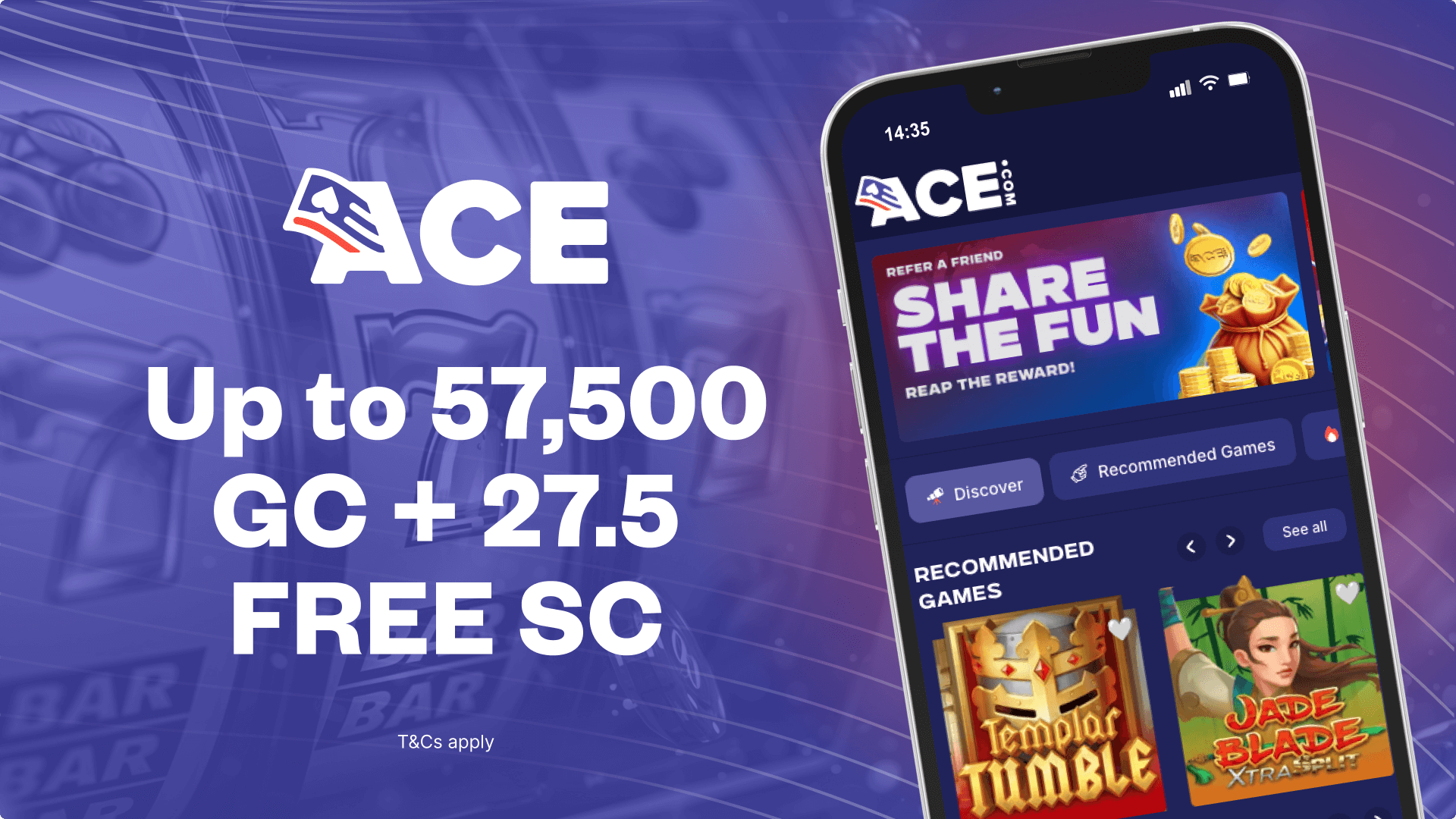

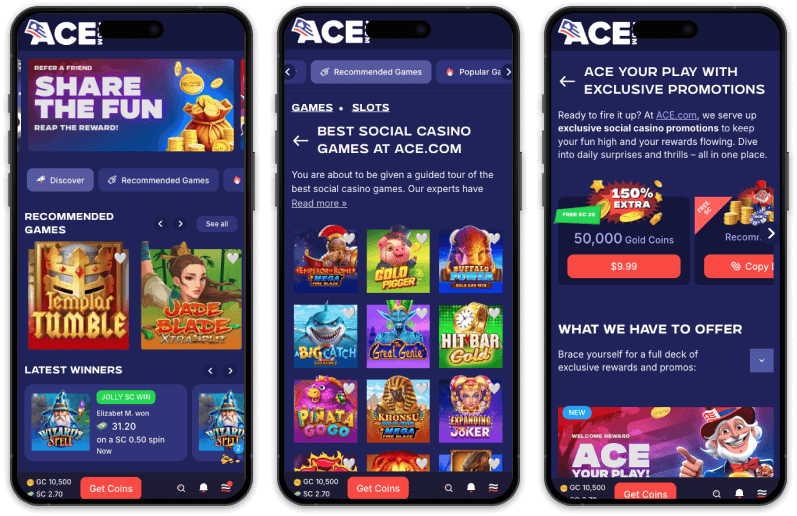

- Ace Benefits

- Daily Reward Wheel to earn extra SC

- Full range of support (24/7 live chat, email, phone)

- 70+ Hold & Win titles

- ACE.com Casino Review

- More details

- Show less

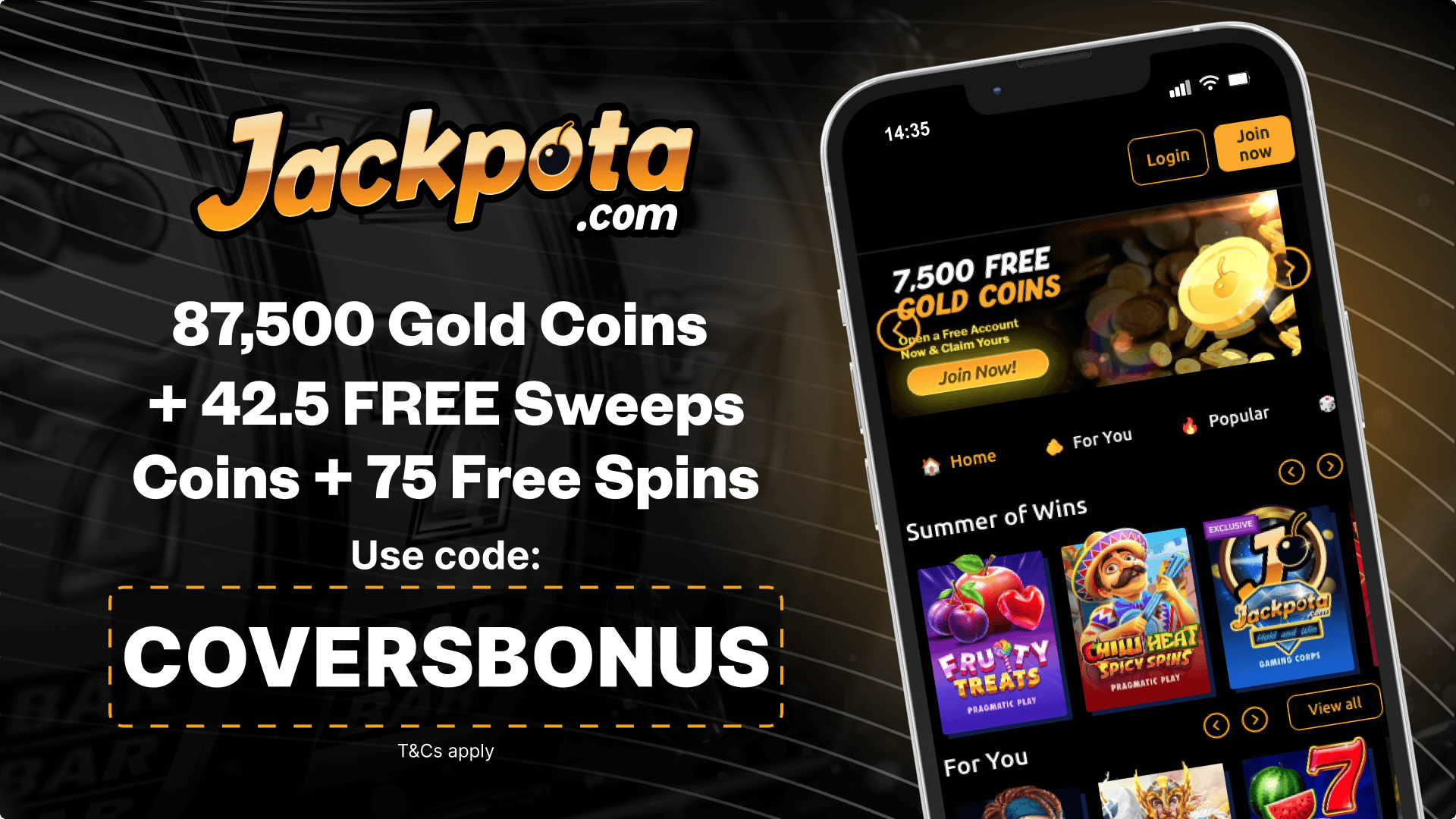

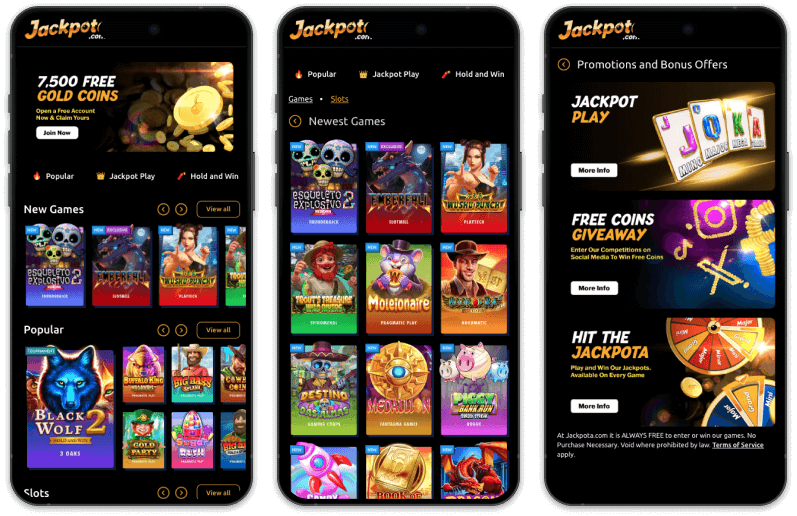

- Jackpota Benefits

- 700+ online slots

- 48-hour redemption

- Progressive jackpots

- Jackpota Review

- More details

- Show less

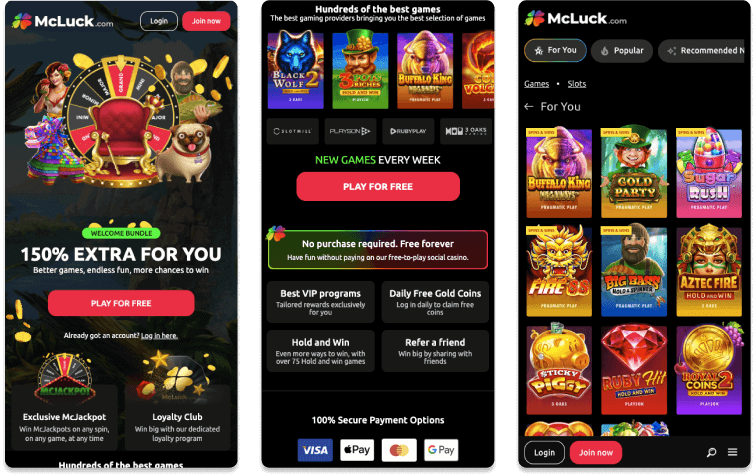

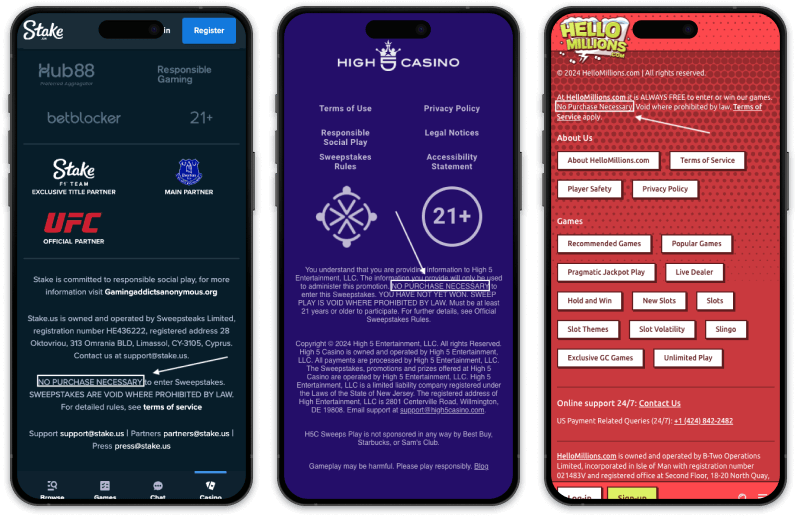

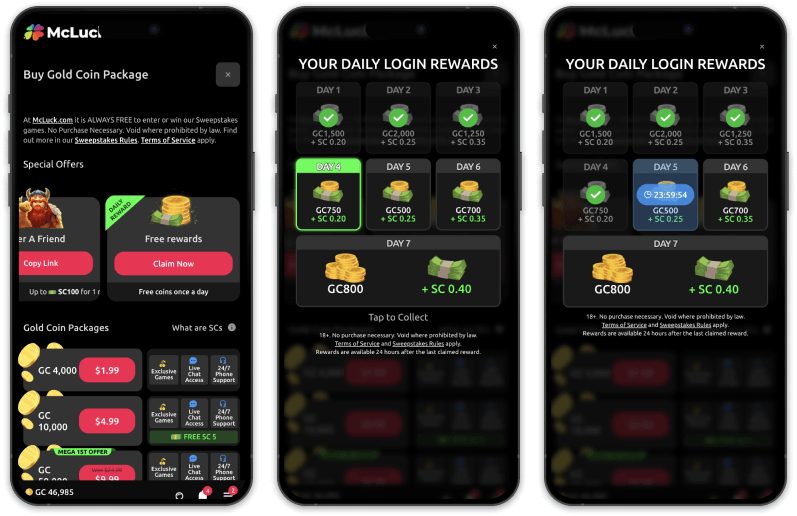

- McLuck Casino Benefits

- First-purchase bundle 150% more coins

- Excellent sweepstakes app

- Bundles available from $1.99

- McLuck Review

- More details

- Show less

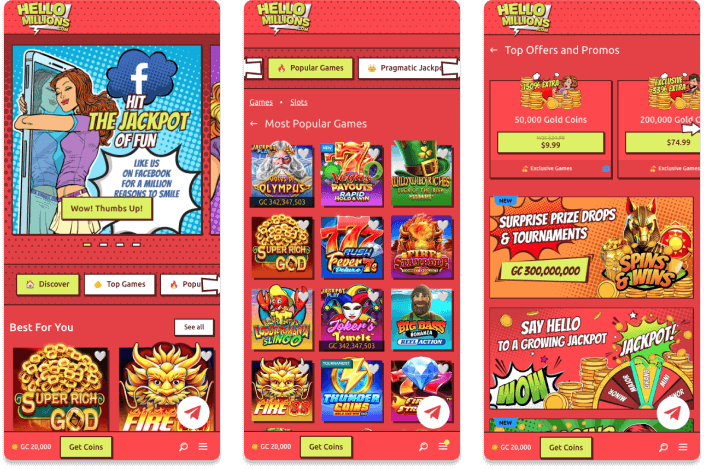

- Hello Millions Casino Benefits

- RTP over 97% on many slots

- More than 1,300 games

- Relatively low redemptions from 10 SC

- Hello Millions Review

- More details

- Show less

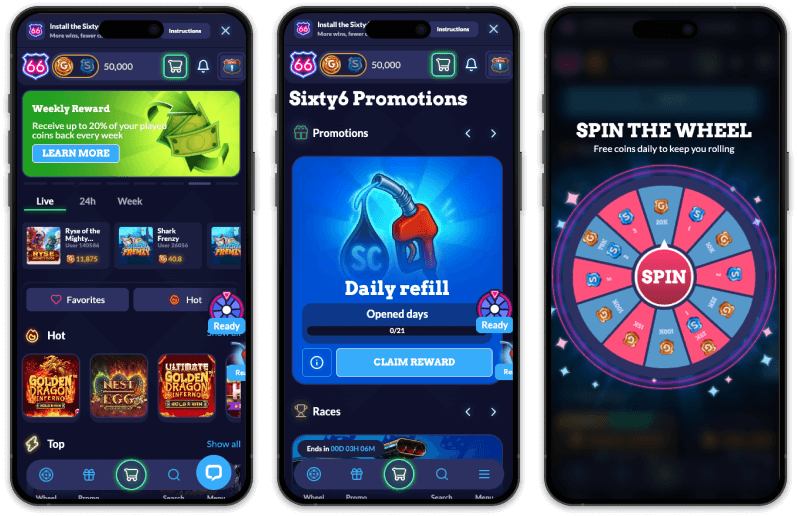

- Sixty6 Casino Benefits

- Weekly coinback rewards up to 20%

- Free live chat support available

- Spin Fortune Wheel for free daily coins

- Sixty6 Casino Review

- More details

- Show less

- NoLimitCoins Casino Benefits

- Daily free bonuses

- High winning percentage

- Convenient withdrawal of winnings

- NoLimitCoins Review

- More details

- Show less

- Spree Benefits

- Gold Coin bundles start at $0.99

- Retention campaigns

- Daily login bonuses

- Spree Casino Review

- More details

- Show less

- Funrize Casino Benefits

- Generous welcome bonus

- Exciting tournaments and races

- Amazing VIP program

- Funrize Review

- More details

- Show less

- Legendz Benefits

- Over 250 slots from 10+ providers

- Exciting live casino powered by Live 88

- First-purchase bonus gives you 100% more coins

- Legendz Casino Review

- More details

- Show less

- SweepNext Benefits

- Frequent GC and SC tournaments for slot players

- Free live chat and email support around-the-clock

- Get 20,000 GC + 2 FREE SC on sign up

- SweepNext Casino Review

- More details

- Show less

- SpeedSweeps Casino Benefits

- Over 1,300 slots and table games

- Daily Wheel and Faucet bonuses

- Multiple weekly package boosts

- SpeedSweeps Casino Review

- More details

- Show less

- Fortune Coins Benefits

- 1,500+ games

- Generous no-deposit bonus

- Ongoing promotions and a referral bonus

- Fortune Coins Review

- More details

- Show less

- Spinfinite Benefits

- Daily missions for free coins

- Mail-in promo awards 3 FREE SC

- Plenty of ongoing slots tournaments

- Spinfinite Review

Up to 800% More Coins! Free Wheel & Plinko Worth Up to 225 SC

What is the best sweepstakes casinos?

Crown Coins ranks as our best sweepstakes casino. We were impressed with its ever-expanding slot catalogue, which includes a collection of jackpots, 'Early Bird' titles, and new weekly additions. Crown Coins offers a progressive daily login bonus and a huge sign-up offer. Apple users will be able to use the Crown Coins iOS app, which is rated 4.8 with over 49,900 player reviews and is rated Excellent on Trustpilot with over 108.8K reviews — the most in the industry.

There are more than 210+ free sweepstakes casino sites available in the United States and that number continues to grow every month. We've reviewed the best sweeps casinos and listed our top 10 below.

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

1. Crown Coins — Best sweepstakes casino iOS app

"Crown Coins first opened its virtual doors in 2023, and the sweeps coins casino has since established a reputation for itself with a lucrative sign-up bonus, an industry-leading iOS casino app, and a strong slots offering. I recommend checking out the early-bird titles and participating in weekly challenges. One area I would like to see Crown Coins improve is by offering a wider variety of games.

"Crown Coins is the perfect sweepstakes for anyone looking to spin the reels. There are 400+ titles available, although this is on the low side for an elite sweeps casino — McLuck has 1,000+ and Stake.us has 2,000+."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ iOS app is highest-rated in the industry

✅ Great sign-up bonus

✅ 4.6/5 rating on Trustpilot with 108K+ player reviews

✅ Progressive daily login bonus

✅ 24/7 live chat customer support available

✅ Regular tournaments and weekend challenges

❌ First-purchase bonus only available for 24 hours

❌ No Android app

| 💼 Crown Coins owner | Sunflower Limited |

| 💰 Crown Coins welcome bonus | Up to 800% More Coins! Free Wheel & Plinko Worth Up to 225 SC |

| 🤑 Crown Coins no-deposit bonus | 100,000 CC + 2 FREE SC |

| 💸 First-purchase bonus | 40 SC + 800K CC + 1 spin on the wheel for $15.99 or 75 SC + 1.5M CC + 1 spin on the wheel + 10 Plinko drops for $24.99 |

| 🔐 Daily login bonus | Progressive up to 100K CC + 0.5 SC on day 7 |

| 📫 Mail-in offer | 1 SC |

| 🗣️ Referral program | Up to 400,000 CC + 20 FREE SC per referral |

| 👑 VIP program | Crown VIP Club |

| 🕹️ Games | Slots, Live Casino, HiLo, Roulette, Coin Flip, Plinko |

| 🎲 Popular titles | Spinning Crowns, Queen of the Crown, Crown Coins GT Tour, Halloween Horrors |

| 🆕 New titles | Grave Rollers, 3 Wicked Demons, Fruity Wilds, Pirate Blimey!, Gorilla Fury Hold & Hit |

| 💎 Exclusive titles | Spinning Crowns, Grave Rollers, Olympian Legends, Diamonds of Liberty, 3 Big Barrels |

| ⚠️ Prize redemption coin minimums | 50 SC for bank transfer, gift card, or Skrill |

| 📱 App availability | iOS |

| ⛔️ Restricted states | CA, ID, LA, MI, MT, NV, WA |

| 🔗 Key links | Crown Coins Casino review | Crown Coins bonus code |

📝 Crown Coins player reviews

"CrownCoins Casino has been a very easy website to play on. It offers nice daily login bonuses as well as substantial weekly and monthly ones. When I had an issue cashing out my winnings their customer support resolved my issue within 24 hours. I've been playing on their site daily for about 6 months now and will continue to do so."

"CrownCoins Casino is definitely worthy of the 5 Stars I have given them. So many extras that they are always coming up with something new whether a new mini game bonus sweeps cash on social media. They give all their customers bonus free play each month! That includes players on the beginning tier. They also have sent random surprise packages in the mail to some customers including CrownCoin Custom Chocolate with a golden ticket!"

"I'm sure I've already left a review or two here but by far my favorite sweeps site… redemptions are quick and easy with skrill — almost not even 20 hours before redemptions are honored!! Wouldn't choose any other gaming site as my first choice. Great loyalty rewards, great hits, and fast redemptions!!"

"I have played several other apps, however Crown Coins is by far the easiest to access. With Crown Coins I've never received a message that the site is down or states user not found or having to sign up again. The games are great, colorful, and best of all I have never had a issue with pay out. It's a well-organized app and definitely would recommend."

2. RealPrize — Easiest to claim daily login bonus

"Launched in 2023, RealPrize offers 700+ free-to-play games, free SC coin bonuses, and a variety of purchasing options. New players are rewarded with 100,000 GC and 2 free SC just for joining. Additionally, you can claim our exclusive first-purchase bonus to add a massive 2 million GC, 80 free SC, and 1,000 VIP Points to your account for $25. One thing I really love about RealPrize is how easy it is to claim the daily bonus of 5,000 GC + 0.30 SC, which pops up on your screen when you login.

"RealPrize makes tournaments easy to play, as they are displayed front and center on the screen when you log in. Right above them is also a button for 'Daily Challenges.' One area where RealPrize shines is their referral program, where you can earn 70 Free SC. This is more lucrative than Crown Coins (20 Free SC) and matches LoneStar."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Sign-up offer up to 2,000,000 GC, 80 Free SC

✅ Fantastic daily free coin bonuses

✅ Up to 200K GC + 70 Free SC using referral link

✅ 700+ games from top software providers

✅ Seven-tier VIP program is great for players

✅ Coin packages available at just $3.00

❌ No sweepstakes app in app stores

❌ Live chat is tied to VIP program

| 💼 RealPrize owner | RealPlay Tech Inc |

| 💰 RealPrize welcome bonus | 2.1 Million GC + 82 FREE SC + 1,000 VIP Points |

| 🤑 RealPrize no-deposit bonus | 100,000 GC + 2 FREE SC |

| 💸 First-purchase bonus | Purchase 2 million GC for $25 and receive 80 SC and 1,000 VIP Points |

| 🔐 Daily login bonus | 5,000 GC and 0.30 FREE SC |

| 📫 Mail-in offer | 1 FREE SC |

| 🗣️ Referral program | 200,000 GC and 70 FREE SC if they purchase $15 in coins |

| 👑 VIP program | RealPrize Loyalty Cards |

| 🕹️ Games | Slots, Live Casino, Roulette, Blackjack, Live Game Shows, Dream Catcher, Video Poker, Sic Bo, Plinko |

| 🎲 RealPrize Picks | Dragon's Fireworks, Hot Charge, 3 Hot Chilli Peppers, Olympian Legends, Fruity Wilds Jackpot |

| 🆕 New titles | Spell of Wealth, Monkey Wu, Whispering Pixie Wilds, Giga Classics, Pinateros vs Zombies |

| 💎 Exclusive titles | Killroad 66, Diamonds of Liberty, Hit the JackBox, Thor's Rage, Rampage Smash4Ca$h |

| ⚠️ Prize redemption coin minimums | 45 SC for gift cards or 100 SC for a bank transfer |

| 📱 App availability | iOS / PWA |

| ⛔️ Restricted states | CA, CT, DE, ID, LA, MD, MI, MT, NJ, NV, NY, RI, WA, WV |

| 🔗 Key links | RealPrize Casino review | RealPrize promo code |

📝 RealPrize player reviews

"User friendly, great selection of games and the customer service is awesome. They also offer a good daily bonus with chances to earn even more by participation on their facebook page and more. Give them a try."

"Legit sight with a multitude of games, fun to play, and daily bonuses to keep you spinning. Real money, real prizes, real wins. Full of real potential. One downside is support is mainly email based so it can take a while to communicate but they are efficient and deal with any issues swiftly."

"With all of the new platforms popping up daily, the competition is fierce and RealPrize has held my attention and attendance. RealPrize keeps everything fresh and upbeat with high energy and numerous opportunities daily to earn enough free SC to give you a good start on your way to the big win. Keep up the great work RealPrize!"

3. LoneStar — Best social media giveaways

"LoneStar Casino, launched in March 2025, is a new player in the U.S. sweepstakes casino scene and a sister site to the well-regarded RealPrize Casino. While its game library is smaller than Stake.us and McLuck, LoneStar is picking up the pace and adding games quickly. They have 49 titles in their 'Fresh Releases' section.

"LoneStar has room for improvement as any new sweepstakes casino. Along with an expanded games library, more bonus offers listed on the site, and a dedicated mobile app. However, the foundation is strong, and their association with RealPrize is a strong endorsement of things to come."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Free daily bonus of 5,000 GC + 0.3 SC

✅ Video Poker and Texas Hold'Em games

✅ Coin bundles start at $2.99

✅ Sister site of popular sweepstakes casino

✅ Great collection of games providers

✅ Excellent UX

❌ No sweepstakes app in app stores

❌ No live dealer titles

| 💼 LoneStar owner | RealPlay Tech Inc |

| 💰 LoneStar welcome bonus | 225,000 GC + 52.5 FREE SC + 250 VIP Points |

| 🤑 LoneStar no-deposit bonus | 100,000 GC + 2.5 FREE SC |

| 💸 First-purchase bonus | 125,000 GC + 50 FREE SC + 250 VIP Points for $24.99 |

| 🔐 Daily login bonus | 5,000 GC + 0.30 FREE SC |

| 📫 Mail-in offer | 1 FREE SC |

| 🗣️ Referral program | Earn up to 200,000 GC + 70 FREE SC |

| 👑 VIP program | LoneStar Casino VIP |

| 🕹️ Games | Slots, Blackjack, Poker, Video Poker, Instant Win |

| 🎲 Popular titles | HellFire Joker, Limbo Crash, Plinkoman, Maestro, Bingo Star |

| 🆕 New titles | Dragon's Fireworks, 64 Gold Coins Hold and Win 20,000, Sizzling Kingdom Bison, Million 777Wheel, Plinko 5000 |

| 💎 High Roller Favorites | Goal Blitz Shootout, Jewels of Jupiter Hold and Win, Golden Reindeer, Rambo, Emperor's Rise |

| ⚠️ Prize redemption coin minimums | 45 SC for gift cards or 100 SC for a bank transfer |

| 📱 App availability | PWA |

| ⛔️ Restricted states | CA, CT, DE, ID, LA, MD, MI, MT, NJ, NV, NY, RI, WA, WV |

| 🔗 Key links | LoneStar Casino review | LoneStar Casino promo code |

📝 LoneStar player reviews

"Just started really playing at Lonestar about a week ago. Got some free spins that won $10 then took that and played for a couple hours and just submitted my first redemption for $200! Has all the games I like (no limit city, relax, btg) and the site is easy to use with no lag. Lonestar really impressed me, I'll be playing here a lot."

"I must say I thoroughly enjoy LoneStar. They have all the top game providers. My only suggestion would be to change the site layout — other than that it's wonderful. Gives away free SC on social media daily. Soon as I win and cash out, I'll change to 5 stars."

"Good social media daily bonuses and a good online slots selection. All my emails have been answered promptly and hopefully the redemption process is as prompt as their customer support."

4. Stake.us — Best for original games

"Stake.us is the ideal sweepstakes casino platform for crypto enthusiasts seeking to play high-quality casino games for free. Boasting over 2,200+ casino games, surpassing competitors like RealPrize (700+ titles) and (Crown Coins 400+), there's something for everyone with slots, live dealer games, game shows, poker, burst games, table games, scratch cards, and a series of Stake Originals.

"Whenever I log in to Stake.us, I check the leaderboards and challenges to see what games are available. Another area Stake.us shines is the bonus drop codes, which are available via Stake.us's Instagram and X feeds. My main complaint about Stake.us is that it's a crypto-only platform, and I understand that this is a barrier for some players."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Sign-up bonus is larger than most

✅ Instant prize redemptions

✅ Daily bonus drop codes

✅ New iOS app

✅ Weekly drop codes, slot battles, daily races

✅ 70+ exclusive titles with RTPs up to 98%+

❌ Crypto only

❌ 3x playthrough requirement

❌ Full welcome offer takes 30 days to claim

| 💼 Stake.us owner | Sweepsteaks Limited |

| 💰 Stake.us welcome bonus | Up to 550,000 GC, $55 Stake Cash + 3.5% Rakeback |

| 🤑 Stake.us no-deposit bonus | 250,000 GC + $25 Stake Cash |

| 💸 First-purchase bonus | N/A |

| 🔐 Daily login bonus | 10,000 GC + 1 SC (for the first month) |

| 📫 Mail-in offer | $5 in Stake Cash |

| 🗣️ Referral program | 10% commission rate based on the house edge and gameplay |

| 👑 VIP program | Stake VIP Club |

| 🕹️ Games | Slots, Live Dealers, Table Games, Dice, Crash, Plinko, Mines, Pump, Darts, Snakes, Burst Games, Scratch Cards, Poker |

| 🎲 Popular titles | Le Cowboy, The Count, Candy Rush, Le Zeus, Wanted Dead or a Wild |

| 🆕 New titles | Boom Town, Sun Princess, Wings of Death, Dr Funkenstein and his Monsters, Black Friday |

| 💎 Only on Stake | Candy Rush, Boom Town, Rooster's Reloaded, Plunder Bonanza, Golden Boy |

| ⚠️ Prize redemption coin minimums | 30 SC for instant prize redemption |

| 📱 App availability | iOS |

| ⛔️ Restricted states | AZ, CT, DE, ID, KY, LA, MD, MI, MT, NJ, NV, NY, PA, RI, VT, WA, WV |

| 🔗 Key links | Stake.us Casino review | Stake.us promo code |

📝 Stake.us player reviews

"Overall I’ve done well playing on Stake. I appreciate the instant payouts, bonus codes offered on social media, Saturday stream codes, and challenges. I have nothing bad to say about Stake, overall it’s been a great experience."

"Stake.US is by far the best online casino, ( in my opinion) out there, I’ve hit really big numerous times, they have great bonuses, definitely number one on my list, hands down, no questions"

"Immediate real cash payout Great selection of games. Very prompt responses from live support 24 hours a day. Best VIP program I’ve ever experienced with daily, weekly, and monthly bonuses. Tailored bonuses as you move up. Immediate withdrawal/cash-out capabilities."

5. Casino Click — Best selection of live dealer games

"A '100,000 GC + 2 FREE SC' sign-up bonus gives you an excellent starting point with which to explore Casino Click. You can boost this further by taking advantage of a first-purchase offer — 200,000 GC + 2 Free SC + 10 Free SC Spins on Joxer for a reduced price of $9.99. I really liked the wide variety of banking options with both crypto and fiat options available. One area I would like to see improvement in is the addition of a VIP program and more loyalty bonuses for existing players.

"The star of the games library is the 30 live dealer games, which is the largest I've seen — in comparison, RealPrize has six and LoneStar doesn't have any. The games here include staples such as blackjack, baccarat, and roulette, as well as specialty titles like Teen Patti, Sic Bo, and Plinko, among others."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Crypto and fiat currencies accepted

✅ Daily login bonus wheel

✅ 3 SC Mail in bonus

✅ Specialty games

✅ Lots of games with 96-97% RTP

✅ Wide variety of slots titles

❌ No VIP program

❌ No tournaments

| 💼 Casino.click owner | Yellow Social Interactive (YSL) Limited |

| 💰 Casino.click welcome bonus | Claim up to 300,000 GC + 22 FREE SC with First-Purchase Bonus |

| 🤑 Casino.click no-deposit bonus | 100,000 GC + 2 FREE SC |

| 💸 First-purchase bonus | Claim 250,000 GC for $15 with a free bonus of 25 SC |

| 🔐 Daily login bonus | Spin for up to 5 FREE SC each day |

| 📫 Mail-in offer | 3 FREE SC |

| 🗣️ Referral program | N/A |

| 👑 VIP program | N/A |

| 🕹️ Games | Slots, Live Casino, Scratch Cards, Mines, Plinko, Boxes, Hi-Lo, Lines, Blocks, Plinko, 21, Dice |

| 🎲 Popular titles | Wild Wild Safari, Pop The Bank, Star Kittyzens, Wolf Moon Pays, Roaring Riches |

| 🆕 New titles | Starlight Travellers, Elven Fortune, Paws of Egypt, Win Circut, The Oracle's Fortune |

| 💎 Exclusive titles | El Dorado, Jo-Jo Joker, Chilly & Willie, Dee Jay Monkey, Diamond Machine |

| ⚠️ Prize redemption coin minimums | 100 SC which can be done via bank transfer or crypto |

| 📱 App availability | N/A |

| ⛔️ Restricted states | CA, CT, ID, KY, MI, MT, NJ, NV, NY, WA |

| 🔗 Key links | Casino.click Casino review | Casino.click promo code |

📝 Casino.click player reviews

"Overall my experience with Casino Click has been very good. They offer great deals regularly and give some good freebies. I would give them 5 stars if their redemption process was faster, but they have always paid me so I stand by them."

"Really cool selection of games. I’ve played here for months and won plenty of times. They always redeem smoothly for me. Always fast, friendly, and professional. Of the many I’ve played, Casino Click is one of my top favorites!"

"Cool daily wheel for rewards like SC and free spins. The service for VIP is top notch, giving out great bonuses. Redemption not instant but getting close within 24 hours. Definitely give them a try."

"I love the promotional discount packages they offer on the coins. My favorite game is the Great Pigsby. Just be ware that not all games count as playthrough for coin redemption, so make sure you check the playthrough requirements. Other than that one quirk, great site. Honestly though, I think they should make that aspect a lot more transparent and obvious for new users."

6. ACE.com — Best new sweepstakes casino in 2025

"ACE.com burst onto my radar this summer with their title 'Uncle Sam' inspired character. They've partnered with some of my top sweeps providers and have been adding new titles every week. There have been some growing pains. I'd like to see the ACE.com sweepstakes casino app added to the iOS and Google Play Store, and a VIP program would be a nice addition. Everything else on ACE.com has been a smash hit, including the daily bonus offer, a refer-a-friend bonus, and SC & GC jackpots. I particularly enjoy the notifications tab that keeps me up to date on special offers and the player safety controls - both are easily found in the main menu."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Unlimited play slots options

✅ Slots from 33 world-class software providers

✅ Gold Coins and Sweepstakes Coins jackpots

✅ Mail in bonus is 4 FREE SC

✅ Coin bundles start at $1.99 and lots of promotional bundles

✅ Daily Reward Wheel

❌ No live or table games available

❌ Live chat is linked to coin purchases

| 💼 ACE.com Casino owner | Full Stop Limited Inc |

| 💰 ACE.com Casino welcome bonus | Receive up to Up to 57,500 GC + 27.5 FREE SC |

| 🤑 ACE.com Casino no-deposit bonus | 7,500 GC + 2.5 FREE SC |

| 💸 First-purchase bonus | 150% extra: Get 50,000 GC + 25 FREE SC for $9.99. |

| 🔐 Daily login bonus | Daily Reward Wheel |

| 📫 Mail-in offer | 4 FREE SC |

| 🗣️ Referral program | Get up to 150K GC + 100 FREE SC |

| 👑 VIP program | N/A |

| 🕹️ Games | Slots, Jackpots, Plinko |

| 🎲 Popular titles | Celestial Flame, Immortal Ways Buffalo, CoinUp, Voltage Blitz Rapid, Buffalo Power 2, Mad Hit Full Steam |

| 🆕 New titles | Golden Cat Fortunes, American Double Gold 2x, Queen of Valhalla, Spin of the Dead, Bison Strike |

| 💎 Recommended Games | Templar Tumble, Jade Blade Xtra Split, Fortune God, Chili Flame 7's Hold and Win, Pink Elephants |

| ⚠️ Prize redemption coin minimums | 10 SC for a gift card or 75 SC for cash |

| 📱 App availability | PWA |

| ⛔️ Restricted states | CT, DE, ID, KY, LA, MI, MT, NJ, NV, NY, PA, RI, TN, VA, WA, WV |

| 🔗 Key links | ACE.com Casino review | ACE.com Casino promo code |

📝 ACE.com Casino player reviews

"I really like Ace.com online Casino! It's platform is simple in the way of easy to navigate through! Ace offers the gaming experience without all the added extra or bells and whistles. I personally tend to navigate towards this type of online Casino environment. Thank you Ace!"

"Signed up on 10/9/25. I was lucky enough to clear a win of $700.00. Verified my account (instant approval) and submitted a redemption. The winnings were approved and in my account in less than 24 hrs. One of the best sites out there today!"

"Ace has been decent so far. I've managed to win twice, and with a minimum redemption limit of 75sc (most places are 100sc although a few other sweeps casinos are only 50 🤷) it makes it that much easier to exchange your sweeps coins for cash prizes! First cash out actually came next business day mid afternoon after it was approved in first 24 hours, second I initiated redemption yesterday, as of less than 24 hours it has already been approved and I received an email saying it has been processed and sent to me, so should be here sometime today (altho banks say 3 business days)"

7. Jackpota — Great for unique limited time bonus offers

"Jackpota has been a regular in my rotation of sweepstakes casinos for over a year now. I first discovered it when I learned it was a sister site to McLuck and Hello Millions. The sign-up bonus remains the same, and the game library is similar, so it scratches the itch. I try to log in every 24 hours to take advantage of bonus coins and keep my eye on the promotions page for limited-time offers.

"The downside is that there aren't any RNG table games, but you can play blackjack and roulette in the live casino section."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Great social media competitions

✅ Jackpota app available via PWA

✅ Numerous exclusive progressive jackpots

✅ Coin bundles start at $4.99 and lots of promotional bundles

✅ Live customer support available for all players

❌ No live or table games available

❌ Social media accounts appear to be inactive

| 💼 Jackpota owner | B2Services OÜ |

| 💰 Jackpota welcome bonus | Receive up to 87,500 GC + 42.5 FREE SC + 75 Free Spins |

| 🤑 Jackpota no-deposit bonus | 7,500 GC + 2.5 FREE SC |

| 💸 First-purchase bonus | Purchase 80,000 Gold Coins + 40 Free Sweeps Coins + 75 free spins for $19.99. |

| 🔐 Daily login bonus | 1,500 GC and 0.20 SC |

| 📫 Mail-in offer | 4 Free SC |

| 🗣️ Referral program | Up to 200,000 GC + 100 Free SC per friend |

| 👑 VIP program | N/A |

| 🕹️ Games | Slots, Live Casino, Roulette, Top Card, Blackjack, Baccarat, Live Game Shows, Sic Bo |

| 🎲 Popular titles | Pirate Chest, Diamond Fortunator, Royal Coins 2, Aztec Fire, MayaSun, Lion Gems |

| 🆕 New titles | Ice Mania, Fruit Nova, Joker Juice 6, Book of Plenty, Coin Galactic |

| 💎 Exclusive titles | Jackpota Wolf, Jackpota Gods, Story of Jackpota, Queen of Jackpota, Jackpota White Rhino |

| ⚠️ Prize redemption coin minimums | 10 SC for a $10 gift voucher or 75 SC for a $75 bank transfer |

| 📱 App availability | PWA |

| ⛔️ Restricted states | AL, CA, CT, DE, GA, ID, KY, LA, MD, MI, MT, NV, NY, WA, WV |

| 🔗 Key links | Jackpota Casino review | Jackpota promo code |

📝 Jackpota player reviews

"Pretty happy so far with my experience. Payouts have been prompt and live chat is pretty solid. I float around between Stake, Jackpota, and Crown Coins Casino, and this one is probably towards the top for me. One thing I’m frustrated about is I won an Instagram competition for 15 SC and they have not distributed to winners at the time they said they would. Again this is a pretty small problem and is outshined by all of the positives of this platform. I would for sure recommend it."

"They have a lot of contest online for free SC. The interface is dope. Their support is great. Wish they had more 10 to 5 cent min. bet slots. They have great games live — their exclusives especially! I recommend"

"This casino is One of the few that also deserves a five-star rating! I am a seasoned slots player, therefore Ive played on a lot of online casinos and for the most part I am usually disappointed however Jackpota is definitely not one of those! If you want to feel as if you've got your money's worth and you want to enjoy your game play this is where you want to be! High payouts delivered fast, great selection of games, and fast responses with inquiries!!"

"I have been playing at Jackpota for years. They've always treated me like family, not allowing their growing popularity affect the personal attention they have always shown my friends and myself. Honest, super fun, lots of extra ways to earn a little extra through all the hip social media platforms. Quick payouts, and great coupons through emails and promos almost every day."

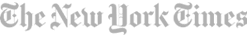

8. McLuck — Best for Gold Coin and Sweeps Coins Jackpots

"McLuck is one of the titans of the sweepstakes casino market. I love the 5 free SC as part of the sign-up offer, which is far superior to much of its competition — RealPrize, LoneStar, Casino.Click all offer 2 free SC. The referral bonus can also net you up to 100 free SC. The games catalog is also elite with RubyPlay, 3 Oaks, Playson, Peter & Sons, and many more powering the library. I tend to venture to the McJackpots where 200 million Gold Coins and 100,000 free sweepstakes casinos are up for grabs.

"I would like to see table games added to McLuck. Still, to their credit, they've expanded their live casino section to include 11 versions of blackjack, six variations of roulette, as well as random titles like Crash Live and Gravity Plinko. Another perk is that McLuck has a great app available for iOS and Android users."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ 5 Free SC as part of sign-up offer

✅ McJackpots are worth up to 200,000 GC +100,00 SC

✅ Sweepstakes app for iOS and Android users

✅ McLuck Loyalty Program

✅ Gift card redemption starts at 10 SC

✅ Over 3,300 titles

❌ Live chat requires purchase

❌ No RNG table games, video poker, fishing titles, or scratch cards

| 💼 McLuck owner | B-Two Operations Limited |

| 💰 McLuck welcome bonus | Receive up to 57,500 GC + 30 FREE SC |

| 🤑 McLuck no-deposit bonus | 7,500 GC + 5 FREE SC |

| 💸 First-purchase bonus | Purchase 50,000 GC for $9.99 and receive 25 SC for free and access to exclusive GC games. |

| 🔐 Daily login bonus | 1,500 GC and 0.20 SC |

| 📫 Mail-in offer | 4 FREE SC |

| 🗣️ Referral program | Get up to 200,000 GC + 100 FREE SC |

| 👑 VIP program | McLuck Loyalty Club |

| 🕹️ Games | Slots, Live Casino, Blackjack, Roulette, Live Game Shows, Baccarat |

| 🎲 Popular titles | Spooktacular Bonanza, Voltage Blitz Rapid, 3 Big Barrels Buffalo, Immortal Ways MagicGems, Ghost Pigger |

| 🆕 New titles | Flaming Hell Hold and Win, Vampire Riches, Pigs N' Pots, Power Crown Hold and Win, Lucky Turkey |

| 💎 Exclusive titles | Lucky Turkey, Lava Coins 2 Hold and Win 3x5x3, Grand Lightning, Spin of the Dead, Magic Gems |

| ⚠️ Prize redemption coin minimums | 10 SC for a gift card or 75 SC for cash prizes |

| 📱 App availability | iOS & Android |

| ⛔️ Restricted states | AL, CT, DE, GA, ID, KY, LA, MD, MI, MT, NV, NY, WA, WV |

| 🔗 Key links | McLuck Casino review | McLuck promo code |

📝 McLuck player reviews

"Can't ever say McLuck Casino disappoints me. I don't always win but the excitement that the games bring makes each experience an experience to remember!!!! I'll be back, again and again."

"I must say… I am over joyed with all you wonderful folk at MC luck , for supplying great slot machines that are always good to me. You take care of your subscribers, and all you good folk will always have 5 stars. Thank you for being fair and honest and very helpful."

"This platform is super dope. I have won, I have lost, but everything has been fair. Payouts have been fair. Sometimes you have to wait, be a tad bit patient for payout. True customer and this is a true honest platform. Remember we are gambling at our own risk!! The games and network is getting better I must add."

9. Hello Millions — Best user experience

"No sweepstakes casino has the look and feel of Hello Millions with its bold, comic-style branding and colorful games lobby. I always feel a positive energy vibe from the site and find it very easy to navigate. The daily reward bonus is front and center, making it easy to activate the games library, which is filled with 35 of the most popular providers, including RubyPlay, 3 Oaks, Playson, Iconic21, and Peter & Sons, to name a few."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Great games catalog from 30 providers

✅ Progressive jackpots available

✅ 2.5 Free SC sign-up bonus is above average

✅ Plenty of ongoing promotions

✅ 20+ live dealer games

✅ Android and PWA app available

❌ No VIP program

❌ No RNG table games

| 💼 Hello Millions owner | B-Two Operations Limited |

| 💰 Hello Millions welcome bonus | Get up to 245,000 GC + 117.5 FREE SC |

| 🤑 Hello Millions no-deposit bonus | 15,000 GC + 2.5 FREE SC |

| 💸 First-purchase bonus | Claim 50,000 GC for $9.99 and receive 25 SC for free — a 150% boost. |

| 🔐 Daily login bonus | 1,500 GC + 0.20 SC every 24 hrs |

| 📫 Mail-in offer | 4 FREE SC |

| 🗣️ Referral program | Up to 130K GC + 65 FREE SC per referral |

| 👑 VIP program | N/A |

| 🕹️ Games | Slots, Blackjack, Plinko, Roulette, Live Game Shows, Baccarat |

| 🎲 Popular titles | CoinUp Hot Fire, Hit More Gold, Black Wolf, Pirate Chest, Lion Gems |

| 🆕 New titles | 3 Hell Pots, Immortal Ways Magic Gems, Paddy Star Smash and Win, Zombie Mash Hold and Win, 3 Wicked Demons |

| 💎 Exclusive titles | Crack the Pumpkin Bank, Paddy Star Smash and Win, Magic Gems, Grand Lightning |

| ⚠️ Prize redemption coin minimums | 10 SC for gift cards and 75 SC for cash redemptions |

| 📱 App availability | Android |

| ⛔️ Restricted states | AL, CA, CT, DE, GA, ID, KY, LA, MD, MI, MT, NV, NY, WA, WV |

| 🔗 Key links | Hello Millions review | Hello Millions promo code |

📝 Hello Millions player reviews

"This is by far one of the best social casinos sites I've played on. Frequent promotions, fun challenges, and fast (1-3 day) redemptions. The only thing stopping it from being 5 stars for me is that the daily bonus is a bit lacking compared to its competitors. Even though I'm slightly down overall, I can see myself continuing to play here."

"This is ABSOLUTELY THE BEST site EVER!!!! Daily bonus and super quick with redemptions!!! So much so that I've been depositing here more than any other site. Plus they have the extra feature of the pop up wheel at any given time!!! WELL worth your time to play here!!! I currently belong to over 30 different sites and this one NEVER disappoints!!!"

"I absolutely love the competition they have going on right now. It makes it so much more exciting. Also the daily login gets higher each day now — more so than most other online casinos. It makes me look forward to logging in to collect that. I haven't had my big win yet but it's coming I know!"

"Hello Millions is the best. I really didn’t think it was gonna cash me out, it took a total of three days to send to my checking account! I haven’t won since but I’ve came close too. People, Hello millions is real — I won 250 dollars from depositing just $5 so yeah Hello Millions is my #2 top social casino."

10. Sixty6 — Best VIP program

"Sixty6 has a free 8-tier VIP program that rewards players with improved 'Daily Refill Reward', Birthday Gifts, and Exclusive promotions. The VIP program pays homage to the iconic Route 66 from Illinois to California. I also like the Fortune Wheel, and you can win up to 5 free SC every 24 hours. And there is 24/7 free chat support available to help. This perk is becoming increasingly rare, with many operators requiring a coin purchase before opening the live chat."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

✅ Great slots library with 18 software providers

✅ Fortune Wheel is available every 24 hours

✅ Free 24/7 live chat

✅ VIP with great benefits like weekly rewards

✅ Mobile-optimized interface that doesn't require an app

✅ Strong collection of ongoing promotions for existing players

❌ No live or table games available

❌ Sign-up bonus is middle of the road

| 💼 Sixty6 owner | Kinetix Ventures LLC |

| 💰 Sixty6 welcome bonus | Receive up to 475,000 GC + 42 FREE SC |

| 🤑 Sixty6 no-deposit bonus | 75,000 GC + 2 FREE SC |

| 💸 First-purchase bonus | Extra 120%: Get 220,000 GC + 22 free SC for $9.99 or Extra 120%: Get 440,000 GC + 44 free SC for $19.99 |

| 🔐 Daily login bonus | 0.20 PE |

| 📫 Mail-in offer | 2 Free SC |

| 🗣️ Referral program | 500,000 GC + 20 Free SC or more |

| 👑 VIP program | Sixty6 VIP |

| 🎲 Popular titles | Shogun SkyLord, Big Fishin' Bounty, Tutankhamun's Tomb, Kick Cash Monkey, 3 Coin Volcanos |

| 🆕 New titles | Fish Tales Halloween, Merge Up2, Burning Chilli 243, Kings of Crystals II, Total Eclipse Supreme |

| 💎 Hot | 3 Hot Chillies Hold and Win, Rages to Witches, Fishin' the Biggest Gold, Oops, Sugar Park |

| ⚠️ Prize redemption coin minimums | 50 SC for a gift card or 100 SC for cash prize |

| 📱 App availability | PWA |

| ⛔️ Restricted states | CA, CT, DE, ID, KY, LA, MD, MI, MS, MT, NJ, NV, NY, VA, WA, WV |

| 🔗 Key links | Sixty6 Casino review | Sixty6 Casino promo code |

Sixty6 player reviews

"So far I’ve been really pleaser with their online chat service. The individual who helped me, Jack, and as polite, attentive and interested in resolving my request. A+ sixty6"

"So far I haven’t had any huge wins, however I have gotten my balance up to $40 and also $20, once each, all off of the daily refills and bonus wheel spins. I have not had to make ridiculous deposits to have success on this site either. I haven’t paid anything into it yet. It’s looking like Sixty6 may be my new favorite social casino!"

"Sixty 6 actually gives you the opportunity to win and cash out your winnings unlike many other providers. Their cash out process is simple and very fast with money hitting your account the next morning. They also have a great selection of games and often have games dinner than some other providers!"

List of sweepstakes casino guides

| 🎰 Sweepstakes casino | 💡 Guides | 🎯 Best features |

|---|---|---|

|

Crown Coins no deposit bonus | Crown Coins review |

Best overall sweepstakes casino and top rated iOS casino app. |

|

RealPrize promo code | RealPrize review | Easy to claim daily login bonus. |

|

Stake.us promo code | Stake.us review | Best for bonus drop codes on social media. |

|

Casino Click promo code | Casino Click review | Best banking options accepting FIAT and cryptocurrency. |

|

LoneStar promo code | LoneStar review | Great new sweepstakes casino adding new titles weekly. |

|

McLuck promo code | McLuck review | Best sweepstakes casino app for both iOS and Android users. |

|

Jackpota promo code | Jackpota review | 45+ game providers and low SC minimum redemptions for gift cards. |

|

High 5 Casino promo code | High 5 review | Great responsible gaming program for U.S. players. |

|

Hello Millions promo code | Hello Millions review | Fun user-friendly design and coin bundles start at just $1.99. |

|

PlayFame promo code | PlayFame review | Prize redemptions start at 10 SC, sign-up offer includes 3 SC. |

|

Funrize promo code | Funrize review | Nine ongoing promotions and the Funrize Club is a top VIP program. |

|

Spree Casino no deposit bonus | Spree review |

Over 2,300 titles from 35+ providers and gift card redemptions start at just $10. |

|

Jumbo88 promo code | Jumbo88 review |

Over 1,600 games and multiple first-purchase and reload bonuses. |

|

LuckyBird.io promo code | LuckyBird.io review | Crypto sweeps casino with daily unlimited faucet. |

|

Mega Bonanza Casino no deposit bonus | Mega Bonanza review | Prize drops, tournaments, leaderboards, and daily competitions. |

|

Spinfinite Casino no deposit bonus | Spinfinite review | Daily Missions and there are several first-purchase bonus options. |

|

ACE.com promo code | ACE.com review | 2.5 Free SC as part of the sign-up bonus. |

|

Baba Casino promo code | Baba Casino review | Large no-deposit bonus and progressive daily login rewards. |

|

BCGAME.us promo code | BCGAME.us review | 9,000 slots and casino-style games from 60+ games providers. |

|

BettySweeps promo code | BettySweeps review | Great sign-up bonus of 3,000 BC + 3 Free SC and 24/7 live chat. |

|

Bracco promo code | Hybrid sportsbook and casino with generous mail-in rewards. |

|

Cazino review | Easy customer support access, but ongoing promotions could be improved. |

|

Chanced Casino bonus code | Chanced review | Exclusive Chanced Originals titles, live casino with 25 titles. |

|

Ding Ding Ding Casino no deposit bonus | Ding Ding Ding review | Community chat rooms, great collection of fishing games, and telephone support. |

|

FreeSpin Social Casino promo code | FreeSpin review | More than 100 exclusive games, accepts crypto purchases, and free live support. |

|

Fortune Coins Casino no deposit bonus | Fortune Coins review | Daily Fortune Coins Casino FC challenges available on social media. |

| A daily 'Prize Wheel' is available every 12 hours, awarding guaranteed free coins. | ||

|

FunzCity Casino promo code | FunzCity review | Slots and Fishing titles and daily missions to win free coins. |

|

Gains promo code | Gains review | Selection of first-purchase offers and a large daily login bonus. |

| Started as a bingo site and has added slots and was a charity social casino for a time. | ||

|

Gold Treasure Casino no deposit bonus | Gold Treasure review | User-friendly site with a great sign-up bonus and cash prize redemptions start at 50 SC. |

|

Legendz Casino no deposit bonus | Legendz review | Legendz also has a live casino and social sportsbook. |

|

Modo.us Casino no deposit bonus | Modo.us review | Progressive daily rewards program and a wide variety of unique casino games. |

|

Moonspin Casino promo code | Moonspin review | Crypto sweepstakes casino with a great three-day Free SC welcome bonus package. |

|

NoLimitCoins bonus code | NoLimitCoins review | They offer a great collection of daily tournaments, Fishing titles, and jackpot slots. |

|

Pulsz promo code | Pulsz review | Fantastic casino app available on iOS and Android. |

|

Pulsz Bingo promo code | Pulsz Bingo review | Best sweepstakes casino for bingo enthusiasts. |

|

Punt.com promo code | Punt.com review | Hourly free SC rewards and free live chat support for all players. |

|

Rich Sweeps promo code | Rich Sweeps review | More than 4,000 slots and a daily spin for regular prizes. |

|

Rolla promo code | Rolla review | Player-2-Player chat and more than 1,600 games. |

|

Sheesh Casino promo code | Sheesh Casino review | Variety of niche games, plus Happy Hour and Flash Deal promotions. |

|

Sidepot.us promo code | Sidepot.us review | Over 1,300 titles with coin bundles available for just $0.99. |

|

Sixty6 promo code | Sixty6 review | Over 900 slots from 18 top software providers, eight-tier VIP program. |

|

Smiles Casino no deposit bonus | Five Free SC coins for all new players and bundles start at just $1.99. |

|

SpeedSweeps promo code | SpeedSweeps review | Speciality games and a choice of first-purchase bonuses. |

|

Spin Blitz no deposit bonus | Spin Blitz review | Great reputation and an impressive selection of scratch-offs and jackpot play titles. |

|

SplashCoins promo code | SplashCoins review | Seven first-purchase bonuses, and free live chat benefits rookie players. |

|

StormRush review | 'Energy Pack' discounts on first seven coin bundles and three separate daily rewards. |

|

SweepNext promo code | SweepNext review | Daily mystery login bonus and frequent tournaments. |

|

SweepShark promo code | Sweepshark review | 5% daily payback and progressive SC login bonuses. |

|

Sweet Sweeps review | 'Sweet Spin Wheel' among fun ongoing promotions, but 2x playthrough requirements on SC. |

|

Tao Fortune no deposit bonus | Tao Fortune review | Great collection of slots and 9 fishing games and coin bundles starting at $4.99. |

|

The Money Factory promo code | The Money Factory review | 2,200+ titles, tournaments, and live dealer games from Iconic21. |

|

Zula Casino no deposit bonus | Best sweepstakes casino sign-up bonus with 10 Free SC for new players. |

List of 210+ online sweepstakes casinos

| 🎰 Sweepstakes casino | 💰 Sign-up bonus offer |

|---|---|

| 1. 𝐀 A1 Casino | 20,000 GC + 20 SC for $10 first purchase bonus |

| 2. 🂡 Ace.com | 90,000 GC + 2.5 Free SC Sign-Up Bonus |

| 3. 🌰 Acorn Fun | 77,777 Gold Coins + 0.3 Free Sweeps Coins |

| 4. 🇺🇸 American Luck | 60,000 Gold Coins + 6 Free Sweeps Coins |

| 5. ⛏ Baba Casino | 500,000 GC + 2 Free SC |

| 6. 🍌 Banana Bets | 10,000 Gold Coins |

| 7. 🏦 BankRolla | 200,000 Gold Coins + 2 Free Sweeps Coins |

| 8. 🌐 BCGAME.us | 60 Free Spins + 360% Coin Boost |

| 9. 🃏 Betcoin.Social | 2,000 Gold Coins + 2 PBR Sweeps Coins |

| 10. 🌊 BetRivers.net | Up to $1,000 in VC |

| 11. 👩 Betty Sweeps | 13,000 BC + 13 FREE SC |

| 12. 🐟 Big Fish Casino | 100,000 Chips |

| 13. 🏴☠️ Big Pirates | Coming Soon |

| 14. 🚢 Bingoport | 500 Port Points + 2 Free Access Tokens |

| 15. 🎲 BitBetWin | $20 first bet offer Sign-Up Bonus |

| 16. 👾 Bitsler.io | 37,500 Gold Coins |

| 17. 💝 BootyChaser | 100% Match on first donation up to $500 |

| 18. 🟤 Bracco | 10,000 Coins + 5 Bracco Cash |

| 19. ✈️ BucksJet | 8,000 Gold Coins + 3 Free Sweep Coins |

| 20. 🎪 Carnival Citi | 10,000,000 Coins + 5,000 Sweeps Coins |

| 21. 💼 Cases.GG | 3 Free Cases on sign-up |

| 22. 💶 Cashoomo | 4,000 Gold Coins |

| 23. 🖱️ Casino Click | 300,000 GC + 22 FREE SC with First-Purchase Bonus |

| 24. 🥋 CasinoKai | 1,000 Gold Coins + 2.5 Free Sweeps Cash |

| 25. 𝐂 Cazino | 8,500 Lucky Coins + 4.5 Free Sweeps Coins |

| 26. ﹖ Chanced | Up to 210 FREE SC + 2.1M GC First-Purchase Bonus |

| 27. 🐿️ Chip'n WIN | 15,000 Gold Coins + 15 Crystals |

| 28. 🕺 Chumba Casino | 2M Gold Coins + 2 Free Sweeps Coins |

| 29. 🏙 CityVerse Tycoon | Get 1,000 Gold Coins + 5 Free Sweep Coins |

| 30. ♧ Club Casino | 100% welcome offer 200k Gold Coins + 40 Free SC |

| 31. 🪩 ClubGG | 20% Store Discount after Subscription |

| 32. ♣️ Clubs Poker | Claim up to 25,000 Gold Coins + 5 Sweeps Coins |

| 33. ⛃ ClubWPT | 5,000 Play Chips + 500 Tournament Points |

| 34. 🐔 Cluck.us | 100,000K Gold Coins + 5 Free Cluck Bucks |

| 35. 💰 CoinBucks | 8,000 Gold Coins + 4.5 Free SC |

| 36. 😎 Cool Spin | 81,000 Gold Coins + 4.5 Sweeps Coins |

| 37. 💰 Coinz.us | 50,000 Gold Coins |

| 38. 🌠 Cosmo Slots | 10,000 Game Tokens + 5 Sweeps Tokens |

| 39. 🤺 CrashDuel | 1,000 Gold Coins +1 Free Sweeps Coins |

| 40. 🏁 CrazyWin | Coming Soon |

| 41. 👑 Crown Coins | Up to 800% More Coins! Free Wheel & Plinko Worth Up to 225 SC |

| 42. 🤭 Dara Casino | 100,000 Gold Coins + 2 Free Sweeps Coins |

| 43. 🛎️ DingDingDing | 2,600,000 GC + 35 Free SC |

| 44. 💵 Dollar Mills | 8,000 Gold Coins + 3 Free Sweeps Coins |

| 45. 🧚🏻♀ Enchanted | 5 BTC + 180 Free Spins |

| 46. 🔥 Fire Kirin | Free Daily Wheel Spin |

| 47. ☁️ Fliff | 5,000 Fliff Coins + 1 Fliff Cash |

| 48. 🥠 Fortune Coins | Up to 1.23 Million GC + 3,900 FREE FC |

| 49. 🛞 Fortune Wheelz | 500,000 GC + 1,125 FREE FC |

| 50. 🆓 FreeSpin | 200,000 Gold Coins + 20 Free SC Spins |

| 51. 🐠 Funrize | 2,125,000 TC + 10,000 FREE PE |

| 52. 🎊 Funz | 5 Gold Coins + 0.5 Sweeps Coin |

| 53. 🌴 FunzCity | 875,000 FC + 3,500 FREE CC |

| 54. 🥳 Funzpoints | 1,000 Standard Funzpoints + 250 Premium Funzpoints |

| 55. 🏋🏻♂️ Gains | 100,000 Gold Coins + 5 Sweeps Coins |

| 56. 🎡 Gambino Slots | 100,000 G-Coins + 200 FREE Spins |

| 57. 🗄 Game Vault | $20 first bet offer Credits |

| 58. 🏟️ GameDayZone | Get 200% Extra |

| 59. 💛 Golden Hearts Games | 250,000 GC + 2.5 FREE SC |

| 60. 🤞Gold N Luck | 400,000 Gold Coins + 1 Free Sweeps Coin |

| 61. ⚙️ Gold Machine | 100,000 Gold Coins + Free 1 Sweeps Coins |

| 62. 🌕 Gold Rush City | 15,000 Gold Coins + 500 Sweeps Coins |

| 63. 🔱 GoldSlips | 10,000 Fun Coins + 5 Gold Slips |

| 64. 🗝️ Gold Treasure Casino | 600,000 GC + 29 FREE SC |

| 65. ⛏ Go Go Gold | 100,000 Gold Coins + up to 8 Free Sweeps Coins |

| 66. 😀 Good Vibes | 100,000 Gold Coins + Special Gift |

| 67. 🔐 Grand Vault Casino | 50,000 Gold Coins + 25 FREE Sweeps Coins |

| 68. 🍬 Gummy Play Casino | 100,000 Gold Coins + 3 Free SweepCoins |

| 69. 🎸 Hard Rock Social Casino | 300,000 Free Coins |

| 70. 💥 Hello Millions | 245,000 GC + 117.5 FREE SC |

| 71. ✋ High 5 | 1,020 GC + 108 FREE SC + 1,300 Diamonds |

| 72. 🐎 Horseplay | First purchase bonus up to $500 |

| 73. 🫂 Huuuge | 5,000,000 chip Welcome Bonus |

| 74. ⓘ iCasino | 100,000 IC Coins + 2 Free Sweeps Coins |

| 75. 💲 Jackpota | 87,500 GC + 42.5 FREE SC + 75 Free Spins |

| 76. ⏩ Jackpot Go | 10,000 Gold Coins + 1 Free Sweeps Coin |

| 77. 🐰 Jackpot Rabbit | 125,000 Gold Coins |

| 78. 💃 JefeBet | 100,000 Gold Coins + 2 Free Sweeps Coins |

| 79. 🫦 JuicyPopSlots | 100,000 Gold Coins + 3 Free Sweeps Coins |

| 80. 8️⃣8️⃣ Jumbo88 | 10,000 Gold Coins and 1 Free Sweepstakes Coin |

| 81. 🥾 Kickr | 150,000 Bits Sign-up Bonus + 4 Free Bucks |

| 82. ☘️ Lavish Luck | 20,000 Gold Coins + 0.3 Sweeps Coins |

| 83. 🌚 Legendz | 100% Bonus on First Purchase! Up to 203 FREE SC + 20,500 GC |

| 84. 🦁 Lions Den | 1 Lions Den Coin |

| 85. ▶ Live Play Mobile | 10,000 Coins + 50 Credits + 1,000,000 Slot Bucks |

| 86. 🤠 LoneStar | 225,000 GC + 52.5 FREE SC + 250 VIP Points |

| 87. 🫅 Loyal Royal | 2,000 Loyal Coins + 2.5 Royal Rubies |

| 88. 🌆 Lucky Bits Vegas | Coming Soon |

| 89. 🐥 LuckyBird.io | 5,000 GC, 0.98 SC + 3 Treasure Chests |

| 90. 🛶 Lucky Canoe | 2,000 Gold Coins + 1.2 Free Sweeps Coins |

| 91. 🐡 Lucky Goldfish | No bonus listed on site |

| 92. 👐 Lucky Hands | 1,000,000 Gold Coins + 2 Free Sweepstakes Coins |

| 93. 🧧 Lucky Jackpot Hit | 2,000,000 Welcome Coins |

| 94. 🙋 Lucky Me | 20,000 Gold Coins + 2 Free Sweepstakes Coins |

| 95. 💫 Lucky Stars | 100,000 Gold Coins + 3 FreeSweeps Coins |

| 96. 🥩 Lucky Stake | 50,000 Gold Coins + 25 Free Sweeps Coins |

| 97. 🍀 Luckyland Slots | 7,777 Gold Coins + 10 Free Sweeps Coins |

| 98. ᯓ LuckyRush.io | 10,000 Gold Coins + 0.20 Sweeps Coins |

| 99. 🦅 Luckyslots.us | Up to 3,800,000 GC + 38 Free SC |

| 100. 🦊 LuckyZino | 12,000,000 Gold Coins + 1.7 Free Sweeps Coins |

| 101 🎡 Lunaland | 50,000 Luna Coins + 1 Free Sweeps Coin |

| 102. 🗺 MaxQuest | 50,000 QuestCoins + 5 MaxCoins |

| 103. 🍔 McLuck | 57,500 GC + 30 FREE SC |

| 104 📣 Mega Bonanza | Up to 200,000 Gold Coins + 104 SC FREE |

| 105. 📢 Mega Frenzy | 20,000 Gold Coins + Free Spins |

| 106. 💫 MegaSpinz | Get 60,000 Gold Coins + 40 Free Sweeps Coins + Mega Wheel Spin! |

| 107. 🍾 MetaWin | Win $100K in daily prizes |

| 108. 🆚 Me v U | Coming Soon |

| 109. 🌡️ Midas Jackpot | 1,000 Gold Coins + 0.25 Free SC |

| 110. 🌌 Milky Star Slots | 3,777 Gold Coins + Sweepstar Coins |

| 111. 🤖 Modo.us | 37,500 GC + 550 VIP Points + 6 FREE SC |

| 112. 🐵 MonkeySpins | 100,000 Gold Coins + 2.5 Free Sweepstakes Coins |

| 113. 🪙 Moonspin | 60,000 GC + 3 FREE SC |

| 114. 🐮 Moozi | 20,000 Gold Coins + 1 Free Sweeps Coins |

| 115. 🚨 MyJackpot.com | 150,000 Free Chips |

| 116. 🎊 MyPrize.us | 1,000 Gold Coins + 1 Sweeps Cash |

| 117. 📀 Nio Play | 100,000 Gold Coins + 3 Free Sweeps Coins |

| 118. 🟡 NoLimitCoins | 1.36 Million GC + 6,100 FREE SC |

| 119. 🧃 Novig | 1,000 Novig Coins + 5 Novig Cash |

| 120. 🏹 Orion Strike | Coming Soon |

| 121. 🐼 Panda Master | First bet offer Credits |

| 122. ⛰️ PeakPlay | BOGO offer on coin packages |

| 123. 🖊️ Penn Play | Integrated with of PENN Play Rewards |

| 124. 👇 PICKEM | 50,000 Gold Coins + 1 Free Sweeps Coins |

| 125. 🛝 PlayFame | 90,000 GC + 33 FREE SC |

| 126. 🕹️ Playnomic | 2,000 Tokens and 0.10 Sweeps Coins |

| 127. ♠️ PlaySoPo | 1,000 Gold Coins |

| 128. 🧞♂️ Pulsz | Up to 405,000 GC + 42.3 FREE SC + 460 VIP Points |

| 129. 🎱 Pulsz Bingo | 90,000 GC + 9.8 FREE SC |

| 130. 🏈 Punt.com | Up to 152 FREE SC + 1,510,000 GC |

| 131. 𐂐 Rake.us | Coming Soon |

| 132. 🎁 RealPrize | 2.1 Million GC + 82 FREE SC + 1,000 VIP Points |

| 133. 🤑 Rich Sweeps | 50,000 Gold Coins + 1 FREE Sweeps Coin |

| 134. 🏞️ River Sweeps | $10 first bet offer Credits |

| 135. 🍥 Rolla | 3 Million GC + 32 FREE SC |

| 136. 💲Rolling Riches | 100,000 Gold Coins and 1 Sweeps Coin |

| 137. 💂♂️ Roll Royale | 1,000 Gold Coins + 5 Free Sweeps Coins |

| 138. 👩 Roxy Moxy | 50,000 Gold Coins + 2.5 Free Sweeps Coins |

| 139. 🔻 Ruby Sweeps | 10,000 Gold Coins |

| 140. 🏃 Runestake | Various rakebacks, giveaways, live rains, Sweeps Cash and Fun Cash based on participation in chats |

| 141. 👟 Runewager | 50,000 Fun Cash + 5 Sweeps Cash |

| 142. 🗡 Rust Clash | 50,000 Coins + 1 Free Case |

| 143.⛱️ Scarlet Sands | 250,000 Gold Coins + 1 Free Sweeps Coin |

| 144. ᝰ.ᐟ Scratchee | Discount Hub for exclusive savings |

| 145. ␥ Scratchful | 7,500 Gold Coins and 2.5 Sweepstakes Coins |

| 146. 🐱 Scratchstakes | Up to 80 free scratch card plays per day |

| 147. 🎩 Scrooge | 250 Sweeps Tokens and 2M Gold Coins |

| 148. 🤫 Sheesh | 50,000 Gold Coins + 5 Free Sweeps Coins |

| 149. 🔀 Shuffle.us | 25,000 Gold Coins + 1 Free Shuffle Cash |

| 150. 🫖 Sidepot.us | Up to 90,000 GC + 41 FREE SC |

| 151. 6️⃣6️⃣ Sixty6 | 100,000 Gold Coins + 2 Free Sweeps Coins |

| 152. 🥏 Skills & Slots | No current sign-up bonus offer |

| 153. 🤹🏻 Skillz.com | Free Z Coins on signup |

| 154. 🍒 Slotomania | 1,000,000 Free Spins |

| 155. 😊 Smiles | 1 Million GC + 5 FREE SC |

| 156. 🧙♂️ Sorcery Reels | 10,000 Gold Coins + 0.40 Free Sweeps Coins + 5 free spins |

| 157. 🏍 SpeedSweeps | 50,000 GC + 1 FREE SC |

| 158. 🔄 Spin Blitz | 57,500 GC, 12.5 FREE SC + 30 FREE SC Spins |

| 159. 🌪️ Spinfinite | 63,000 GC + 40 FREE SC + Mystery Bonus |

| 160. 👷 Spinova.us | 15,000 Gold Coins + 3 Free Sweeps Coins |

| 161. 👬 SpinPals | 30,000 Gold Coins + 3 Sweeps Coins |

| 162. 📜 SpinQuest | 10,000 Gold Coins + 1 Free Sweep Coin |

| 163. ⚔️ SpinSaga | 100 Gold Coins + 1 Free Saga Coins |

| 164. 🗽 Spins America | 100,000 Gold Coins + 2 Sweeps Coins |

| 165. 🧙♂️ Spin Sorcery | 10,000 Gold Coins + 0.4 Sweeps Coins |

| 166. 🐦 Spindoo | 11,111 Gold Coins + 2 Free Sweeps Coins + 3 Free Spins |

| 167. 🌊 Splash Coins | 150,000 GC + 2 Free Sweeps Coins |

| 168. ⚽ Sports Millions | 7,500 Gold Coins and 2.5 Sweeps Coins |

| 169. 🏆 Sportzino | 1.570.000 Gold Coins + 45 Free Sweeps Coins |

| 170. 💎 Spree | 1,030,000 GC + 32.5 FREE SC |

| 171. 🧱 Stackr | 500,000 GC + 25 Free Spins + 200% First Purchase Offer |

| 172. 🔵 Stake.us | Up to 550,000 GC, $55 Stake Cash + 3.5% Rakeback |

| 173. ⛈️ StormRush | 750,000 Gold Coins + 1 Free Sweeps Coins |

| 174. 🍭 Sugar Sweeps | $10 + 100% match |

| 175. 🎮 SweepsCoins Games | 2 for 1 First Purchase Bonus |

| 176. 🏜️ Sweep Las Vegas | 1,000 Gold Coins + 2 Free Sweeps Coins |

| 177. 💨 SweepLuxe | 150% Now + 25% Daily for Free |

| 178. 🎩 SweepNext | 25,000 Gold Coins + 2.5 Free Sweeps Coins |

| 179. 🦈 SweepShark | 175,000 Game Coins + 3 Free Sweeps Coins |

| 180. 🦾 Sweepstake.ai | 2,000,000 Gold Coins + 1 Free Sweeps Coins |

| 181. 🤴🏻 SweepsRoyal | 50,000 Gold Coins + 1 Free Sweeps Coin |

| 182.🍬 Sweet Sweeps | Get 7,500 Gold Coins + 2.5 Free Sweepstakes Coins |

| 183. 👨🏼⚖️ SweepsUSA | 5,000 Gold Coins + 5 Free Sweeps Coins |

| 184. 🤴🏻 Sweeps.us | Get 5,000 Gold Coins + 3 Free Sweeps Coins |

| 185. 🧹 Sweeptastic | Get 30,000 LC + 30 Free Sweeps Coins |

| 186. 🎯 Sweepslots | 10,000 GC + 1,000 SC |

| 187. ✖ SweepX | Coming Soon |

| 188. 🖲 Sweepz | 100 Free Sweepz Coins |

| 189. 🤫 Sheesh Casino | 50,000 Gold Coins + 5 Free Sweeps Coins |

| 190. ⛩️ Tao Fortune | 250,000 TC |

| 191. 🚬 TheBoss.Casino | 50,000 Gold Coins + 2.9 Boss Bucks |

| 192. 🏭 The Money Factory | 55,000 GC + 43 FREE SC |

| 193. 🌴 Threelz | 3,000 Gold Coins + 3 Free Sweeps Coins |

| 194. ⚡ Thrillzz | Get $3 of SC + 3,000 Coins |

| 195. 𝐓 ToraTora | 4,000 Gold Coins + 1 Free Sweeps Coins |

| 196. 🎩 Tycoon | Coming Soon |

| 197. 🧿 UltraSpin | 200,000 Gold Coins + 2.5 Sweep Stars |

| 198. 🍸 Vegas Coins | 5,000 Gold Coins + 1 Free Sweeps Coin |

| 199. ♦️ Vegas Gems | Up to 1,000 Gems + 50% Extra Gems with First Purchase |

| 200. 🧨 VegasGlory | 25,000 Gold Coins + 1 Free Sweeps Coin |

| 201. ✌ Vivaro.us | 20,000 Gold Coins and 2 Free Sweeps Coins |

| 202. 🐴 Wildhorse Bucks | 5,000 Bucks + 5 Sweeps Coins |

| 203. 🌎 Wild World | 10,000 Gold Coins + 3 Sweepstakes Coins |

| 204. 🚧 Win Zone | 20,000 Gold Coins + 2.5 Free Sweeps Coins |

| 205. 🤩 WOW Vegas | 1.75 Million WOW Coins + 35 FREE SC |

| 206. 🙌 Yay Casino | 50,000 Gold Coins + 5 Sweeps Coins |

| 207. 🗣 Yotta | Linked to first coin purchase |

| 208. 📺 ZitoBox | Up to $10 in Free Coins |

| 209. 🔊 Zoot | 20,000 Gold Coins + 2 Sweeps Coins |

| 210. ✨ Zula | 220,000 GC + 15 FREE SC |

What is a sweepstakes casino?

Sweepstakes casinos are a free online gaming platform that allow players to enjoy casino-style games. You can play slots, blackjack, roulette, baccarat, plinko, bingo and many of the other games you would expect to see at online gaming sites for free.

When it comes to identifying a sweepstakes casino, look for these primary differences from their real money counterparts:

✅ Virtual currency: Sweepstakes casino sites use virtual currencies called Gold Coins and Sweeps Coins — the latter can also be referred to as Sweepstakes Coins.

✅ Free-to-play model: Players don't deposit money or place real money wagers — they use virtual currency.

✅ Prize redemption: Because gameplay doesn't use real money, players win SC and redeem them for rewards.

✅ Legal accessibility: Sweepstakes casinos are legal in 40+ states.

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

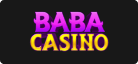

How do sweepstakes casinos work?

Sweepstakes casinos are free-to-play sites that offer traditional casino-style games. While sweepstake casinos look and feel similar to online casinos, they do not involve real money wagers. Instead, they operate using virtual currency, generally in the form of Gold Coins and Sweeps Coins.

Because no money is required to play, sweeps casinos aren’t subject to the same regulations and licensing requirements as U.S. online casinos. Two key things to look for are the use of a dual-virtual system like Gold Coins and Sweeps Coins and the term 'No Purchase Necessary.'

How to win at sweepstakes casinos

We’ve put together our top tips to help give you the best chance to win at sweepstakes casinos:

-

Follow social channels

Player communities often sprout up on social media platforms. Sweeps and social casinos typically engage with followers on Twitter, Facebook, and YouTube. Chanced, for instance, does daily YouTube live-stream videos with an active chat group. Participating in these groups and social media contests is a great way to improve your gameplay skills, get support from fellow players, and receive free coins and bonus drop codes.

-

Read the rules for sweepstakes casino games carefully

Reading the terms and conditions is obvious but always worth bringing up. Every site has slight differences, whether it's minimum sweeps coins needed for redemptions, KYC requests, or what prizes are available for redemptions. Before playing, make sure you are familiar with the terms, and don't hesitate to reach out to customer support via live chat or social media channels if you have questions.

-

Take advantage of free Sweeps Coins

Sweepstakes casinos consistently award free SC, whether it's daily login bonuses or bonus drop codes. You can also ask live chat for them or mail-in a request, so there is no shortage of ways to get free coins and build up your account balance.

-

Choose respected game providers

Any game provider worth their salt has their games and their Random Number Generators (RNGs) tested and certified by independent bodies like Gaming Laboratories International (GLI), BMM Testlabs, and Gaming Associates. This ensures fairness and randomness. Some of our favorite providers include Playson, Novomatic, 3 Oaks Gaming, and Hacksaw Gaming.

Hacksaw Gaming, as an example, holds licenses from several reputable international gambling regulatory bodies, including the Malta Gaming Authority (MGA), the UK Gambling Commission (UKGC), and the Isle of Man (GSC).

-

Understand RTP

Return to Player, commonly referred to as RTP, is vital to understanding sweepstakes casino games. RTP conveys the ratio of wagered coins that a game will pay back to players over time. For example, a sweepstakes slot with an RTP of 97% implies that, on average, players can expect to receive 97% of their wagered coins back over an extended gaming timeline. The remaining 3% represents the house edge or yield for the sweeps casino.

-

Sign up at multiple online sweepstake casinos

Every sweeps coin casino extends a sign-up bonus for new players, among other daily bonuses you can claim. There's no reason for you to not take advantage of these offers by signing up for multiple sweep sites.

-

Play games that require element of skill

Slots are easy to play and only require a tap of a button. Other games at online sweepstakes casinos, such as blackjack and poker, require skill that can significantly reduce the house edge. Luck will always be part of the game, but skill-based games can increase your chances of winning.

What is the newest sweepstakes casino?

The list of new sweepstakes casinos available for U.S. players is continuously growing, with new casinos surfacing every month. We always like to have a closer look at some of the new sweeps cash casino operators entering the market and select the top new additions.

Rich Sweeps - August 2025

Rich Sweeps is one of the newest sweepstakes casinos in the U.S. market, and it’s already showing a lot of promise. New players are greeted with a no-deposit sign-up bonus of 50,000 GC + 1 FREE SC. From there, players have access to over 4,000 titles. If you're looking for free coins, there is an exclusive Telegram channel for players.

✅ 4,000+ titles from over 30 software providers

✅ Multiple first-purchase bonus offers

✅ Referral bonus is a lifetime weekly commission

✅ Fiat and cryptocurrency purchase options

❌No social media giveaways

❌Minimum purchases start at $5.99, which is higher then competitors

| 💰 Rich Sweeps welcome bonus | Get up to 100,000 GC + 66 FREE SC |

| 🤑 Rich Sweeps no-deposit bonus | 50,000 GC + 1 FREE SC |

| 💸 First-purchase bonus | 200% boost - 10,000 GC + 30 free SC for $9.99 100% boost - 25,000 GC + 50 free SC for $24.99 25% boost - 50,000 GC + 65 free SC for $49.99 |

| 🎲 Best games | Pilot, Plinko, Mines, Dice, Hi-Lo, Boxes, Coins |

| ⚠️ Prize redemption coin minimums | 100 SC for a bank transfer |

| ⛔️ Restricted states | ID, LA, MI, MT, NV |

Jumbo88 Casino - May 2025

Jumbo88 went live in May 2025 and features over 1,500 titles. We are pleased to report that a wide variety of options is available, including slots, jackpots, table games, live dealer options, and specialties. The impressive game collection is this casino’s biggest selling point, with titles from 23 software providers that cover all the major gaming categories.

✅ 1,500 titles from over 20 games providers

✅ Multiple first-purchase bonus offers

✅ App available via PWA app

✅ Great collection of payment methods

❌No VIP program

❌No live chat support

| 💰 Jumbo88 welcome bonus | Up to 70,000 GC + 61 FREE SC |

| 🤑 Jumbo88 no-deposit bonus | 10,000 GC + 1 FREE SC |

| 💸 First-purchase bonus | Extra 100% — 20,000 GC + 20 FREE SC for $9.99 or Extra 50% — 60,000 GC + 60 FREE SC for $39.99 |

| 🎲 Best games | Bonanza Billion, Tasty Bonanza, Gravity Roulette, Anubis vs Horus Twin Titans, Aztec Magic Bonanza |

| ⚠️ Prize redemption coin minimums | 100 SC for a bank transfer |

| ⛔️ Restricted states | CT, DE, ID, LA, MD, MI, MT, NJ, NV, NY, PA, RI, WA, WV |

SpeedSweeps Casino - April 2025

SpeedSweeps is one of the most recent additions to U.S. sweepstakes casino market, and it’s already showing a lot of promise. New players are given a no-deposit bonus of 50,000 GC + 1 FREE SC. From there, the 'Daily Wheel' awards one free bonus coin each day. One area where SpeedSweeps stands out from the crowd is its 1,300+ game library, which features a variety of unique titles not typically found in most sweeps, including Plinko, Dice, Lines, Mines, Pilot, and more.

✅ Weekly coin bundle boosts

✅ Live chat available 24/7

✅ 2,200+ games library

✅ Great VIP program

❌ No sweepstakes casino app

| 💰 SpeedSweeps welcome bonus | 50,000 GC + 1 FREE SC |

| 🤑 SpeedSweeps no-deposit bonus | 50,000 GC + 1 FREE SC |

| 💸 First-purchase bonus | 10,000 GC and 30 SC for $9.99, 25,000 GC and 50 SC for $24.99, or 50,000 GC and 65 SC for $49.99 |

| 🎲 Best games | Pilot, Plinko, Dice, Lines, Mines |

| ⚠️ Prize redemption coin minimums | 100 SC |

| ⛔️ Restricted states | DE, ID, MD, MI, NV, VA, WV |

List of new sweepstakes casinos

With the surge in popularity, new sweeps casinos are launching every month, and our experts are always on top of the latest developments. Here is a list of new sweeps casinos 2025 that we have our eyes on:

| New sweepstakes casinos | Best features | Opened |

|---|---|---|

| 🏴☠️ Big Pirates | Coming Soon | TBD |

| 🏁 CrazyWin | Coming Soon | TBD |

| 🌆 Lucky Bits Vegas | Coming Soon | TBD |

| 🆚 Me v U | Coming Soon | TBD |

| 🏹 Orion Strike | Coming Soon | TBD |

| 𐂐 Rake.us | Coming Soon | TBD |

| ✖ SweepX | Coming Soon | TBD |

| 🎩 Tycoon | Coming Soon | TBD |

| 🐦 Spindoo | Great mail in bonus and referral bonus and over 800 games | October 2025 |

| 💫 MegaSpinz | 200% bonus on first purchase, 24/7 customer support | October 2025 |

| 🏟️ GameDayZone | Sweeps and social sportsbook mixed into one with 20 leading games providers | September 2025 |

| 🤺 CrashDuel | 16 software providers power an impressive games library of 1,900 titles | September 2025 |

| 🔀 Shuffle.us | Accepts 19 crypto currencies and great collection of slot and live dealer games | September 2025 |

| 🇺🇸 American Luck | 60,000 Gold Coins + 6 Sweeps Coins sign-up offer and over 1,500 titles | September 2025 |

| ⛈️ StormRush | 1,200+ slots, 10-level VIP program, up to 5 SC in daily rewards | September 2025 |

| 🛶 Lucky Canoe | 1,000 Gold Coins sign-up bonus and Daily Spin wheel for the first 10 days | August 2025 |

| 🏜️ Sweep Las Vegas | Over 2,000 titles including bingo and arcade games + great ongoing promotions | August 2025 |

| 🤑 Rich Sweeps | Over 2,500 slots + casino games and VIP bonus offers | August 2025 |

| 🟤 Bracco | Social sportsbook and casino with slots, table games, and arcade | August 2025 |

| 👩 Roxy Moxy | Slots only social casino with multiple bonuses | July 2025 |

| 🆓 FreeSpin | Great sign-up offer with 20 SC free spins and 650+ games | July 2025 |

| 🦈 SweepShark | Over 1,000 games, VIP Club, and daily activities and challenges | July 2025 |

| 🂡 Ace.com | 150% extra coins, Rewards Wheel, and 400+ slots | July 2025 |

| 🥋 CasinoKai | Live poker tournaments and great selection of providers | June 2025 |

| 🚧 The Win Zone | 2.5 free SC sign-up bonus and great collection of software providers | June 2025 |

| 🌡️ Midas Jackpots | 800+ games with 200 in-house titles and 20-level VIP program | June 2025 |

| 🗽 SweepsUSA | 2,000+ titles including bingo, table, and live dealer tables and 5 Free SC in sign-up offer | May 2025 |

| 🚦SpeedSweeps | Daily wheel, daily boosts, and VIP promotions | April 2025 |

| 🍥 Rolla | 7-day welcome offer and over 1,600 titles | April 2025 |

| 🍬 Gummy Play Casino | Over 2,000 free online slots and great promotions for new players | April 2025 |

| 🎊 Funz | 250 slots, blackjack, and dice games from trusted brands, and a great daily login bonus | March 2025 |

| 🎡 Lunaland | 150% first purchase bonus, coin bundles begin at $1.99, and 150+ slot titles | March 2025 |

| 🫖 Sidepot.us | 10,000 GC + 1 FREE SC | February 2025 |

| 6️⃣6️⃣ Sixty6 | 100,000 GC + 2 SC sign-up bonus, two 100% first purchase bonus offers, and over 550 titles. | February 2025 |

| 𝑩 Betty Sweeps | 300+ games and 5 free SC mail-on bonus | January 2025 |

| ⛰️ PeakPlay | BOGO on coin bundles | January 2025 |

| 🌕 Gold Rush City | 15,000 Gold Coins + 500 Sweeps Coins | January 2025 |

Who invented online sweepstakes casinos?

Sweepstakes casinos first emerged in 2005, originating from internet cafes and phone shops in the southern United States. These early sweepstakes parlors offered casino-style games through sweepstakes systems, often tied to the sale of phone cards or computer usage. Over time, the model evolved into today’s online sweepstakes casinos, which use virtual currencies like Gold Coins (GC) and Sweep Coins (SC) to remain within state regulations. While they didn’t stem from a single inventor, it was a mix of operator innovation, shifting laws, and player demand that truly turned the screws and transformed these small local setups into a nationwide online industry.

How are sweepstakes casinos legal?

Sweepstakes casinos are legal in most U.S. states. However, some states possess restrictive legislation that discourages brands from operating in them.

Sweepstakes casino sites operate outside traditional federal gambling laws — in particular, the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) — due to their unique free-to-play and virtual currency business model. This distinction allows them to operate legally in the majority of U.S. states.

Remember the following when looking to play at a Sweeps Coins casino:

✅ Sweepstakes casinos are legal across the country and only banned in California (Starting January 1, 2026), Connecticut, Delaware, Idaho, Missouri, Montana, New Jersey, Washington.

✅ You can always play games for free.

✅ Sweeps are compelled to offer an Alternate Method of Entry (AMOE) that does not require any purchase. Generally, this comes in the form of a mail-in bonus.

✅ No purchase is necessary to win nor do they increase your chances of winning.

Why are states banning sweepstakes casinos?

Several states have passed legislation or taken regulatory actions to ban sweepstakes casinos, with a growing number of others actively considering similar measures. These jurisdictions are focusing on the dual-currency model that powers sweepstakes casinos, which critics see as a way to bypass gambling regulations.

What is the legal age to play at sweepstakes casinos?

Most sweepstakes allow players to sign up from 18 years old and above, but some states have a higher minimum age requirement. For example, Alabama and Nebraska state laws set the age at 19+, and Mississippi plates must be over 21.

Over the past few months, we've seen many sweepstakes casinos raise their legal age to 21 across the country, regardless of state law. For instance, Hello Millions, Jackpota, McLuck, Mega Bonanza, PlayFame, Pulsz, SpinBlitz, and Stake.us.

What states allow sweepstakes casinos?

Idaho and Washington are the only states where sweep casinos are currently illegal, although Connecticut and Montana are set to join this list on October 1, 2025 while other states are also progressing anti-sweepstakes legislation.

"Just because sweepstakes casinos are legal in a state doesn't mean all sweepstakes casinos are available. Each sweepstakes casino chooses which states it operates in."

Colin MacKenzie, Senior Casino Editor

Colin MacKenzie, Senior Casino Editor

What's new in sweepstakes casinos? (November 1, 2025)

Sweepstakes casinos are still a relatively new addition to the iGaming space, and there are constant developments regarding state-by-state regulation and operator launches. Keep on top of all the latest updates here:

- The Social Gaming Leadership Alliance warns banning sweepstakes could cost New York $230 million in potential revenue.

- Covers Senior News Analyst Ryan Butler is reporting that industry experts at G2E 2025 expect sweepstakes-style casinos to be nearing their end amid crackdowns.

- Minnesota is quietly pressuring sweepstakes casinos to cease unregulated operations within the state.

- The Social Gaming Leadership Alliance will host their own expo on the legitimacy of sweepstakes casinos after being denied a platform at the Global Gaming Expo 2025, according to Straight to the Point. The SGLA offered to sponsor its own panel discussion or join existing events at G2E, but all requests to participate were reportedly rejected.

- The Social Gaming Leadership Alliance is opposing Bill 831, which bans sweepstakes casino games in California and has proposed a regulatory framework to support consumers and tribal sovereignty.

- The California State Assembly passed A.B. 831, which bans sweepstakes casinos and sportsbooks, sending the bill to Governor Gavin Newsom for approval.

- California Senate votes 36-0 to pass A.B. 831, a bill aimed at banning sweepstakes casinos and sportsbooks.

- Louisiana Department of Revenue is suing multiple sweepstakes casino operators in the hopes of claiming nearly $44 million in purported unpaid taxes.

- A San Francisco Superior Court judge denied High 5 Entertainment's motion to compel arbitration, keeping a consumer lawsuit active.

- Pragmatic Play announces it will withdrawal from U.S. online sweepstakes casino market.

- California's Senate Appropriations Committee has advanced bill 831 to the Senate floor, a bill that would ban online sweepstakes casinos.

- Canadians will no longer have access to VGW’s network of sites, including Chumba Casino, Luckyland Slots, and Global Poker, as they'll begin pulling out of Canada this week and will be completely out of the country by October 23rd.

- Nationwide lawsuit filed against VGW Holdings, payment processors Yodlee and Trustly, ID verification vendor Jumio, and slots influencer Brian Christopher.

- VGW signs conditional agreement with California tribe to offer sweepstakes casino gaming.

- California’s anti-sweepstakes casino bill has been placed on the Senate Appropriations Committee’s “Suspense File.

- New Jersey Bill 5447 signed into law officially banning sweepstakes casinos in the Garden State.

- B-Two Operations re-enters sweepstakes casino markets in Alabama and Georgia.

- Sweepstakes casino Crown Coins named title sponsor for upcoming GT World Challenge America that features more than 100 race cars across six competitive series.

- According to new data the American Gaming Association compiled, 90% of sweepstakes casino users consider the activity to be gambling.

- VGW tells players it will wind down sweepstakes casino operations on its sites, Chumba Casino, LuckyLand Slots, and Global Poker in Mississippi.

- Michigan regulators have sent out 17 cease-and-desist letters since early June to sweepstakes casinos.

- VGW will no longer offer its sweepstakes casinos in New Jersey as regulatory ban looms.

- California lawmakers revised AB831 to remove language that could have criminalized players in sweepstakes-style online gambling games.

- California lawmakers are advancing Assembly Bill 831 keeps moving forward which aims to ban sweepstakes casinos using dual-currency models.

- West Virginia's crackdown on sweepstakes casinos is leading to a mass exodus after the attorney general sent out nearly 50 subpoenas.

- VGW implements sales tax on Gold Coins amid increased regulatory scrutiny on sweepstakes casinos

- Meta updates advertising rules to restrict sweepstakes casino ads on Facebook and Instagram.

- Tribal gaming leaders and lawyers are confident sweepstakes operators are fighting a losing battle in California.

- California sweepstakes casino ban bill passed by a vote of 10-0, but not without concerns from lawmakers.

- Louisiana Attorney General declares sweepstakes casinos a violation of the state's gaming laws, making it the fourth state to outlaw sweepstakes casinos, joining Michigan, Montana, and Washington.

- New Jersey pass anti-sweeps legislation that will prohibit sweepstakes casinos and contains other measures, such as criminalizing proxy betting.

- Stake.us and High 5 among operators sent cease-and-desist letters from the Arizona Department of Gaming.

- Lawsuits against online sweepstakes operators are piling up in Alabama.