Best Massachusetts sports betting sites

- More details

- Fewer details

- Fanatics Sportsbook Benefits

- Flexible FanCash Rewards

- Leading Fair Play policy

- Unique and creative promos

- Fanatics Sportsbook Review

- More details

- Fewer details

- BetMGM Benefits

- Do-it-all parlay builder

- Consistent daily NFL promos

- Classy MGM Rewards program

- BetMGM Bonus Review

- More details

- Fewer details

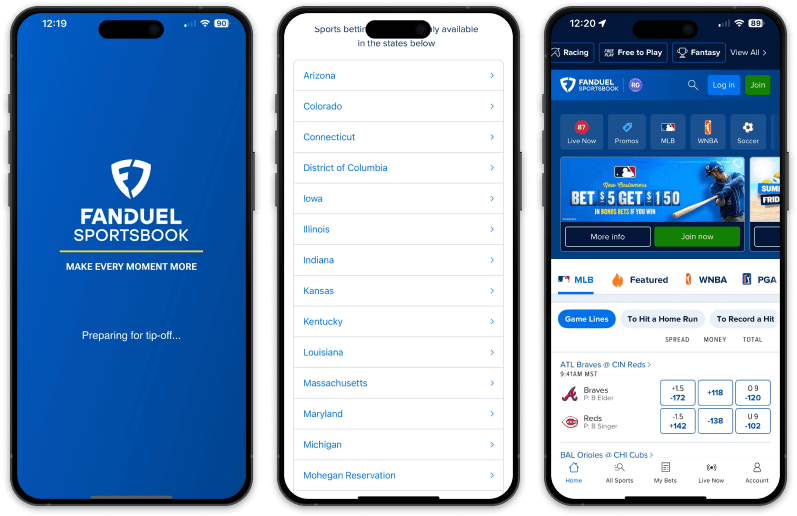

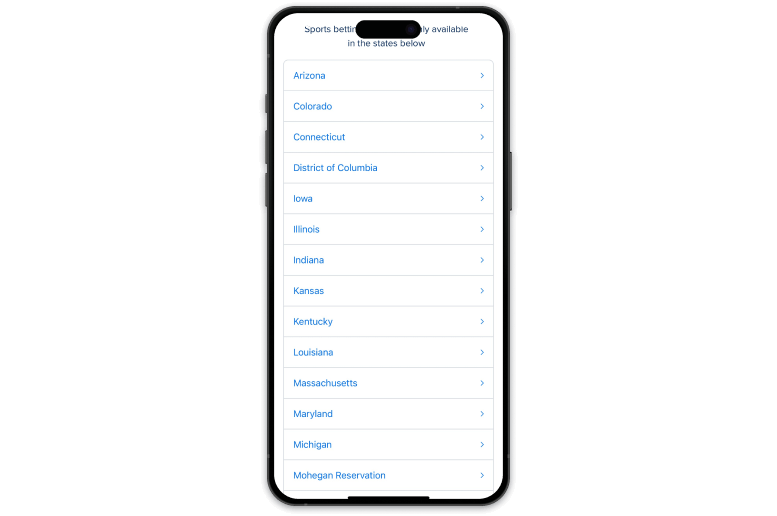

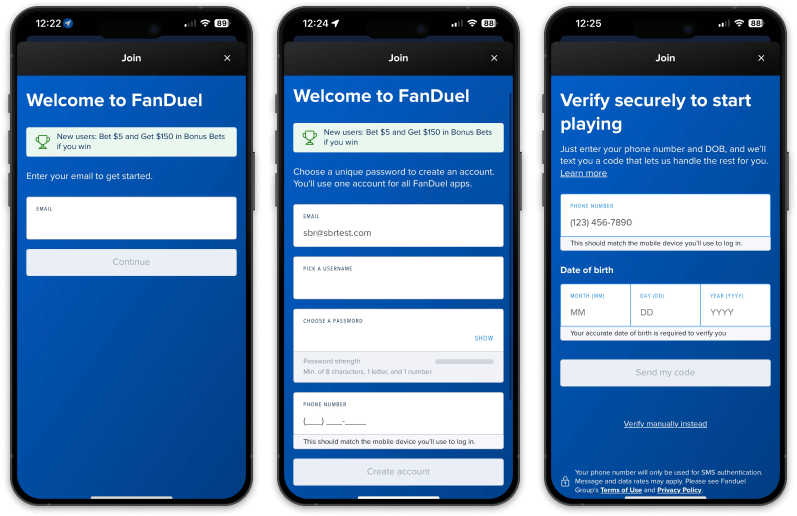

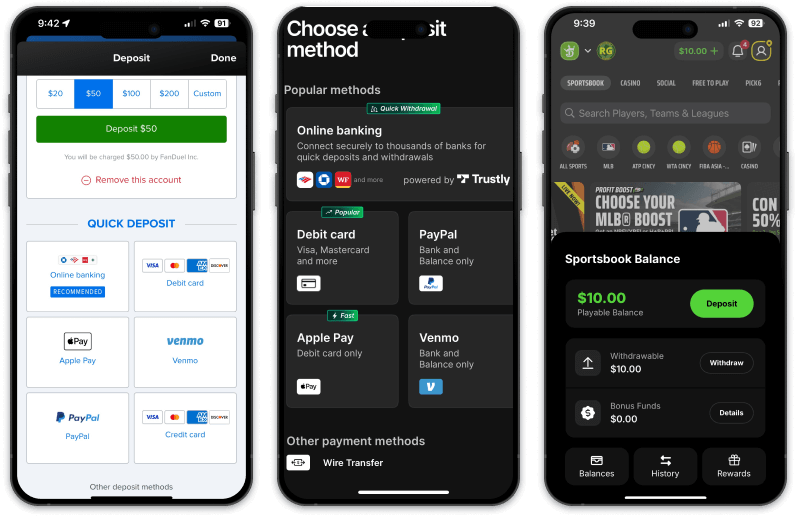

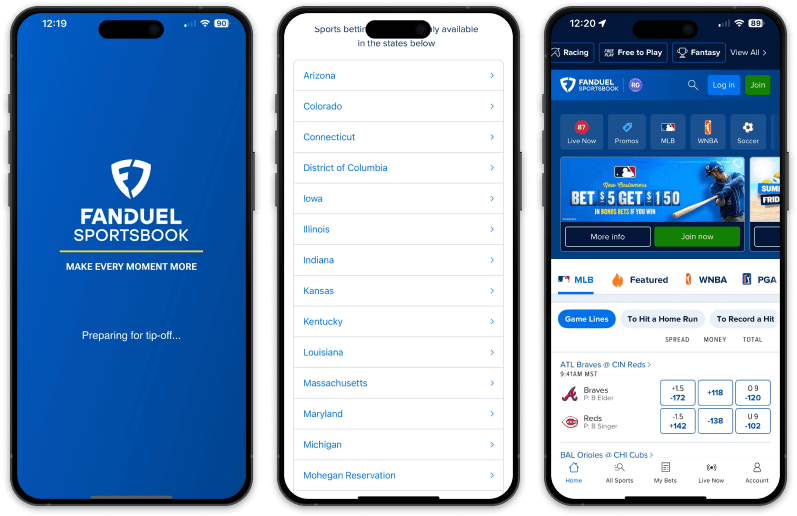

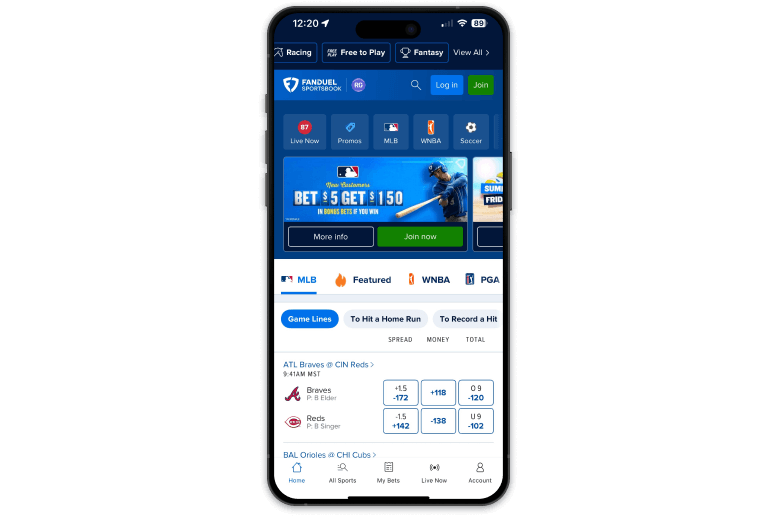

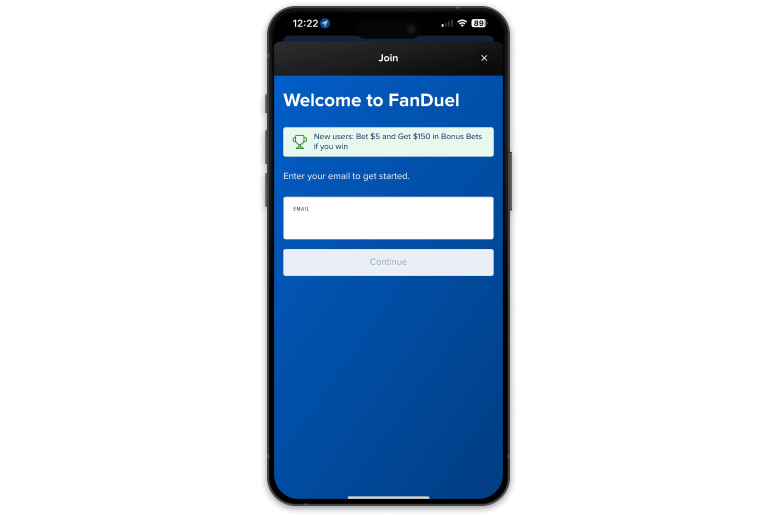

- FanDuel Benefits

- Excellent user experience

- Best for NFL betting

- World-class mobile platform

- FanDuel Review

- More details

- Fewer details

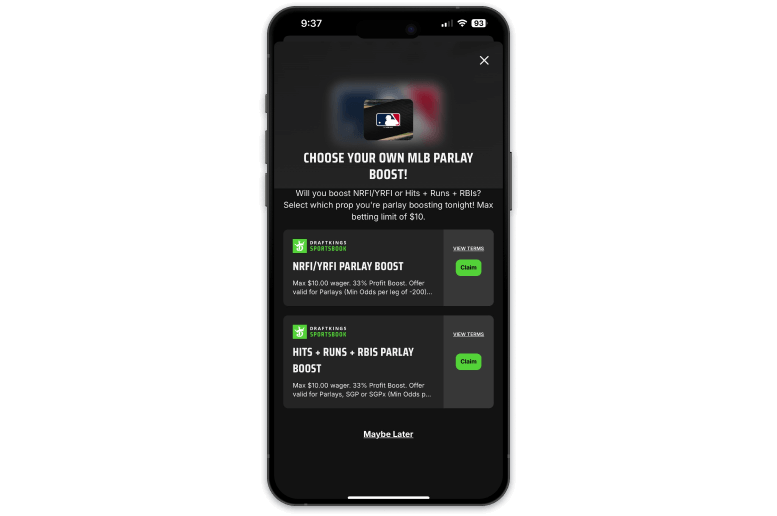

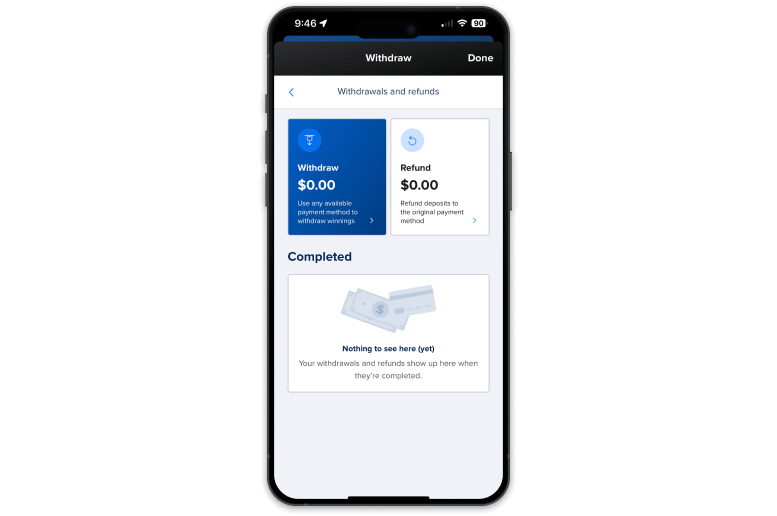

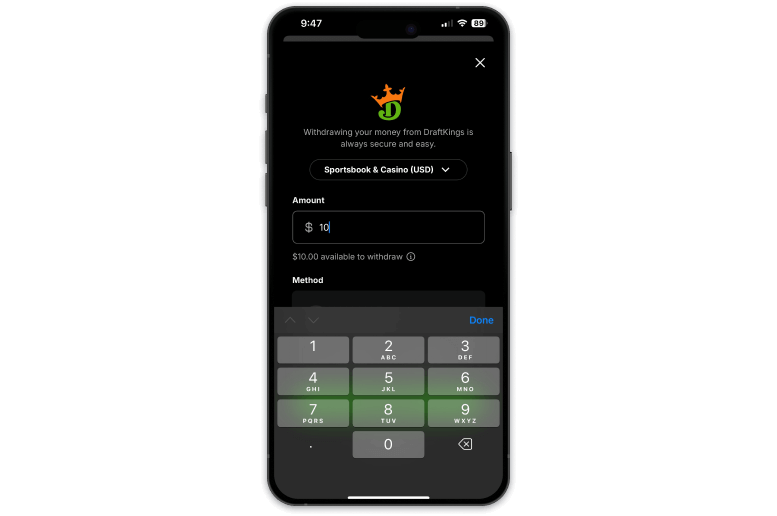

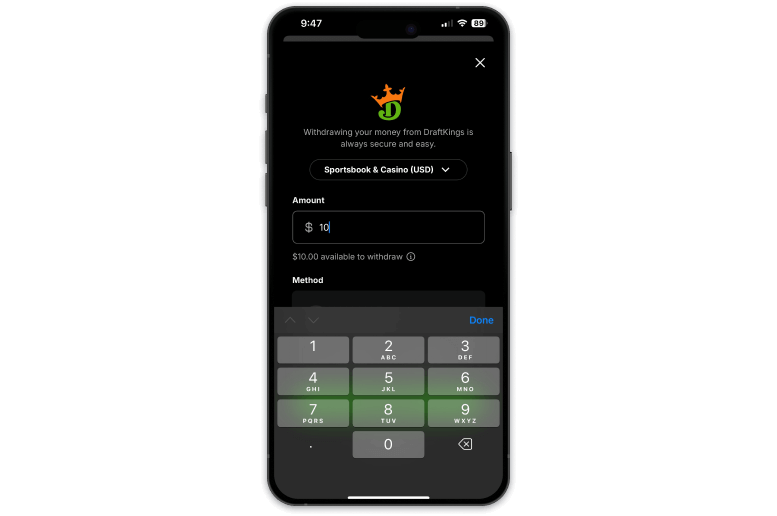

- DraftKings Benefits

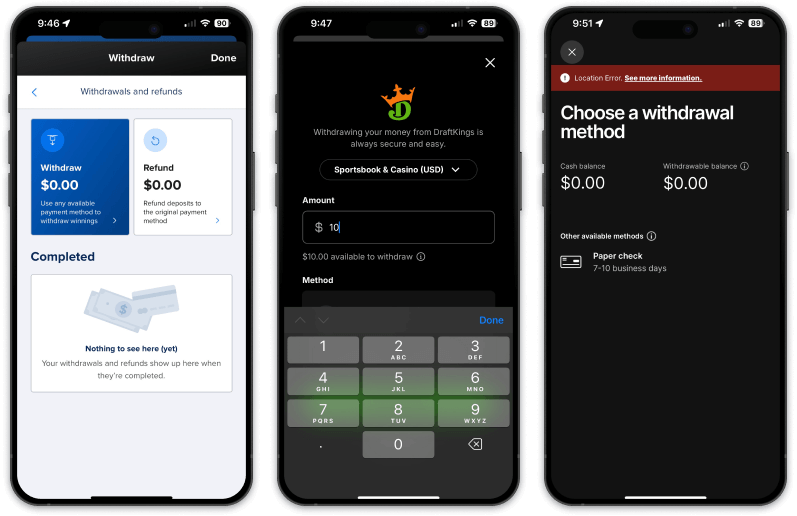

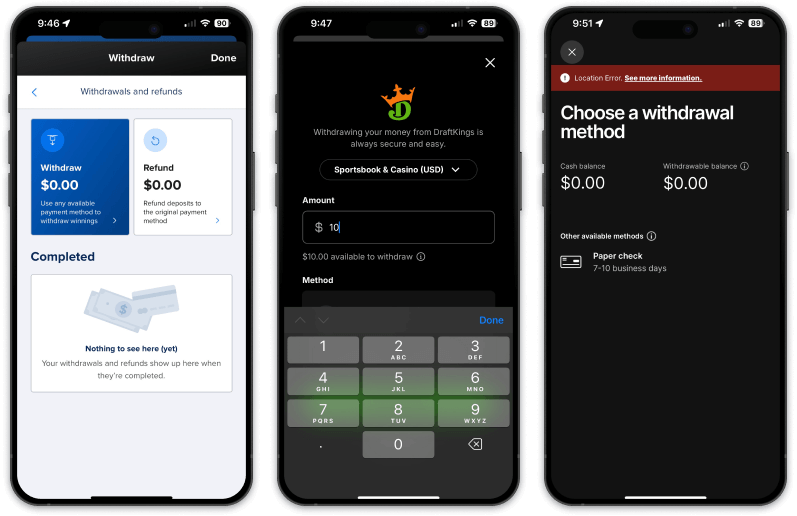

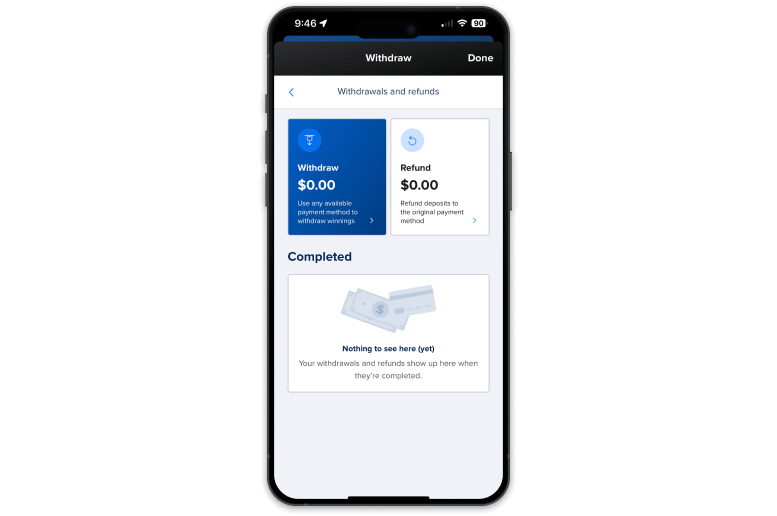

- Lightning fast withdrawals

- Supreme navigation

- Best for grading winners

- DraftKings Review

- More details

- Fewer details

- Caesars Benefits

- Best VIP experience

- White glove customer support

- Highly trusted legacy brand

- Caesars Review

Up to $1,000 in FanCash Bet Matches

Massachusetts sports betting key details

Browse the pertinent details about the online Massachusetts sports betting market in 2026 below:

| Massachusetts Betting Facts | |

|---|---|

| Massachusetts online sports betting status | Live ✅ |

| Legal betting age | 21+ |

| Number of betting licenses | 15 |

| Online betting sites | 7 |

| Tax rate | 20% |

| State regulator | Massachusetts Gaming Commission |

| Last verified | Feb. 11, 2026 |

All verified Massachusetts sportsbook promo codes

| MA sports betting site 🏆 | Welcome bonus 💰 | Promo code ✅ |

|---|---|---|

| ⭐ Fanatics Sportsbook | Up to $1,000 in FanCash Bet Matches |

Claim $1,000 without code |

| ⭐ BetMGM | $1,500 First Bet Offer |

COVERS |

| ⭐ Caesars Sportsbook | $250 Bet Match, Win or Lose |

COVERS250BM |

| ⭐ DraftKings | Bet $5, Win $300 + $1K Deposit Bonus |

Claim $1,300 without code |

| ⭐ FanDuel | Bet $5, Win $100 |

Claim $100 automatically |

| ⭐ theScore Bet | Bet $10, Get $100 |

No code required |

|

⭐ Bally Bet |

No code required |

Is sports betting legal in Massachusetts?

Yes, sports betting is legal in Massachusetts. House Bill 5164 was signed into law on August 10, 2022, by former Governor Charlie Baker, just 10 days after the Sports Betting Conference Committee agreed to introduce legal wagering in the Bay State.

Top 5 Massachusetts sports betting apps reviewed

Massachusetts' mobile sports betting legal landscape comprises of seven online sportsbook. But with choices can come uncertainty, so we've taken the liberty of parsing through the top sports betting apps Massachusetts has to offer, narrowing our list according to the mobile platforms' overall performance.

Here are our picks for the best betting apps Massachusetts offers in 2026:

1. Fanatics Sportsbook - Best for merch rewards

2. BetMGM - Best overall experience

3. FanDuel - Best user experience

4. DraftKings - Best for grading winners

5. Caesars Sportsbook - Best rewards program

1. Fanatics Sportsbook Massachusetts

Fanatics Sportsbook, an emerging online operator, arrived in Massachusetts in May 2023. The online sportsbook is a must for all sports fans, as you can earn FanCash — its version of reward points — with every wager you place, which you can redeem later for discounts on sports merchandise, events, tickets, and more.

Check out our Fanatics Sportsbook review to learn more.

| Fanatics Sportsbook | |

|---|---|

| Is Fanatics Sportsbook live in Massachusetts? | Yes ✅ |

| App Store rating | 4.8/5 (135.7K reviews) |

| Android rating | 4.6/5 (29.3K reviews) |

2. BetMGM Massachusetts

$1,500 First Bet Offer

COVERS

Expert Verdict

A hallowed name in the gaming industry, BetMGM packs a lot into its aesthetically striking mobile app, making it a staple of our list of best sports betting apps in the U.S.. With strong odds pricing, an intuitive design, a straightforward betting interface, and enough markets to keep you scrolling for hours on end, BetMGM Massachusetts has something for newbies and sharps alike. In particular, its live streaming feature works in harmony with in-game betting, showing your active wagers on screen throughout the game.

Refer to our BetMGM bonus code review for an in-depth analysis.

| BetMGM Sportsbook | |

|---|---|

| Is BetMGM live in Massachusetts? | Yes ✅ |

| App Store rating | 4.8/5 (239.4K reviews) |

| Android rating | 4.2/5 (36.6K reviews) |

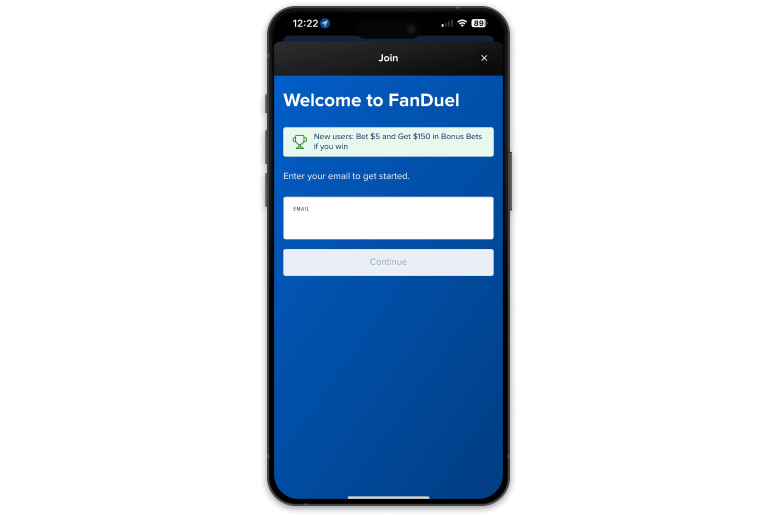

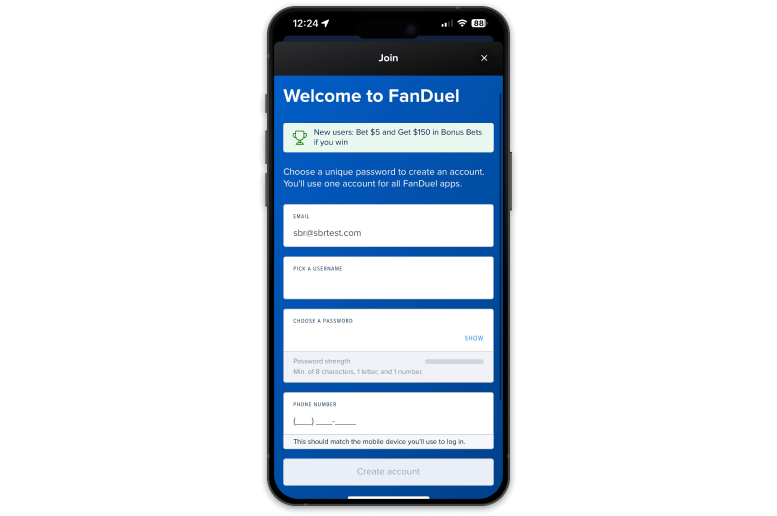

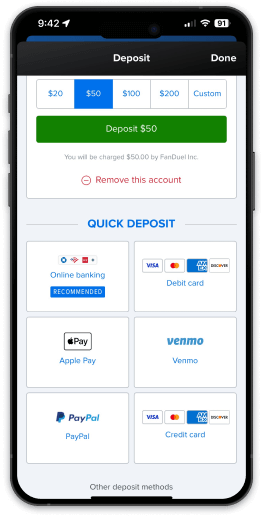

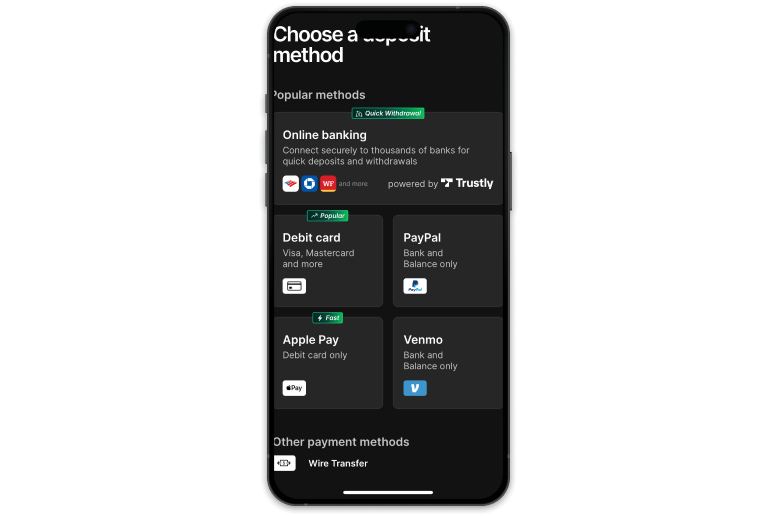

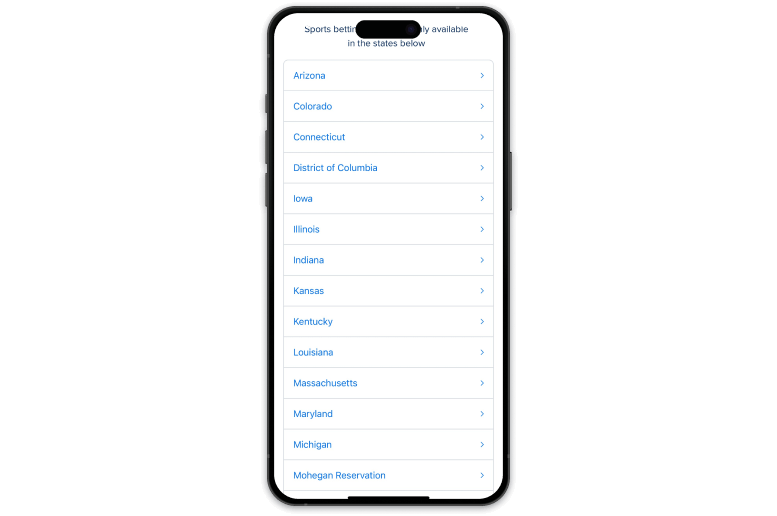

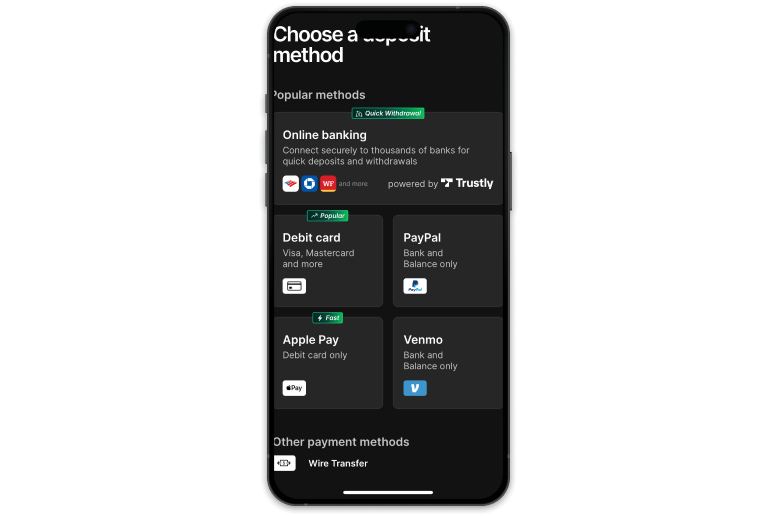

3. FanDuel Massachusetts

Bet $5, Win $100

The DFS-turned-sports-betting staple, FanDuel's built a reputation largely through a mobile sports betting app that is steadfast in its reliability, fluid in its navigation, and unmatched in its top-notch live betting section. In fact, the sports betting operator is so confident in its mobile platform that it requires you to download the FanDuel sportsbook app after registration before you can redeem any available sign-up offers.

Check out our FanDuel review for further analysis.

| FanDuel Sportsbook | |

|---|---|

| Is FanDuel live in Massachusetts? | Yes ✅ |

| App Store rating | 4.9/5 (1.9M reviews) |

| Android rating | 4.6/5 (382K reviews) |

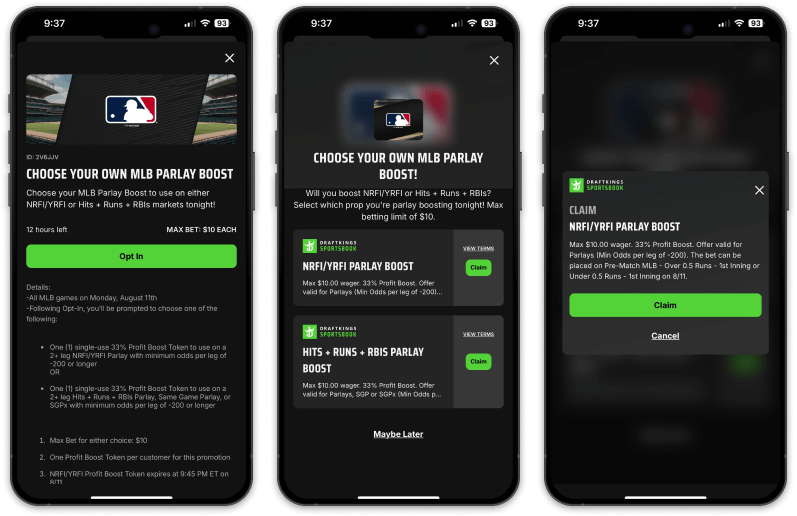

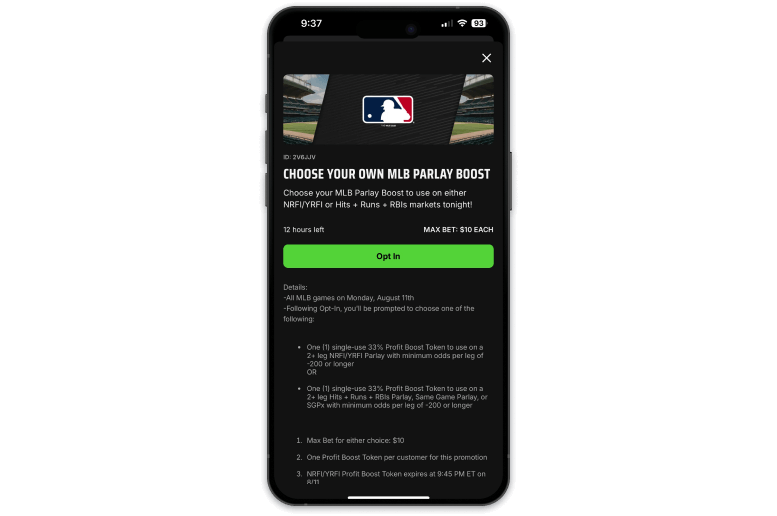

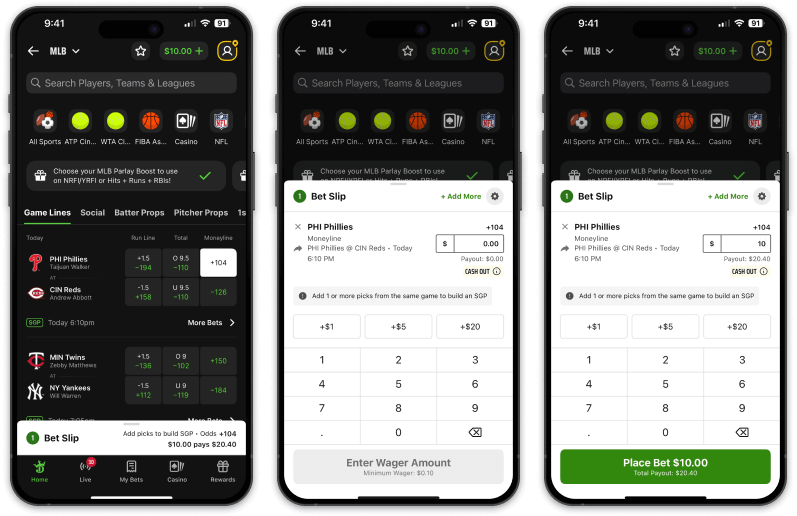

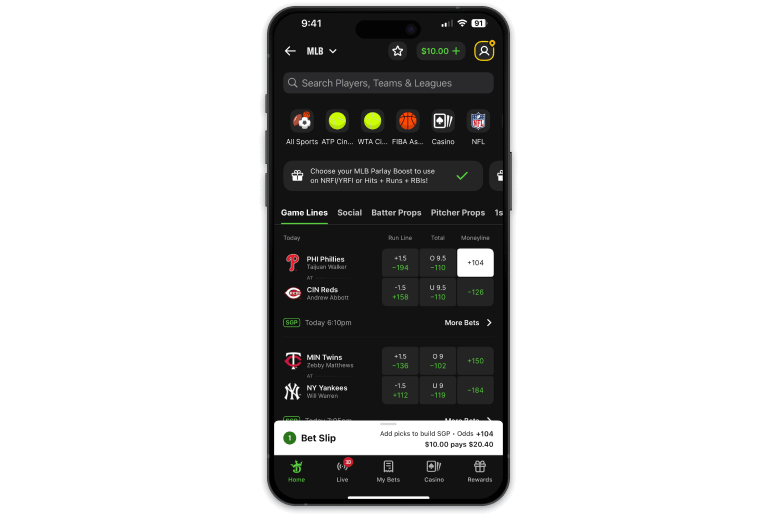

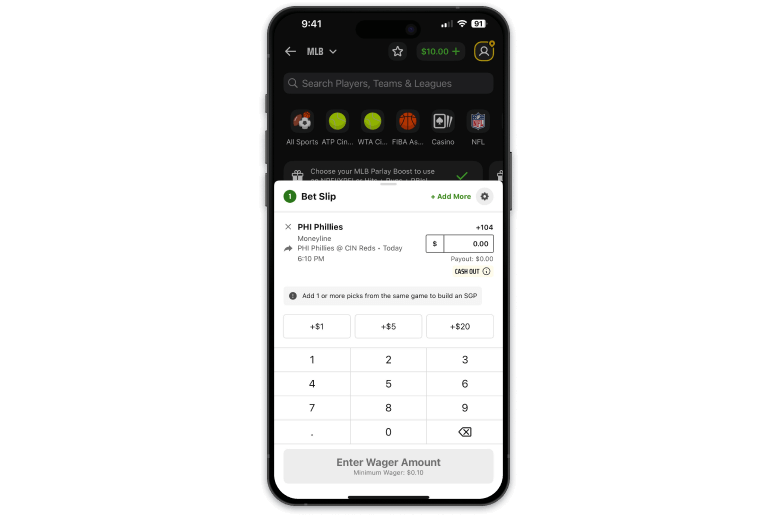

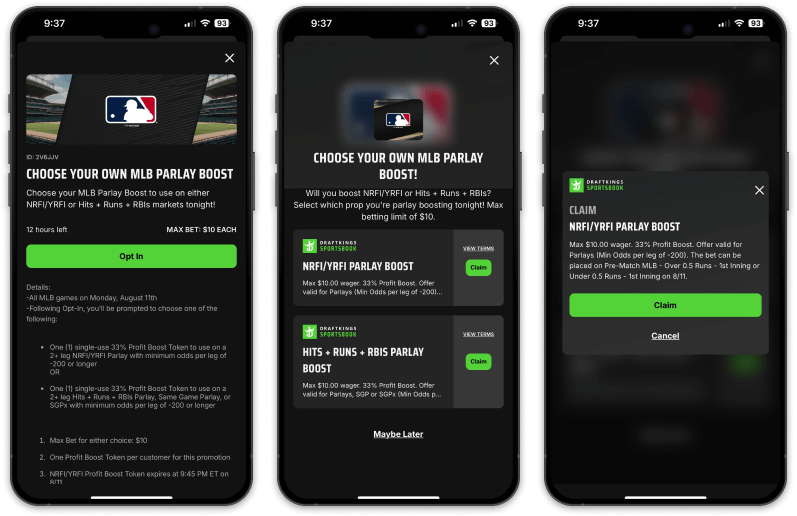

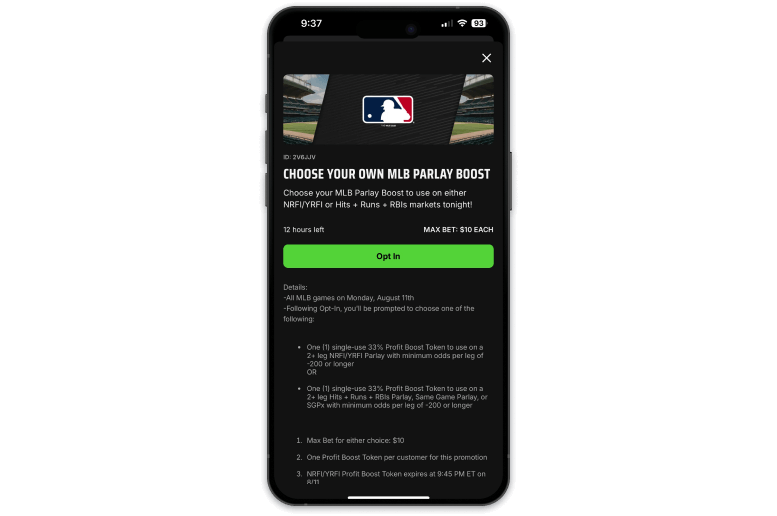

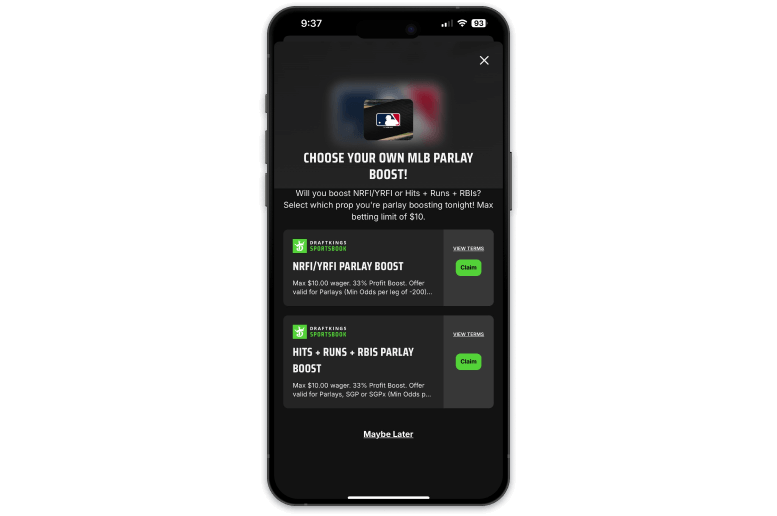

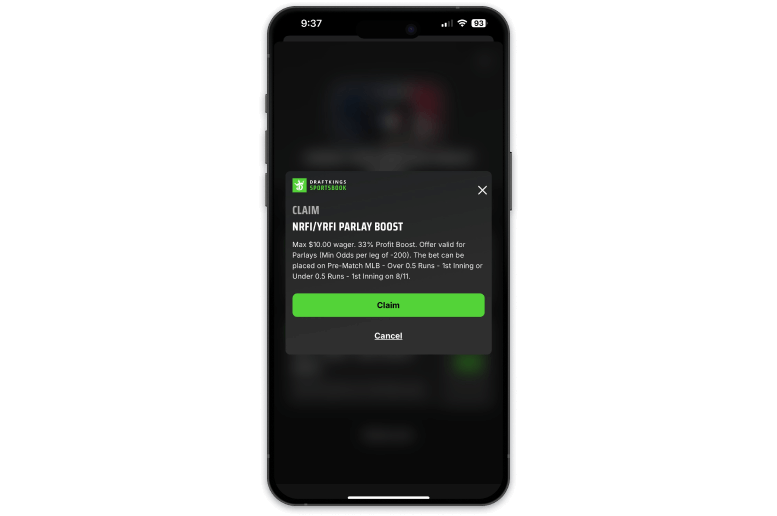

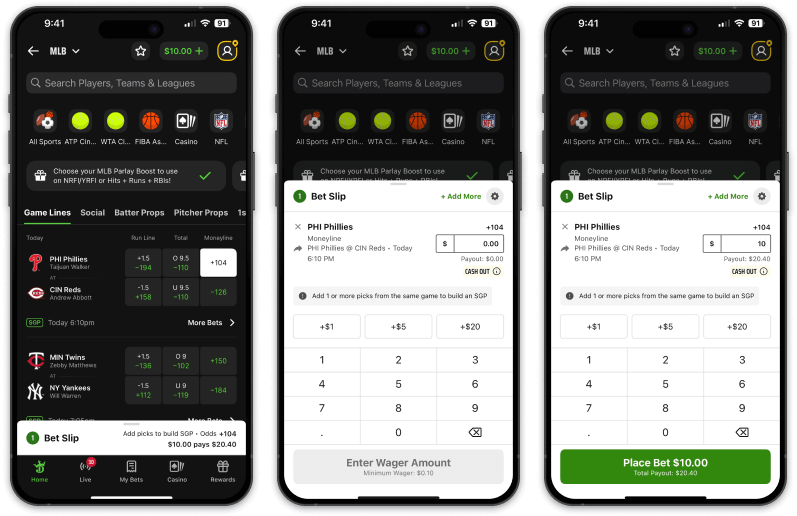

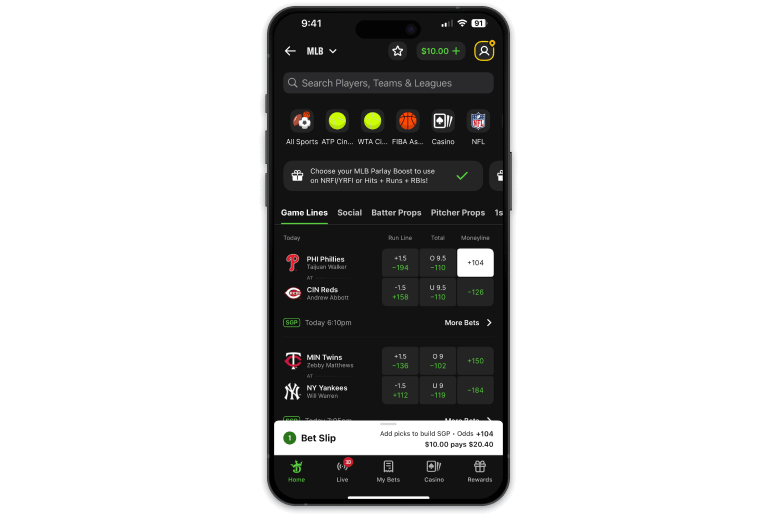

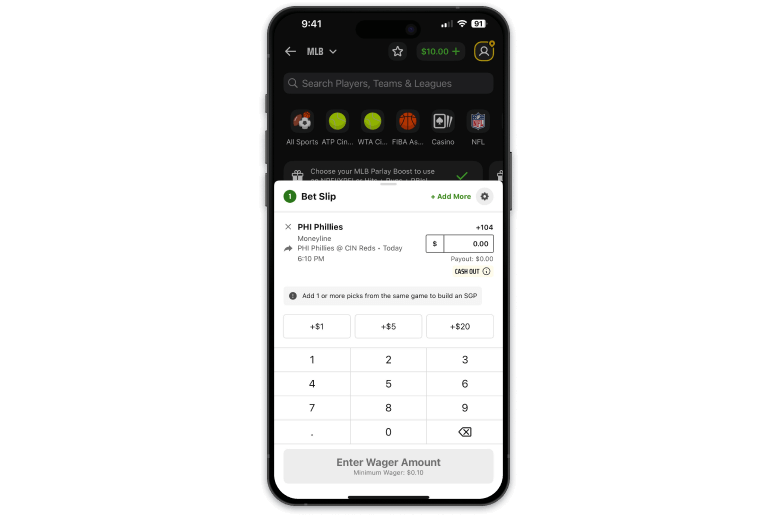

4. DraftKings Massachusetts

Bet $5, Win $300

Available in Massachusetts

One of the predominant titans of the sports betting market, DraftKings Sportsbook now offers its exceptional betting app in Massachusetts. With a mobile sportsbook that makes navigation a snap and carries the most sought-after features — such as same-game parlays, lightening quick payouts, and great daily boosts. Bay Staters can expect DraftKings Massachusetts to continually search for ways to improve its product as it attempts to remain king of the hill.

Our DraftKings promo code review pages offers an in-depth look at this great MA sportsbook.

| DraftKings Sportsbook | |

|---|---|

| Is DraftKings live in Massachusetts? | Yes ✅ |

| App Store rating | 4.8/5 (845.7K reviews) |

| Android rating | 4.3/5 (175K reviews) |

GAMBLING PROBLEM? CALL 1-800-GAMBLER or 1-800-522-4700, (800) 327-5050 or visit MA Gambling Helpline (MA). Call 877-8-HOPENY/text HOPENY (467369) (NY). Please Gamble Responsibly. 888-789-7777/visit CONNECTICUT COUNCIL – ON PROBLEM GAMBLING (CT), or visit Home (MD). 21+ and present in most states. (18+ DC/KY/NH/WY). Void in ONT/OR/NH. Eligibility restrictions apply. On behalf of Boot Hill Casino & Resort (KS). Pass-thru of per wager tax may apply in IL. 1 per new customer. Must register new account to receive reward Token. Must select Token BEFORE placing min. $5 bet to receive $300 in Bonus Bets if your bet wins. Min. -500 odds req. Token and Bonus Bets are single-use and non-withdrawable. Bet must settle by and Token expires 2/22/26. Bonus Bets expire in 7 days (168 hours). Stake removed from payout. Terms: http://sportsbook.draftkings.com/promos. Ends 2/15/26 at 11:59 PM ET. Sponsored by DK.

5. Caesars Sportsbook Massachusetts

$250 Bet Match, Win or Lose

COVERS250BM

Caesars Sportsbook Massachusetts' platform is stylish and intuitive and hosts many betting markets, bet types, and exclusive promotions and rewards. Bay Staters will find that the sportsbook's first-rate customer service is seamlessly integrated and that a plethora of banking methods await their perusal.

Visit our Caesars Sportsbook review for more information.

| Caesars Sportsbook | |

|---|---|

| Is Caesars Sportsbook live in Massachusetts? | Yes ✅ |

| App Store rating | 4.7/5 (89.3K reviews) |

| Android rating | 4.5/5 (30.7K reviews) |

Comparing top Massachusetts sports betting sites

| Compare | |||||

| Welcome bonus | $1,500 First Bet Offer | $250 Bet Match, Win or Lose | Bet $5, Win $300 | Bet $5, Win $100 | Up to $1,000 in FanCash Bet Matches |

| Promo code | COVERS | COVERS250BM | Automatically applied after registration | Automatically applied after registration | Automatically applied after registration |

| Payout speed | Within 48 hours | Within 24 hours | Within 24 hours | Within 24 hours | Within 24 hours |

| Odds provider | BetMGM | Caesars | SBTech | Flutter | Amelco |

| Top feature | Overall experience | Rewards program | Grading winners | User experience | Merch rewards |

| Live streaming? | Yes ✅ | Yes ✅ | Yes ✅ | Yes ✅ | Yes ✅ |

| Covers BetSmart Rating | ⭐ 4.9/5 | ⭐ 4.6/5 | ⭐ 4.5/5 | ⭐ 4.8/5 | ⭐ 4.6/5 |

| Claim Bonus | Claim $1,500 | Claim $250 | Claim $300 | Claim $100 | Claim $1,000 |

Best Massachusetts sports betting offers and bonuses

If you’re looking to start claiming the top legal online Massachusetts sportsbook bonuses and promos but don’t know where to begin, this is a great place to start. These are the best Massachusetts bonuses and promotions available in 2026:

Fanatics Sportsbook - Up to $1,000 in FanCash Bet Matches: No Fanatics Sportsbook promo code is required to claim its latest welcome offer of up to $1,000 in FanCash Bet Matches. Make a $1 wager on a market with -200 odds or longer. You'll receive one (1) bonus bet equal to the amount of your wager, up to $100, for your first 10 days using the operator. This offer is valid until June 1, 2026.

BetMGM Sportsbook - $1,500 First Bet Offer: Create a new BetMGM MA account, and you will have the opportunity to garner up to $1,500 back in bonus bets. If your qualifying wager goes down in flames, BetMGM will reimburse your stake, up to $1,500, in bonus bets. Bonus bets expire after seven days. Use BetMGM bonus code COVERS to redeem this limited-time offer which expires on June 30, 2026.

FanDuel Sportsbook - Bet $5, Win $100: Sign up with FanDuel Massachusetts to get $100 in bonus bets if your wager wins. Register an account, deposit at least $5, and place a $5 wager on any market. No FanDuel promo code is required, but the offer expires on March 8, 2026.

Caesars Sportsbook - $250 Bet Match, Win or Lose: Deposit at least $10 and place a qualifying wager of $1 to activate this offer from Caesars. Caesars will return an equal stake, up to $250 in bonus bets, win or lose. Enter Caesars promo code 'COVERS250BM' by March 18, 2026 to scoop this offer.

DraftKings Sportsbook - Bet $5, Win $300: With DraftKings Massachusetts, new users get $300 bonus bets (12 $25 bonus bets) from an initial $5 wager if it wins. No DraftKings promo code is needed to claim this offer, which is valid through Feb. 15, 2026.

21+ and present in MA. Hope is here. GamblingHelpLineMa.org or call (800) 327-5050 for 24/7 support. Play it smart from the start! GameSenseMA.com or call 1-800-GAM-1234.

Massachusetts sports betting updates

Let's take a closer look at key dates in Massachusetts betting history:

Jan. 21, 2026: A prominent California tribal gaming leader praised Massachusetts for taking successful legal action against Kalshi for violating state law and tribal sovereignty by offering sports event contracts.

Jan. 21, 2026: The Massachusetts sports betting industry thrived in December, accepting $833.6 million in online wagers and producing nearly $100 million in taxable revenue, up nearly 70% relative to the previous year.

Jan. 20, 2026: Massachusetts won a significant court battle against prediction market platform Kalshi that gives the Bay State the ability to prohibit sports event contracts from being offered there.

Dec. 24, 2025: Massachusetts sports betting has set new handle records in three consecutive months, with bettors wagering $914.7 million in November.

Dec. 18, 2025: The Massachusetts Gaming Commission (MGC) became the first state regulator to approve two measures that force sports betting operators to inform a bettor that they’ve been limited and why their wagers are being capped in certain markets.

Dec. 5, 2025: The Massachusetts Gaming Commission fined Fanatics $20,000 for accepting 83 illegal wagers on a Boston College regular-season football game, marking Fanatics' third fine in Massachusetts, totaling $45,000.

Nov. 21, 2025: The Massachusetts Gaming Commission (MGC) reported $892.2 million in wagers at legal sportsbooks during October, a 19.3% year-over-year increase and a new monthly record.

Nov. 13, 2025: The Massachusetts Gaming Commission (MGC) told sportsbooks - several of which have already began exploring prediction allies - they risk losing their ability to operate inside state lines if they sign partnership deals.

Oct. 22, 2025: The Massachusetts Gaming Commission reported that online and retail sportsbooks generated $800.3 million in bets for September, more than $50 million better than the previous handle record set in December 2024.

Oct. 14, 2025: Massachusetts has filed a formal brief opposing Robinhood's motion for a preliminary injunction, the latest salvo in the growing legal dispute over prediction markets and sports-related event contracts.

Sept. 30, 2025: The Massachusetts Gaming Commission is exploring ways to help limited sports bettors – particularly those restricted simply for winning – regain fuller access to betting.

Sept. 23, 2025: Massachusetts sports betting enjoyed a successful month in August, accepting $545.3 million in wagers, 21.9% more than the $447.3 million it brought in during the same period a year ago.

Sept. 1, 2025: Massachusetts' state auditor reported last week significant shortcomings in the Massachusetts Gaming Commission's (MGC) oversight of sports betting operations from 2020 to mid 2023, highlighting failures in advertising, review, training, and settlement management.

Aug. 22, 2025: Despite generating the lowest handle of 2025, Massachusetts sports betting operators accepted $485.9 million in wagers in July, an 18.9% year-over-year increase.

Aug. 20, 2025: Massachusetts Rep. David Muradian has introduced Bill H.4431, which would legalize and regulate online casino gambling.

July 29, 2025: DraftKings was fined $450,000 because of several infractions of Massachusetts regulations prohibiting credit card use in sports betting.

July 22, 2025: Massachusetts sports betting operators generated nearly 10% fewer dollars wagered in June compared to the same month in 2024, but revenue skyrocketed nearly 50% year-over-year.

June 27, 2025: Massachusetts’ gaming market purification is still in progress after its attorney general sent cease-and-desist orders to BetOnline.ag and SportsBetting.ag.

June 23, 2025: Massachusetts sports betting operators produced the third-highest gross revenue and second-best hold ever in the Bay State during May.

June 19, 2025: An upcoming hearing on June 23 will discuss two bills that would authorize online casinos in Massachusetts.

June 17, 2025: Lawsuits against prediction market operator Kalshi, and the trading platforms Robinhood, Susquehanna, and Webull, started to pop up across the U.S. this month, with lawsuits filed in five states, including Massachusetts, Kentucky, Ohio, Illinois, and South Carolina.

May 20, 2025: Massachusetts' April sports betting handle increased 14.4% while revenue surged 33.6% compared to the same month in 2024.

May 16, 2025: A deceased Massachusetts bettor’s widow saved more than $100,000 about a month after the Massachusetts Gaming Commission unanimously approved the wife’s petition to void several bets before the Boston Celtics were eliminated in the NBA Playoffs.

April 22, 2025: Massachusetts sports betting operators saw an 18% year-over-year increase in action during March Madness, but customer-friendly results led to the second-lowest win rate that Massachusetts sportsbooks have endured.

April 10, 2025: The Massachusetts Gaming Commission (MGC) approved a request to void futures bets totaling $106k on the Boston Celtics to win the 2025 NBA title and the Eastern Conference from a customer who had died. The request was made by the spouse of a deceased bettor who placed the wagers at DraftKings.

April 10, 2025: Massachusetts regulators plan to work with a data analyst and seek even more information from sportsbook operators about the wagering limits they are placing on bettors.

March 25, 2025: The Massachusetts Secretary of State's office issued a subpoena to Robinhood, the electronic trading platform, seeking information about its recently launched sports betting prediction market.

March 21, 2025: The Super Bowl helped spur $67.1 million of gross revenue for Massachusetts sports betting operators during February, leading to a 29% year-over-year increase through the first two months of 2025.

Feb. 20, 2025: Massachusetts set new January revenue and hold records as sportsbooks bounced back from a lackluster December by crushing bettors with a 12.6% hold on a $763 million handle.

Feb. 6, 2025: The Massachusetts Gaming Commission made a late decision to add several Super Bowl 59 coin-toss markets just days before Sunday’s Chiefs-Eagles showdown.

Jan. 22, 2025: Massachusetts continued its run of record setting handles in December, with just over $788 million wagered in the final month of 2024, marking a fourth consecutive month with a new handle record.

Jan. 21, 2025: Massachusetts Senator John F. Keenan is making another push for a tax hike for state sports betting after his recent attempt failed in 2024.

Dec. 23, 2024: Massachusetts earns $777.8 million in wagers in November, marking the third consecutive month of record sports betting handles.

Nov. 21, 2024: Massachusetts regulators are inching towards actioning sports betting limits in the Bay State.

Nov. 21, 2024: Massachusetts' sports betting handle grows as revenue falls in October.

Nov. 7, 2024: Massachusetts regulators continue to allow wagering on the Mike Tyson-Jake Paul boxing match, ahead of their November 15th fight.

Oct. 21, 2024: A lawsuit was filed last week against three Daily Fantasy Sports operators, alleging that the companies offer and accept illegal sports bets, generating over $10M per month from prop and pick 'em bets.

Oct. 16, 2024: Massachusetts sports betting handle increased over 32% year-over-year in September. Over $678 million in wagers were taken, resulting in over $73 million in revenue.

Oct. 3, 2024: Massachusetts hits Bovada with a cease-and-desist letter, marking the 12th U.S. state to restrict access to the offshore betting site.

Sept. 16, 2024: Massachusetts' handle tops $4.4 billion in August after a 42% year-over-year increase.

Sept. 12, 2024: Massachusetts regulators are investigating DraftKings for a golf betting email the sportsbook sent out in August.

Sept. 11, 2024: The Massachusetts limiting sports bettors debate grows, as state regulators meet with local operators, advocates, and gambling experts to discuss the possibility of limiting a small percentage of bettors. .

Sept. 10, 2024: Covers' Geoff Zochodne outlines why Massachusetts is investigating into sports betting limiting.

Sep. 2, 2024: MGC members discuss amending Title 205, which would require multi-factor authentication when using online sportsbooks.

Aug. 16, 2024: Massachusetts sports betting operators produce a 10% hold in July following a recorded handle of $411.8 million for the month.

Aug. 15, 2024: The Massachusetts Gaming Commission wants to have a frank discussion about sports betting limiting with local bookmakers this fall.

Aug. 1, 2024: Operators tell Massachusetts regulators that a "very low percentage" of bettors will be impacted by the proposed betting limit rule.

July 31, 2024: A Massachusetts online lottery is set to launch in December 2025 after confirming the 2025 fiscal budget earlier this week.

July 29, 2024: Massachusetts sports betting regulators praise the impact of legal wagering, stating it has produced thousands of jobs and hundreds of million in tax revenue.

July 18, 2024: The Massachusetts Gaming Commission distributes $18 million in grants to Massachusetts communities.

July 15, 2024: The Boston Celtics NBA Title win drives a major rise in Massachusetts betting action in June, generating a $509.4 million handle, which is a 65.1% year-over-year increase.

July 2, 2024: Bally Bet launches in Massachusetts, marking the seventh online sportsbook now active in the state.

June 27, 2024: Bally Bet is gearing up for a potential July launch in Massachusetts, should it receive its compliance license.

June 12, 2024: Massachusetts regulators will consider sending a cease-and-desist letter to Bovada for operating illegal sports betting within the state.

June 3, 2024: The Massachusetts Gaming Commission will keep sports betting limiting on the front burner during this month's upcoming regulatory meeting.

May 23, 2024: Massachusetts avoids another sports betting tax hike after local Senate shoots down a recent proposal to revise the state's financial arrangement with legal sportsbooks.

May 21, 2024: Massachusetts sportsbooks duck betting limits forum during the latest Massachusetts Gaming Commission roundtable, citing business reasons for their absence.

April 1, 2024: Massachusetts Lottery pushes for online sales option to compete with its sports betting competitors.

March 28, 2024: Massachusetts is limiting sports betting customers and local operators may be forced to explain why it happens to some bettors but not others.

March 15, 2024: Massachusetts' sports betting catalog will introduce new betting options, including expanded markets for NFL, NHL, and MLB.

March 15, 2024: Top Massachusetts sports betting regulator is upset with Bally's delayed sports betting launch, which is still unclear at this time.

March 4, 2024: PrizePicks will switch to peer-to-peer Arena games on March 8 after reaching a deal with Massachusetts regulators to alter daily fantasy sports (DFS) offerings.

Feb. 23, 2024: Two days after Betr leaves the state, WynnBET online sportsbook calls it quits in Massachusetts. The move will have no effect on WynnBET's retail sportsbook at Encore Boston Harbor.

Feb. 21, 2024: Betr officially exits the Massachusetts sports betting market.

Feb. 16, 2024: Massachusetts' online sportsbooks record second-largest sports betting handle ever in January, bringing in $638 million in wagers.

Feb. 9, 2024: Betr and WynnBet set dates to exit Massachusetts sports betting market, as both sportsbooks will cease operations on Feb. 23, 2024.

Feb. 8, 2024: The Massachusetts Gaming Commission confirms that legal operators are not permitted to offer odds for the outcome of the opening coin toss on Super Bowl 58 and other additional novelty prop bets for the Big Game.

Feb. 1, 2024: BetMGM will face an adjudicatory hearing for allowing 15,000 illegal wagers on a college football player prop, which is forbidden in Massachusetts.

Feb. 1, 2024: WynnBet and Betr to cease operations in Massachusetts shortly. A timeline for the sportsbooks departures is currently being established with the Massachusetts Gaming Commission.

Jan. 30, 2024: FanDuel partners with Operation HOPE to offer a free financial literacy program in MA.

Jan. 18, 2024: Fanatics Sportsbook faces an adjudicatory hearing in Massachusetts for collegiate wager violation occurring in December.

Jan. 17, 2024: Massachusetts' sports betting revenue jumps 20% in December, accepting $658.6 million in wagers during the month.

Jan. 4, 2024: Despite receiving a temporary sports betting license, Betway informs the MGC that it will not launch in the state.

Compare Massachusetts sportsbook apps

|

Massachusetts betting apps |

App Store rating (iOS) |

Google Play rating (Android) |

|---|---|---|

|

Fanatics Sportsbook |

4.8/5 ⭐ (154.3K reviews) |

4.8/5 ⭐ (33.6K reviews) |

|

BetMGM |

4.8/5 ⭐ (241.8K reviews) |

4.2/5 ⭐ (37.2K reviews) |

|

FanDuel |

4.9/5 ⭐ (1.9M reviews) |

4.6/5 ⭐ (383.9K reviews) |

|

DraftKings |

4.8/5 ⭐ (855.9K reviews) |

4.6/5 ⭐ (185.7K reviews) |

|

Caesars Sportsbook |

4.7/5 ⭐ (92K reviews) |

4.6/5 ⭐ (31.5K reviews) |

How we evaluate & rate Massachusetts betting apps

Beside reading our betting site reviews, we've spotlighted the most vital elements to look for when choosing an Massachusetts sports betting site or app.

Welcome bonuses and promotions

Welcome bonuses and promotions

Claiming welcome bonuses and ongoing promotions is the quickest way to build and continue building your bankroll. The most common sportsbook sign-up bonuses include second-chance bets, deposit match bonuses, and no-deposit bonuses. Just ensure you're reading the terms and conditions before you get started with any Massachusetts betting apps' offer.

User experience

User experience

One of the greatest sins a sports betting app can commit is providing a poor user experience. You'll want to ensure you choose platforms that load rapidly and harbor intuitive navigation while forgoing those that tend to glitch and crash at the most inopportune times. Nothing is more important than finding and locking in your preferred bets swiftly.

Variety of bet types

Variety of bet types

The best sports betting apps Massachusetts offers yield a panoply of bet types, such as moneylines, point spreads, Over/Unders (totals), and same-game parlays. Various player props and sections wholly dedicated to live betting help make wagering on your favorite teams and athletes — such as the Boston Red Sox or Jayson Tatum — a more engaging experience.

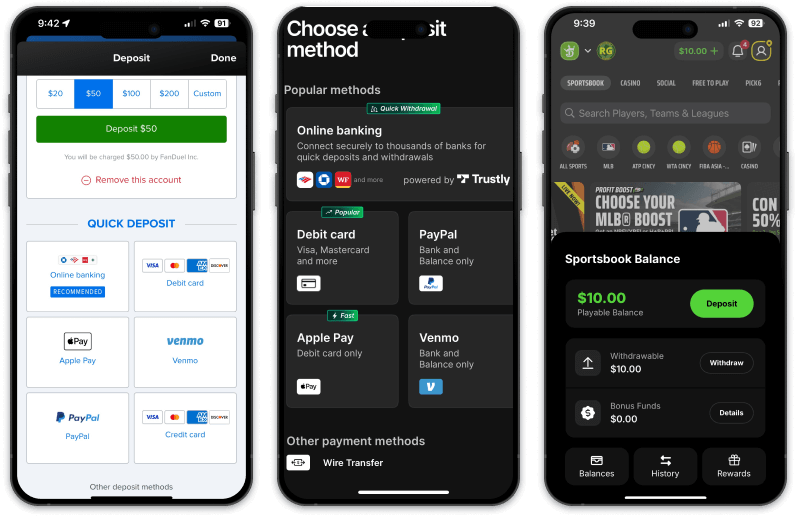

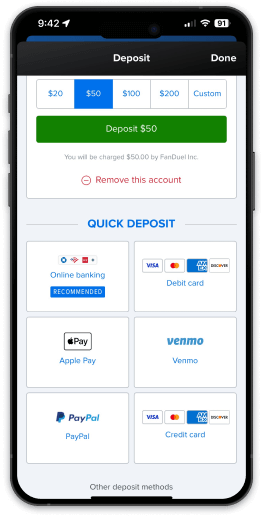

Banking Options

Banking Options

All of the top MA sports betting apps feature a wide variety of the best sportsbook deposit and withdrawal methods, including debit cards, online banking, and e-wallets. The more options a betting app offers, the higher the likelihood you will find a method you prefer.

Payout Speed

Payout Speed

Perhaps the only thing more thrilling than hitting on a huge parlay is withdrawing the funds to your personal bank account. Keep a close eye on payout speeds when reviewing any potential sports betting app, and remember that whichever withdrawal method you choose will impact how quickly you receive your money. Options like PayPal and Play+ will ensure your winnings arrive within a matter of days.

Security

Security

The sports betting apps in Massachusetts have been thoroughly tested to guarantee players' banking and personal information is handled securely. All MA sports betting apps included in this guide use the latest data encryption technology and are certifiably reliable.

Customer support

Customer support

Should you run into issues an FAQ section can't resolve, the top betting apps Massachusetts has feature 24/7 customer support via multiple contact methods, including live chat, phone, email, and even social media.

Covers tip: Gauging agent response times and aptitude is important — send a live chat message, email, or call customer support before registering to get a feel for how they operate.

List of legal sportsbooks in Massachusetts

MA bettors can currently select from seven different sportsbooks and online Massachusetts betting apps. A total of 15 licenses were made obtainable in the Bay State, including seven standalone mobile licenses.

Bally Bet is the most recent addition to the Massachusetts betting landscape, officially launched in MA in July 2024, after receiving its sports betting license in January 2023.

Massachusetts betting sites

|

Online sportsbook 🏆 |

Top feature 🏅 |

Retail partner 🤝 |

Retail sportsbook 🏆 |

Odds provider 🔮 | Launch date 📅 |

|---|---|---|---|---|---|

|

Nice odds boosts |

N/A |

N/A |

Bet.Works |

July 2024 |

|

|

BetMGM |

Great range of sports |

MGM Springfield |

BetMGM Sportsbook |

BetMGM |

March 2023 |

|

Caesars Sportsbook |

White glove customer service |

Encore Boston Harbor |

Caesars Sportsbook at Raynham Park |

Caesars |

March 2023 |

|

DraftKings |

Best for grading winners |

N/A |

N/A |

SBTech |

March 2023 |

|

Fanatics Sportsbook |

Flexible FanCash Rewards |

Plainridge Park Casino |

TBD |

Amelco |

May 2023 |

|

FanDuel |

Best user experience |

N/A |

N/A |

Flutter |

March 2023 |

|

Lots of markets |

N/A |

N/A |

PENN |

December 2025 |

Land-based Massachusetts sportsbooks

|

Sportsbook 🏆 |

Venue 🏛️ |

Address 🌎 |

Launch date 📅 |

|---|---|---|---|

| The Sportsbook |

Plainridge Park Casino |

301 Washington St, Plainville, MA 02762 | January 2023 |

| BetMGM Sportsbook | MGM Springfield | 1 MGM Wy, Springfield, MA 01103 | January 2023 |

| WynnBET Sportsbook | Encore Boston Harbor | 1 Broadway, Everett, MA 02149 | January 2023 |

Latest Massachusetts sports betting news

Who can partake in Massachusetts sports betting?

Legal sports wagering is now accessible online and in retail locales in the Bay State. Individuals 21 years of age or older are permitted to participate in MA sports betting.

Legal age

Legal age

Although some states allow players 18 and up to wager on sports, Massachusetts does not. MA sportsbooks will only accept wagers from those 21 and older.

Mobile betting

Mobile betting

Bettors can access legal mobile sports betting apps via seven Massachusetts betting sites. Fifteen (15) total licenses are available — including seven untethered mobile sports betting licenses — and eight operators can partner with land-based casinos and MA off-track betting sites.

Remote registration

Remote registration

Sports bettors can create sports betting accounts from anywhere in Massachusetts.

Within state borders

Within state borders

Massachusetts bettors can place any wager as long as they are doing so within state borders. Of course, those conditions also apply to in-person betting, but all online wagers must be verified in-state, too.

Retail sportsbooks

Retail sportsbooks

On Jan. 31, 2023, Massachusetts’ three casinos — Encore Boston Harbor, MGM Springfield, and Plainridge Park — opened their doors to MA sports bettors. Two pari-mutuel simulcast facilities — Raynham Park and Suffolk Downs — will also be home to retail sportsbooks in the future.

Taxable winnings

Taxable winnings

Massachusetts gamblers are taxed on sports bet winnings the same way they are on other gambling income, meaning a 24% federal tax and 5% state tax.

How to start betting in Massachusetts

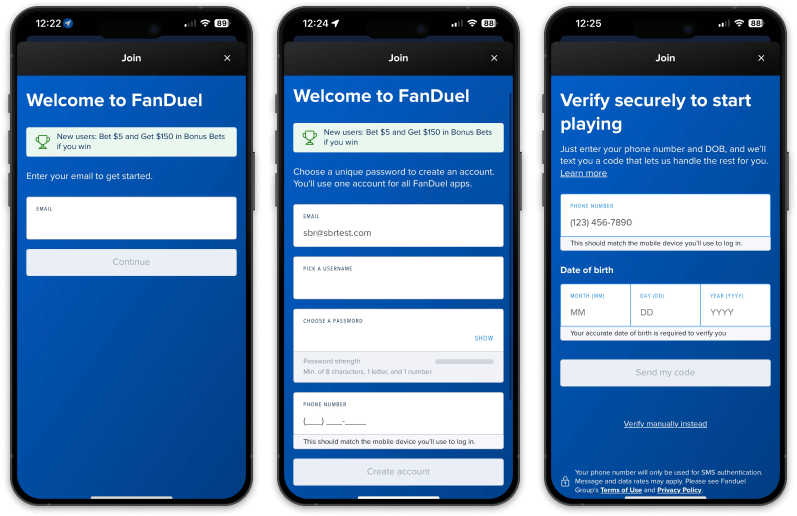

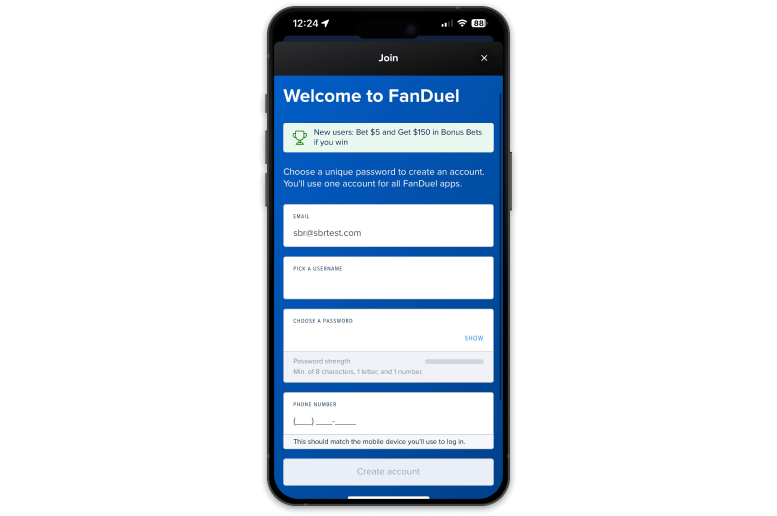

Read below to learn how to sign up and claim Massachusetts welcome offers in minutes:

- With legal online betting open, MA bettors have multiple online sportsbooks they can register with today.

- Consider sign-up bonuses, odds pricing, supported banking methods, and the look and feel of each sports betting platform before getting started.

- After choosing your sportsbook(s), you’ll have to create an account in Massachusetts.

- Enter your name, email, and address, and follow the prompts provided by the online platform.

- Once you’ve confirmed your identity and location, your account will be active.

- Massachusetts sports betting sites are vying for your attention by offering the most common sportsbook sign-up bonuses, including second chance bets, bet and gets, and deposit match bonuses.

- Be sure to enter a sportsbook promo code, if necessary.

- Online betting sites support a wide variety of sportsbook deposit and withdrawal methods, including credit cards, debit cards, e-wallets, online banking, and more.

- Bettors should understand each payment method fully and look for potential fees charged by banks or financial institutions.

- Bettors will find a wide range of sports bet types, including moneylines, point spreads, Over/Unders (totals), same-game parlays, futures, teasers, and live betting.

- Once you’ve identified the best price for your bet(s), fill up your bet slip and confirm your wager(s).

- With licensed and regulated Massachusetts sportsbooks, accessing your sports bet winnings is painless.

- Expect to wait a few days to see your funds arrive in your bank account or e-wallet, though some withdrawal methods offer almost instant access to your bankroll.

What you can't bet on in Massachusetts

Bay Staters can access locally regulated sportsbooks online and via the state's three casinos, and wager on professional and college (with some exceptions) sports is in play.

However, some events are out of bounds in MA. On Jan. 24, 2023, the Massachusetts Gaming Commission approved a list of allowable wagers and leagues. Among those not making the cut were esports, cornhole, chess, Jai alai, the Winter and Summer Olympics, and sporting events overseen by Belarusian or Russian governing bodies.

NFL Draft

You can legally bet on the NFL Draft in Massachusetts, but bookmakers must follow specific rules for the event, such as pre-draft future bets must be placed before the event starts. Check out our guide for how to bet on the NFL Draft in 2026.

Awards ceremonies

Wagers on popular celebrity awards shows, such as the Academy Awards, are accepted in MA.

Politics

Betting on political outcomes, like presidential elections, is not permitted at the state or federal level. Political betting sites do not operate legally in Massachusetts.

esports

Despite connections to esports embedded in some of the state's major sports franchises — such as Boston Bruins owner Jeremy Jacobs’ company, Delaware North, a partner of Splyce — regulators opted against allowing wagering on all virtual and esports events.

Massachusetts college sports betting

College sports were a point of major contention between the House and Senate when it came to the legalization of wagering on sports. The good news is that MA bettors can now wager on college sports online and at retail venues. The not-so-great news? Bets on in-state collegiate teams, like Boston College, are only permitted during major events, such as March Madness.

Massachusetts sports teams to bet on

Eliminate any hometown bias by conducting relevant research on prospective bets. This is a great way to manage your bankroll and will help you to avoid blindly backing any team or player. Although no fights are scheduled to come to the Bay State anytime soon, the best UFC betting sites and top boxing betting sites allow you to easily browse the markets and back fighters you can cheer on as passionately as your hometown teams.

Review our how to bet guides for actionable intel aimed at new and intermediate bettors before confirming your picks with legal Massachusetts sportsbooks.

Betting insight into local Massachusetts sports teams for February 2026

Despite a rocky start to the MLB season, the Boston Red Sox have turned it around in July, posting a 13-5 record for the month. The recent hot streak has propelled the Red Sox firmly into the race for the American League east title, but great seasons from both the Yankees and Blue Jays still have Boston sitting at +2,000 odds to win the division. The Red Sox will need to continue their winning ways post-All-Star break to get into the 2025 MLB postseason.

Massachusetts sports betting law

Legal Massachusetts sports wagering was inevitable the moment outgoing Governor Charlie Baker signed H.5164 — otherwise known as the Massachusetts Sports Wagering Act — into law on Aug. 10, 2022. Here are the sports betting law's key takeaways:

- Up to 15 online sports betting licenses are available, including seven standalone licenses

- Casinos and racetracks are awarded sports betting licenses

- Depositing funds into sportsbook accounts via credit card is prohibited

- Online sportsbooks pay a 20% tax on revenue, while retail sportsbooks are taxed at a 15% rate

- Betting on in-state college teams is not allowed unless it is during a big event (such as March Madness)

- The legal age to gamble on sports is 21

- Wagering on esports, the Olympics, cornhole, chess, jai alai, and sporting events overseen by Belarusian or Russian governing bodies is prohibited

Prior to the introduction of the Massachusetts Sports Wagering Act, bills aiming to legalize sports betting had difficulty gaining any traction in the state legislature. Despite the repeal of the Professional and Amateur Sports Protection Act (PASPA) in May 2018, apprehension over college sports and problem gambling prevented numerous attempts at legitimizing the practice.

Although the law does not stipulate a specific go-live date for either retail or online sports betting, the former launched on Jan. 31, 2023, while the latter went live on March 10, 2023.

Massachusetts sports betting market outlook

Massachusetts has always been home to some of the most passionate sports fans in the country, so it makes sense for the state's sports betting community to be just as dedicated. Massachusetts increased its yearly sports betting revenue by nearly $200 million from 2023 to 2024, and we expect the 2025 numbers to be even higher based on early monthly projections.

Massachusetts, which has a population of roughly 7.1 million, still has several sports betting licenses available due to a few operators recently closing their operations. It's unclear when the state plans to fill those vacant spots, but we expect competitive jockeying from several sportsbooks as they try to secure a piece of one of the most lucrative betting states in 2026.

Massachusetts sports betting handle

Massachusetts sports wagering was only live for one day in January 2023, but MA bettors made their presence felt at the state's three retail casinos. Between Encore Boston Harbor ($371K), MGM Springfield ($35K), and Plainridge Park ($83K), roughly $488K was wagered on sports.

In the state's first full month of legal sports betting, sportsbooks took in $24.4 million in total bets. Even more impressively, online sportsbooks accounted for more than $548 million of MA's $568 million March betting handle. Massachusetts betting handle fell slightly in April to $559 million and to $554 million in May. A further 27% drop occurred in June, with a $332 million handle, and continued in July, down to $294.9 million.

Yearly breakdown

| Year | Total handle | Revenue | Hold percentage | Tax revenue |

| 2025 | - | - | - | - |

| 2024 | $7.4B | $670.8M | 9.1% | $130.2M |

| 2023 | $4.96B | $483.1B | 9.7% | $93.8M |

Monthly handle

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2025 | $762.6M | $628.2M | $772.5M | $690.3M | $655.8M | $532.7M | $489.5M | $545.3M | $789.4M | $879.6M | $901.8M | - | - |

| 2024 | $651.7M | $542.5M | $654.9M | $603.3M | $587.3M | $509.4M | $411.8M | $447.3M | $678.7M | $748.1M | $777.8M | $788.3M | $7.4B |

| 2023 | $488K | $24.4M | $568.2M | $559.3M | $554M | $332M | $294.9M | $314.9M | $512.7M | $571.7M | $654.4M | $658.7M | $4.96B |

Other legal betting options

The Massachusetts Gaming Commission regulates commercial operations in the state. In addition to sports betting, there are a few other forms of legal gambling in Massachusetts, including charitable gaming and the Massachusetts Lottery.

Casino

Casino

Massachusetts contains five casinos: Two operated by Native American tribes, two commercial resorts, and one slot parlor. Now, wagering on sports at three of these Massachusetts venues — Encore Boston Harobor, MGM Springfield, and Plainridge Park — is allowed.

Poker

Poker

Poker players can find a multitude of poker rooms in Massachusetts’ major cities, such as Boston. Online poker is illegal in MA.

Horse and dog racing

Horse and dog racing

There is only one presently active racetrack in the Bay State: Plainridge Racecourse. There, legal pari-mutuel betting is allowed on horse racing. Simulcast wagering for both horse races and dog races is also available at two former racetracks: Suffolk Downs and Raynham Park. Since 1934, betting on horse and dog racing has been legal in Massachusetts.

You can place online wagers at FanDuel Racing and other horse racing betting sites.

Daily fantasy sports

Daily fantasy sports

In 2016, then-Governor Charlie Baker temporarily legalized daily fantasy sports (DFS) as part of a larger economic development bill while details like taxes and regulations got hashed out. Two years later, in 2018, a new bill was passed to make daily fantasy sports permanently legal in the state. Massachusetts sports fans can get their fill of DFS via industry heavyweights like DraftKings & FanDuel. Additionally, you can sign-up and claim the ProphetX promo code today.

Predictive sports trading

Predictive sports trading

Predictive-based sports trading is becoming one of the most popular alternatives to traditional betting in 2026. You can use to best prediction market sites to buy, sell, and trade 'Yes' or 'No' contracts based on the speculative outcome of sports and various unique events, such as politics, pop culture, weather, and more. Register with the Kalshi promo code 'COVERS' to access the top predictive-based platform today.

Here's our picks for the best Massachusetts DFS and predictive betting sites available today:

| 📅 Social sportsbook site | 🤑 Sign-up bonus | 📟 Promo code |

|---|---|---|

| 🥇 Thrillzz | Spend $10, Get 53 | COVERS |

| 🥈 ProphetX | Up to 200 in Prophet Cash | COVERS1 |

| 🥉 Novig |

COVERS100 |

|

| 🐶 Underdog Fantasy | Plat $5, Get $50 | COVERS |

| ⛏️ Betr Picks | $10 on Sign-Up + $200 Bonus Cash | COVERSBONUS |

| 6️⃣ DraftKings Pick6 | Play $5, Get $50 | Claim $50 without code |

| 🟡 Fliff | Spend $5, Get $50 Free Play + 100% Match up to $100 | COVERS |

| 🤝 Kalshi | $10 Bonus | COVERS |

| 🔗 ParlayPlay | $100 Deposit Match | Claim $100 without code |

Responsible gaming in Massachusetts

To this point, there has been limited access to gambling within Massachusetts. With legal online and retail sports wagering now live, there are many Bay Staters who may succumb to gambling addiction. The Massachusetts Council on Gaming and Health provides educational opportunities and support to raise awareness of problem gambling.

Individuals wishing to ban themselves from Massachusetts sports betting can join a voluntary self-exclusion list online, via phone, or at a casino.

Visit the Massachusetts Council on Gaming and Health

U.S. gambling helplines

U.S. gambling helplines

| Organization 🤝 | Phone number ☎️ |

|---|---|

| Gam-Anon | 718-352-1671 |

| Gamblers Anonymous | 855-2CALLGA |

| National Problem Gambling Helpline | 1-800-GAMBLER |

| Substance Abuse and Mental Health Services Association | 1-800-662-HELP (4357) |

Legal U.S. sports betting markets

With legal Massachusetts betting now available, the state joins the ranks of these already legalized U.S. jurisdictions:

Recent legal U.S. sports betting launches

The legal online Missouri sports betting market went live in December 2025. NC online sportsbooks launched when legal North Carolina sports betting became a reality in March 2024. Vermont sports betting arrived in January 2024, with three online sportsbooks — FanDuel, DraftKings, and Fanatics Sportsbook — taking wagers.

Potential legal U.S. sports betting markets

There are several states moving toward legal sports betting that could potentially join Massachusetts in the near future:

Current state of Massachusetts sports betting

Legal Massachusetts sports wagering went live on Jan. 31, 2023, when three retail locales — Plainridge Park Casino, MGM Springfield, and Encore Boston Harbor — welcomed MA sports bettors for the first time. Six online operators — Barstool, BetMGM, Caesars, DraftKings, and FanDuel — followed suit on March 10, 2023, effectively opening the floodgates for state-wide mobile wagering.

With Selection Sunday taking place on March 17, 2024, the timing couldn't be better for Massachusetts players eager to capitalize on the iconic NCAAB tournament via the best March Madness betting sites.

Fanatics Sportsbook launched in the state in 2023, while Bally Bet entered the MA market in July 2024. In total, 10 of the 15 digital sports betting licenses available in the Bay State have been claimed.

Massachusetts sports betting history

Massachusetts online sports betting became a reality nearly five years after the Supreme Court of the United States struck down the Professional and Amateur Sports Protection Act. Today, local bettors can place legal wagers with seven mobile sportsbooks.

2024: Betway pulls out of Massachusetts after being approved for an untethered category 3 sports betting license. In February, Betr and WynnBET exit the MA sports betting market.

2023: Massachusetts became the second state to launch retail and online sports betting in 2023. Three brick-and-mortar sportsbooks opened their doors on Jan. 31, while six online sports betting apps went live on March 10. Betr launches its MA sports betting site on May 8, and Fanatics Sportsbook became the eighth online operator in the state on May 25.

2022: After several amendments and compromises, HB 3993 became H.5164. On Aug. 10, Governor Charlie Baker signed H.5164 into law, officially legalizing online and retail sports betting in Massachusetts. After considering an "aggressive timeline," regulators agreed to push the state's online sports betting launch from late February 2023 to early March 2023.

2021: Nearly two dozen sports betting bills were introduced, but none made it across the finish line. Notably, lawmakers honed in on HB 3993, an amended bill that the House passed by a vote of 156-3.

List of Massachusetts resources

Continue your MA sports betting deep dive by checking out some of our favorite resources:

- Massachusetts Gaming Commission: MA state gambling regulator

- Office of Problem Gambling Services: A resource for those affected by gambling addiction

- Massachusetts sports betting law: Bill H.5164

- Massachusetts sports betting regulations: Rules related to online and retail sports wagering

- Massachusetts Legislature: Stay up-to-date on the latest gambling-related bills

- The Boston Globe: Leading newspaper covering New England sports

Sportsbooks to avoid in Massachusetts

See all blacklisted sportsbooks

Exercise caution and patience concerning legal sports betting. Massachusetts gamblers should refrain from registering with unregulated offshore sportsbooks due to their unlawful business practices.

Funding an illegal offshore sports betting site is playing with fire, as your funds and personal information are at risk. Please avoid these sportsbooks at all costs and save your bankroll for legal Massachusetts sports wagering sites.

- Allegations of withdrawal issues

- No license information available on site

- Poor customer service

- Multiple reports of slow payments

- Allegations of non-payments

- Risk of account closure simply for winning bets

- Reports of confiscated winnings

- Slow customer support response times

Why trust Covers?

Why trust Covers?

Covers is a leading expert in the sports betting industry, with three decades of experience establishing authority in the fields of sports betting odds, lines, picks, and news.

The Massachusetts sports betting sites and bonuses that we've recommended here have been personally reviewed, meticulously curated, and regularly updated by our team of experts. For more about the analysts who review each MA sportsbook, meet the experts behind our ratings →

News outlets look to Covers due to our deserved reputation as a trusted and authoritative source of sports betting information. Here are some of the numerous notable publications and media outlets that have referenced Covers.com and our industry experts:

Massachusetts sports betting FAQ

Yes, sports betting is legal in Massachusetts. Former Gov. Charlie Baker signed the Massachusetts Sports Wagering Act into law on Aug. 10, 2022. Legal Massachusetts sports betting (retail) launched at 10:00 a.m. ET on Jan. 31, 2023, while online operators went live on March 10, 2023.

The Massachusetts Gaming Commission oversees all sports betting activity — online and in person — in Massachusetts.

Yes. As of 10 a.m. ET on March 10, 2023, legal Massachusetts online sports betting is live.

You must be at least 21 years of age to take part in legal Massachusetts sports gambling.

Yes. With legal MA sports betting live, you can bet on college sports. However, in-state college betting (wagering on Massachusetts teams) is only available during major events like March Madness.

You can legally bet on sports in Massachusetts at one of the state's three casinos or using one of seven active online sportsbooks. On Jan. 31, 2023, retail sportsbooks opened at Encore Boston Harbor (WynnBET Sportsbook), MGM Springfield (BetMGM Sportsbook), and Plainridge Park Casino (The Sportsbook). On March 10, 2023, online operators went live in the state.

No. bet365 withdrew its Massachusetts sports betting license application after its partnership with Raynham Park fell through in January 2023.

Yes. Mobile sports betting via legal Massachusetts betting sites and apps became a reality on March 10, 2023.

Joshua Howe is a content manager at Covers, helping make smarter sports bettors since 2021. An experienced writer and editor, he has developed a sterling reputation within the iGaming space as a meticulous and thoughtful content creator, consistently focused on editorial leadership and strategy, engaging diverse audiences, providing authoritative industry analyses, and crafting compelling stories across multiple mediums. He has reviewed over 30 sportsbooks and has been placing his own wagers for four years and counting.