The bet365 bonus code 'COVERS' allows new users to claim a 'Bet $5, Get $150' sign-up bonus. I'll explain how you can claim and use one of the premier sportsbook promos in 2026 below.

Bet $5, Get $150 Win or Lose

bet365 bonus code comparison

Discover the right welcome bonus for you by seeing how the current bet365 bonus code promo compares to other top U.S. sportsbooks in February 2026:

| Compare | ||||||

| Welcome bonus | Bet $5, Get $150 Win or Lose or $1,000 First Bet Safety Net | Bet $5, Win $200 | $1,500 First Bet Offer | Bet $5, Win $100 | Up to $1,000 in FanCash Bet Matches | $250 Bet Match, Win or Lose |

| Promo code | COVERS | Use unique link | COVERS | Use unique link | Use unique link | COVERS250BM |

| Bonus type | Bet & get | Bet & win | First bet offer | Bet & win | Bet & get | First bet match |

| Bonus form | $150 in bonus bets | 8 $25 bonus bets | One (< $50) or five (> $50) bonus bets | $100 in bonus bets | Up to $1,000 in FanCash | Up to $250 in bonus bets |

| Wagering period | 30 days | 7 days | 7 days | 7 days | 7 days | 14 days |

| Minimum deposit | $10 | $5 | $10 | $5 | $10 | $10 |

| Claim Bonus | Claim $1,000 | Claim $200 | Claim $1,500 | Claim $100 | Claim $1,000 | Claim $250 |

Best bet365 bonus code promotions for new users

Consult with our table below for the latest bet365 bonus code promotions, which vary by region:

| bet365 bonus code | bet365 welcome bonus | Available states |

|---|---|---|

|

AZ, IN, IA, KS, KY, LA, MD, MO, NC, OH, VA |

||

|

CO, IL, NJ, PA, TN |

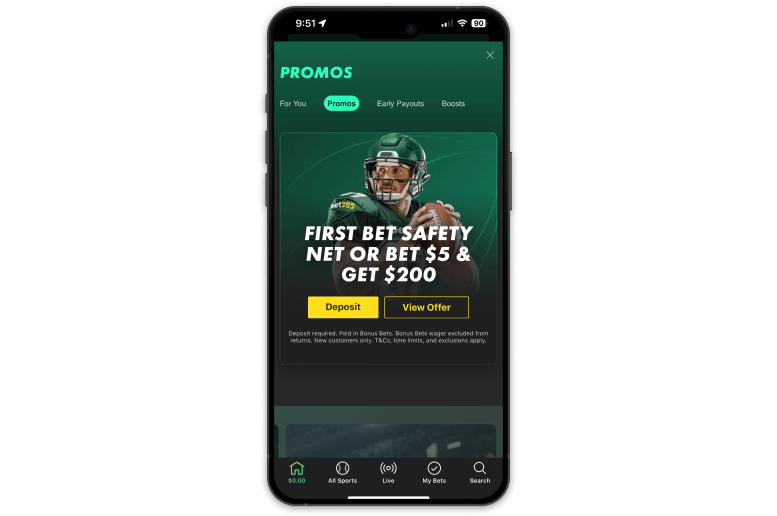

Best bet365 bonus code sign-up promos

First things first: The current bet365 Sportsbook welcome bonuses can only be claimed via the bet365 app by sports bettors of legal gambling age in a legal state, so make sure to download.

What is the bonus code for bet365?

Here at Covers, I'm committed to doing my due diligence and can confirm that new users will earn the bonuses outlined below when using the bet365 bonus code 'COVERS' ('CVSBONUS' (CO, IL, MO, NJ, PA, TN).

How to get 150 bonus bets on bet365?

You must use the bet365 bonus code 'COVERS' ('CVSBONUS' (CO, IL, MO, NJ, PA, TN) to qualify for the $150 bonus.

Once you create a new account on the bet365 mobile app, enter a qualifying deposit of at least $10 to activate $150 in bonus bets, whether you win or lose.

To qualify, trigger this bonus within 30 days of registering your online sportsbook account. Your qualifying bet must settle within seven days (168 hours) of claiming the promo and contain at least one selection at odds of -500 or greater.

Users in New Jersey and Pennsylvania also receive 50 casino spins on Finn and the Swirly Spin, Gonzo's Quest, Jack in a Pot, and Piggy Riches Megaways.

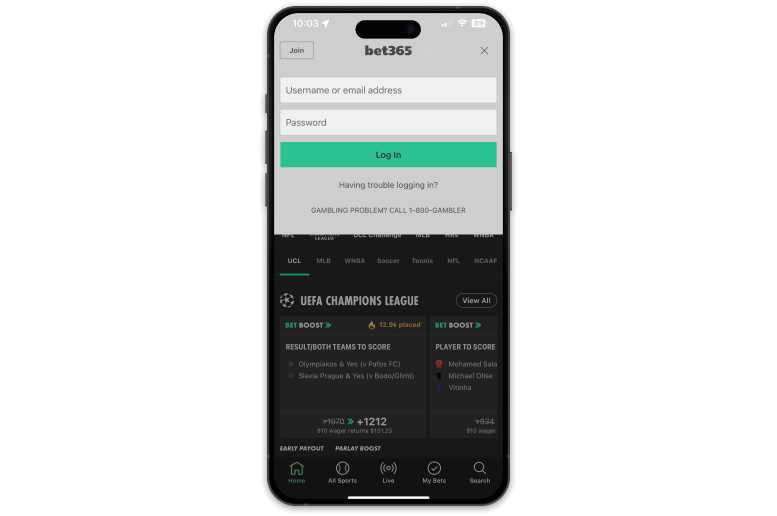

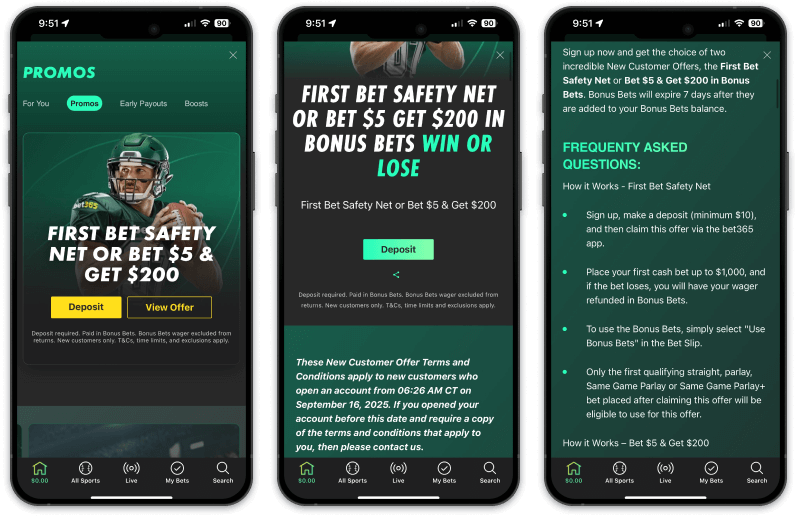

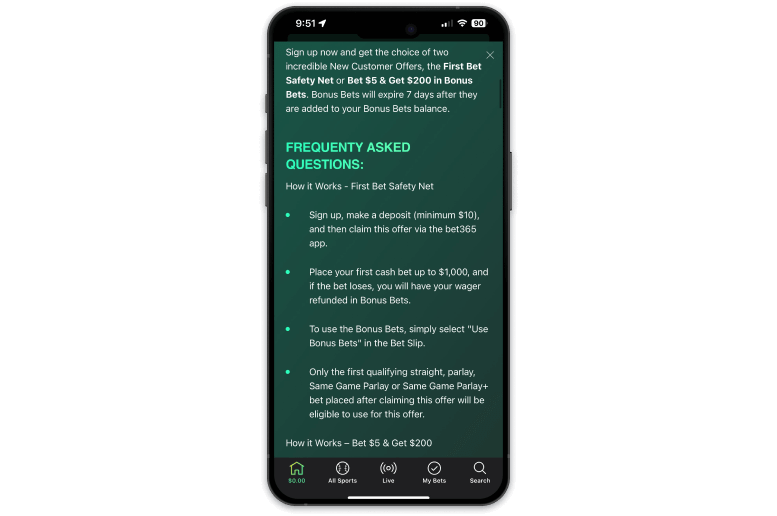

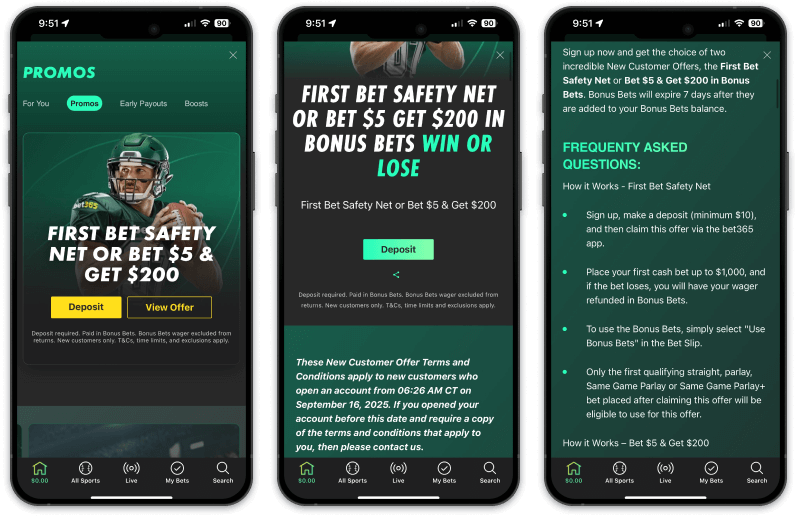

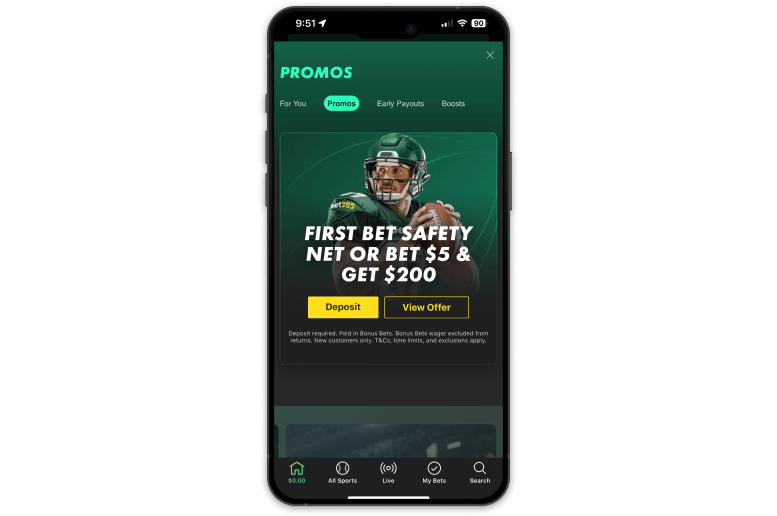

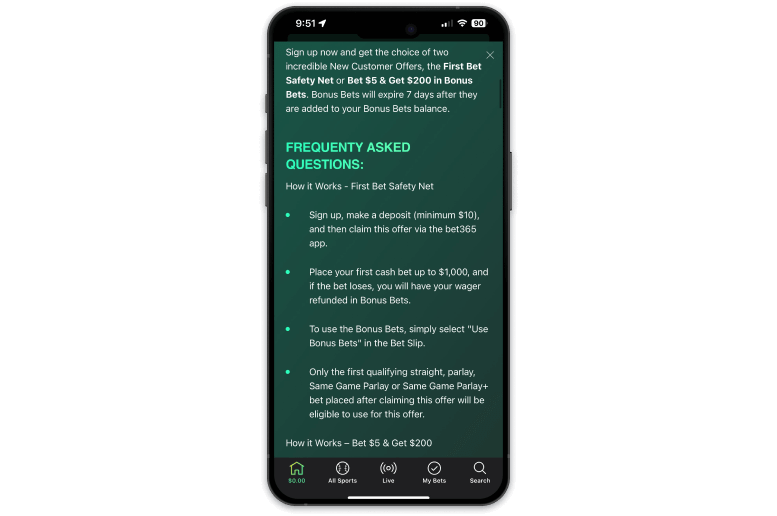

$1,000 First Bet Safety Net

- If you did not claim the bonus above, you are eligible for bet365's '$1,000 First Bet Safety Net' new user promotion.

- Bonus also requires the bet365 bonus code 'COVERS' and a minimum $10 first deposit.

- bet365 will issue a refund in bonus bets matching the entirety of your stake, up to $1,000 if you lose.

- You must claim this reward within 30 days of registration.

- Bonus bets expire within seven days (168 hours) of being issued.

How do I get $200 on bet365? - Terms and conditions

This bonus is no longer available. Instead, we're cutting through the noise to provide the primary terms and conditions you need to consider for the bet365 Sportsbook sign-up bonus:

✅ Sign up here using the bet365 bonus code 'COVERS'. Use code 'CVSBONUS' in CO, IL, MO, NJ, PA, and TN. You must claim the promo via the bet365 app to qualify.

✅ Since this is not a no-deposit bonus, you must make a minimum $10 qualifying deposit to access it.

✅ Place a $5 qualifying bet within 30 days to receive $150 in bonus bets. PA bettors score 50 casino spins.

✅ The qualifying bet must contain at least one bet with minimum odds of -500 or greater.

✅ You can use the bonus funds on any sports market.

✅ Bet credits expire seven days after being issued. This bet365 Sportsbook promo is valid until March 17, 2026.

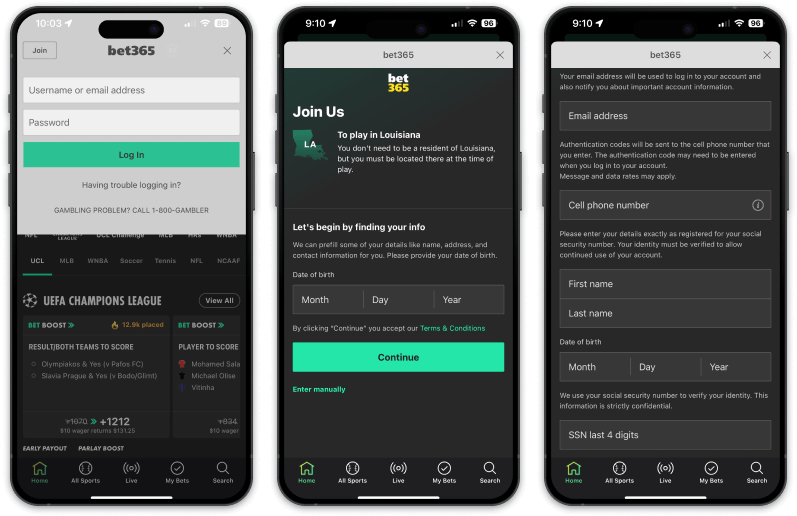

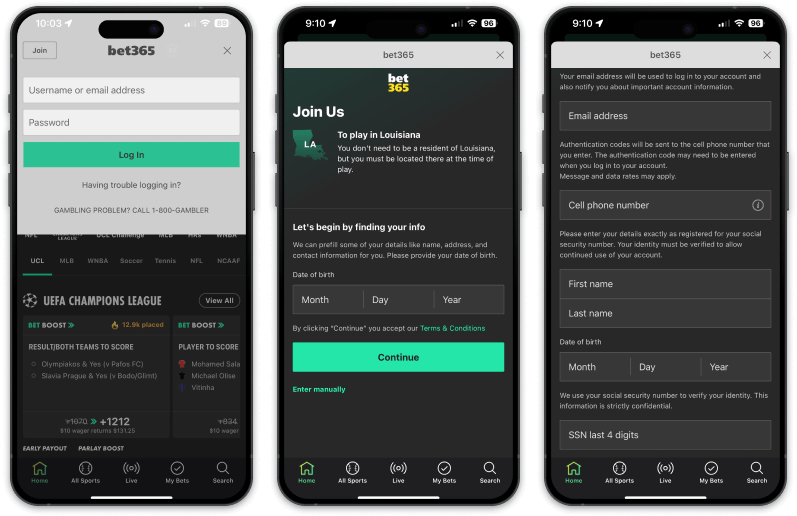

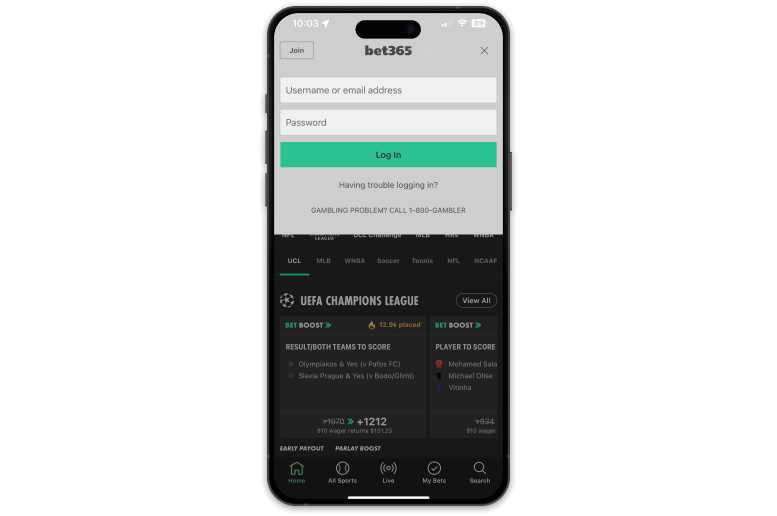

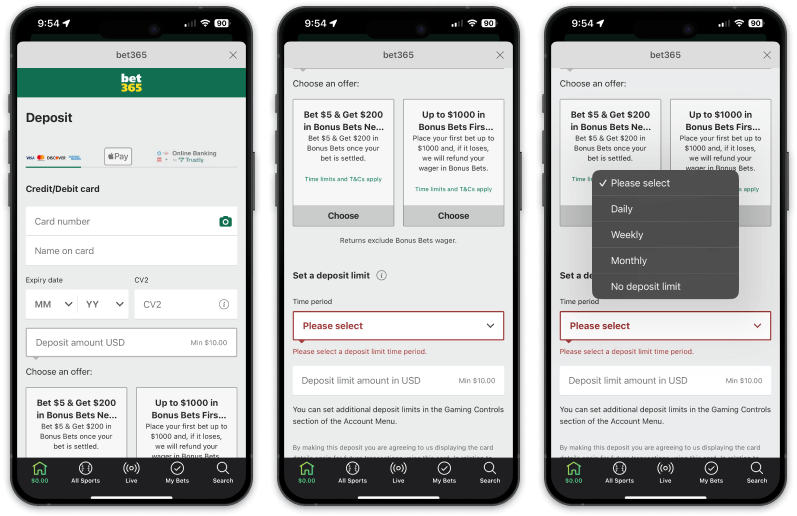

How to claim the bonus bet365 offer?

Claiming your bet365 bonus code is easy, so don’t worry about going through a tedious registration process just to sign up. Follow our simple steps below, and you’ll be wagering with one of the best betting sites in no time.

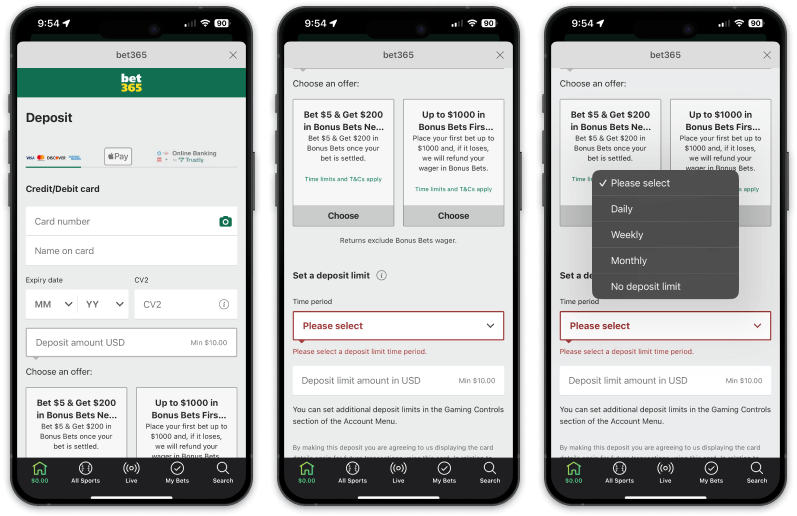

How do I claim the bet365 promo?

You can follow our step-by-step guide to secure $150 in bonus bets today via the current bet365 Sportsbook promo code deal:

- I recommend downloading the bet365 app before creating an account to familiarize yourself with their offerings and how navigation works.

- Check out payment methods and customer service responsiveness to confirm the operator provides what you're looking for.

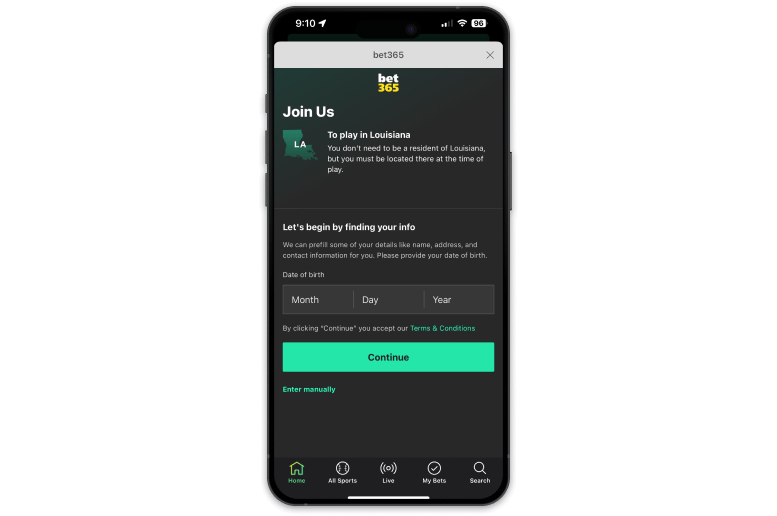

- Register for an account on the bet365 mobile app to ensure your initial bet returns $150 in bonus bets win or lose.

- New users of legal betting age must provide particular personal details to complete the sign-up process. This includes full name, date of birth, address, phone number, email address, and verification documents, such as government-issued identification, Social Security number, and proof of address. Not to worry, this won't take too long to complete. You'll be ready to place your bets before you know it.

- Be sure to enter the bet365 bonus code 'COVERS' during sign-up. Bettors in Colorado, Illinois, Missouri, New Jersey, Pennsylvania, and Tennessee can use code 'CVSBONUS.'

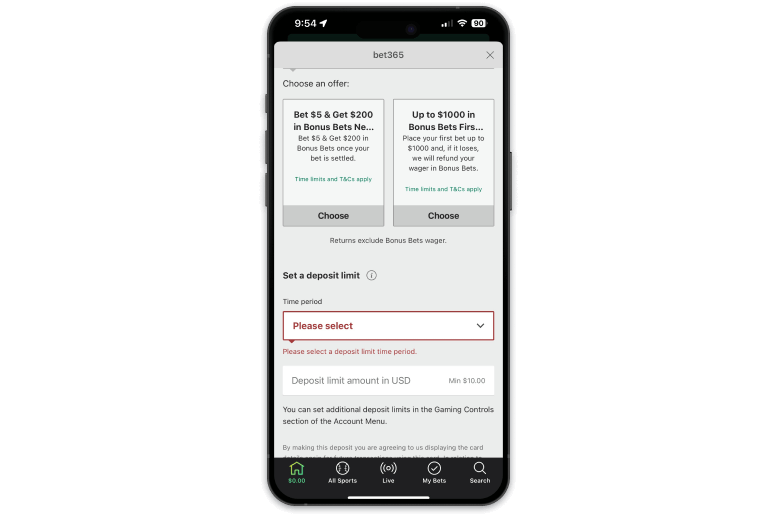

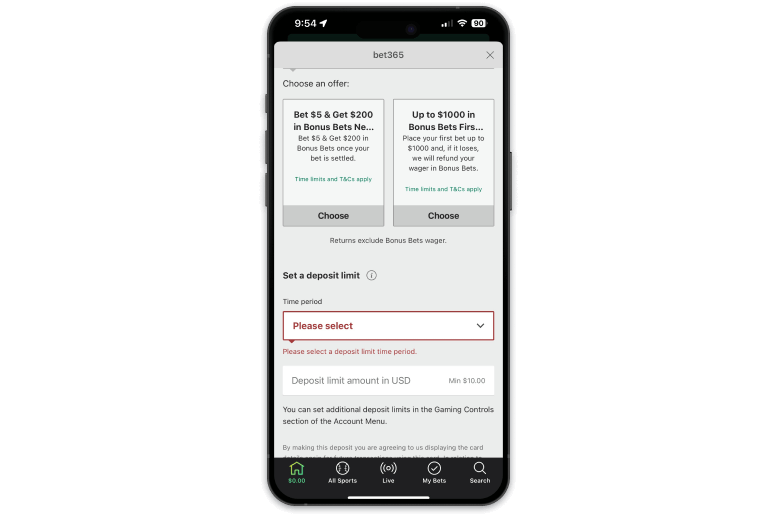

- You can choose one of the two available bet365 new user bonuses.

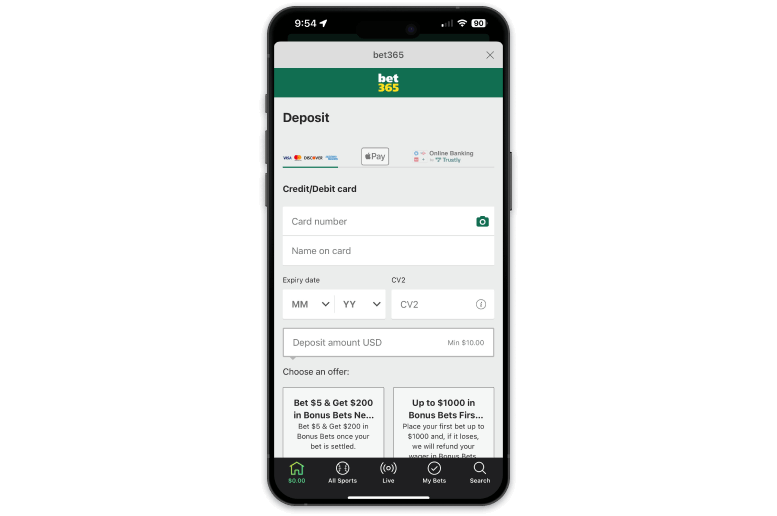

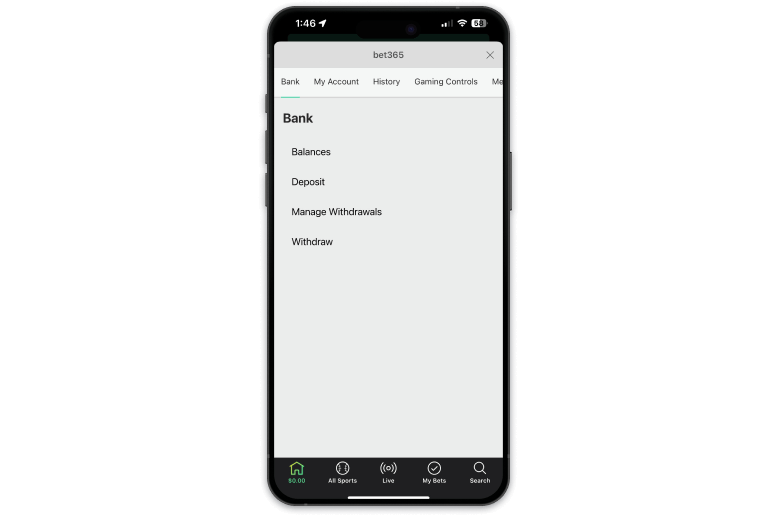

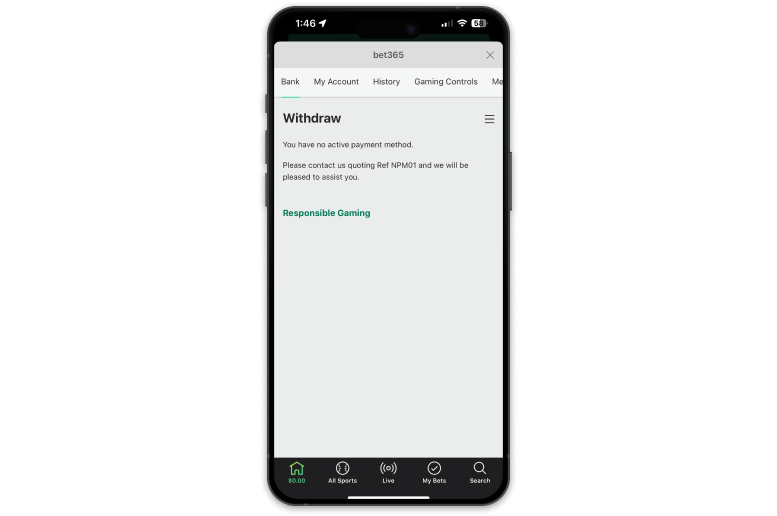

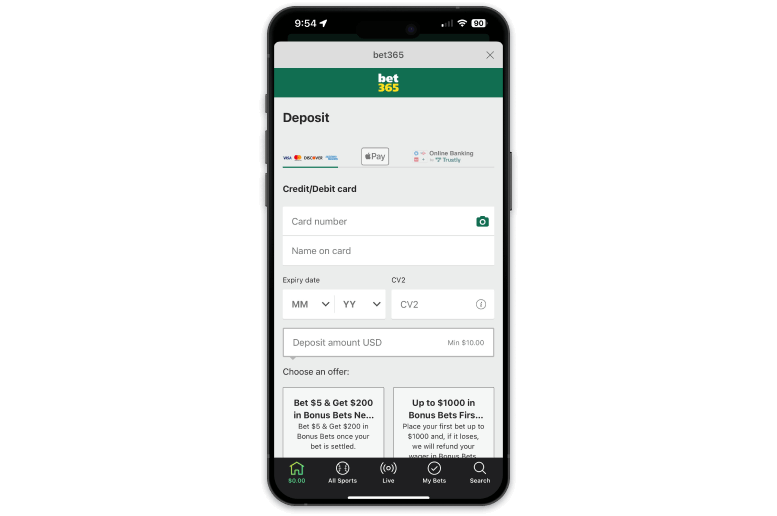

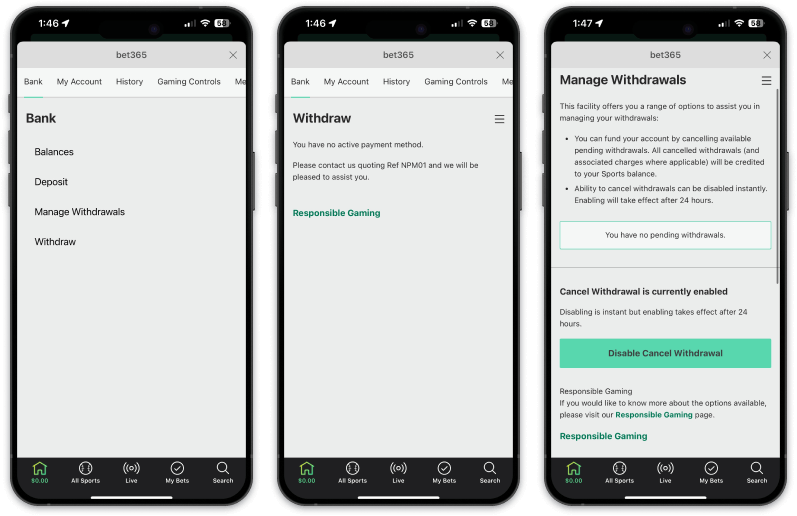

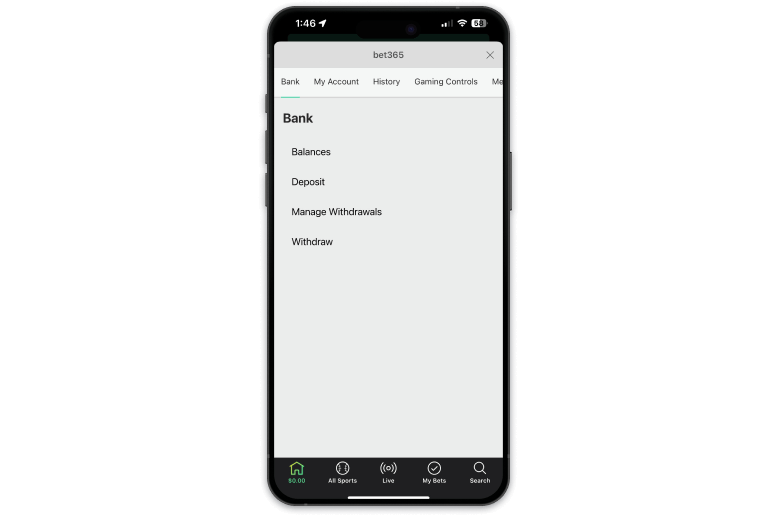

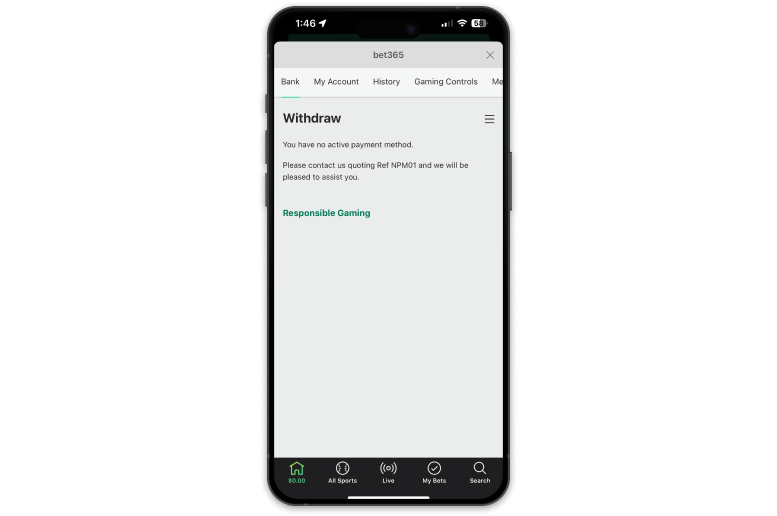

- After registration, choose a deposit method and transfer funds into your new bet365 account balance.

- There are plenty of payment methods available, including PayPal and Venmo.

- A minimum qualifying deposit of $10 is necessary to redeem the bet365 sign-up bonus.

- Once your funds have arrived, choose a sports betting market and place your initial wager of at least $5.

- Choose your market wisely, and be sure to include one market with odds of -500 or greater to qualify for the offer. You don't want to miss out on the welcome bonus by not following these odds restrictions, so make sure to take these into consideration.

- After settling your bet, you will receive your bet365 sign-up offer and accompanying bonus bets. Site credit is not a withdrawable balance as real cash, while typical withdrawals process within five business days.

- In my experience, it was faster than this, so think of five days as the maximum waiting time. You'll have your winnings much quicker.

Best bet365 bonuses for existing users

bet365 Sportsbook also features regular parlay bonuses and bet365 odds boosts to increase potential winnings for sports like golf, boxing, MMA, and more. A dedicated loyalty program would go a long way for the online sportsbook's retention efforts.

| Type of bet365 promo | Description of bet365 promo |

|---|---|

| ⚽ Champions League Super Boost | Get a 50% profit boost to use on any Champions League match. |

| 🏀 NBA SGP Boost | Receive a 30% profit boost to use on an NBA same-game parlay. |

| 🏀 Tip Off Tuesdays | Get up to a $10 bonus back if your NBA same-game parlay loses. |

| 🏀 Slam Dunk Saturday |

Opt-in and receive $25 in bonus bets when you wager $50 across Saturday's NBA action on SGP, SGP+, and/or parlay bets with a minimum of 3 selections. |

| ⚡ 100% Parlay Boost | Receive a 100% odds boost for any 2+ leg parlay across all major US Sports Leagues, as well as major Tennis and Soccer competitions. The boost percentage is based on the number of selections. |

| 🔗 Multi-Sport Parlay Bonus | bet365 provides an odds bonus to certain team parlays spanning several leagues and competitions. Place a pre-game parlay with a minimum of two legs and get up to a 100% boost to your winnings. |

| ⚡ Bet Boosts | Events with a bet boost will be indicated with a green arrow. Be sure to check your promo tab often. |

| 💰 Early Payout | Get an early win on your pre-game moneyline wager if your team has a certain lead at any point of the game, even if they end up losing. The required winning margin varies by sport. NHL, for example, is three goals. |

| ⚖️ bet365's Over/Under Game | Play bet365's new free-to-play Over/Under game to earn exclusive rewards. Stack predictions on a series on NFL player props, such as Saquon Barkley rushing yards or Josh Allen touchdowns, to receive greater bonuses if you win. |

What is the bet365 referral code?

The bet365 referral code is 'COVERS'; enter it during registration.

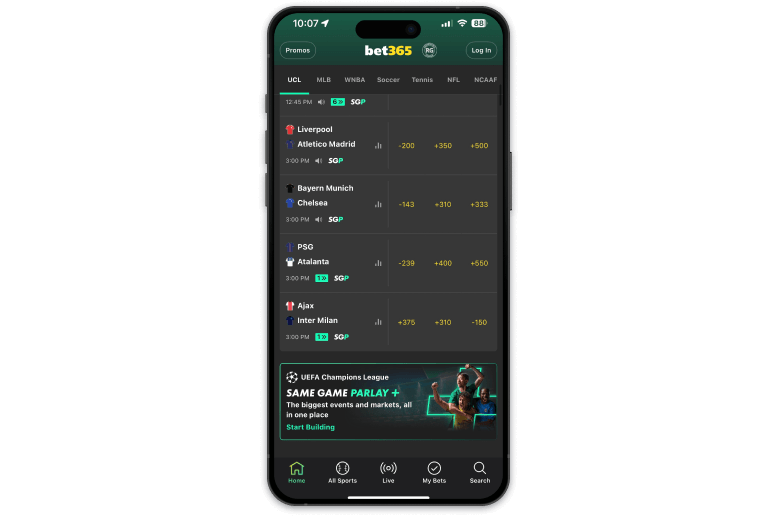

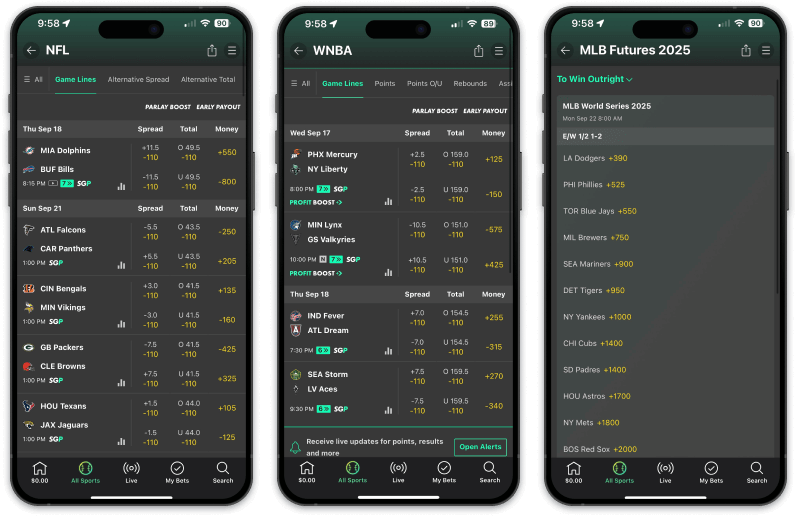

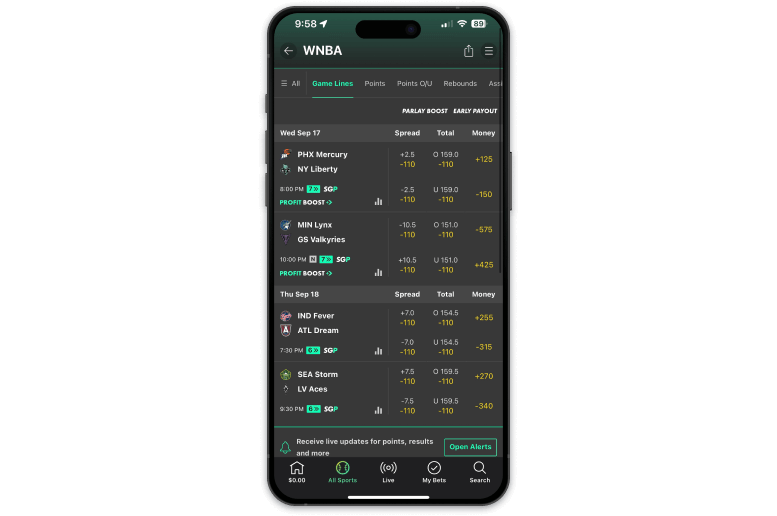

bet365 odds for today's top games

Here are the bet365 odds for the top games on February 24, 2026, including top basketball games:

NBA: Oklahoma City Thunder vs. Toronto Raptors odds

|

|

Spread | Total | Moneyline |

|---|---|---|---|

|

+1.0 (-112) |

Over 218.5 (-110) |

-104 |

|

|

|

-1.0 (-108) | Under 218.5 (-110) | -112 |

NCAAB: Duke vs. Notre Dame odds

|

|

Spread | Total | Moneyline |

|---|---|---|---|

|

-18.5 (-102) |

Over 140.5 (-106) |

-3500 |

|

|

|

+18.5 (-120) | Under 140.5 (-114) | +1280 |

NBA: New York Knicks vs. Cleveland Cavaliers odds

|

|

Spread | Total | Moneyline |

|---|---|---|---|

|

+4.0 (-110) |

Over 230.5 (-110) |

+142 |

|

|

|

-4.0 (-110) | Under 230.5 (-110) | -168 |

All odds shown above are correct as of February 24, 2026 and are subject to change.

What I like about the bet365 bonus code

Exclusive promo code

Enter the exclusive bet365 bonus code 'COVERS

during the signup process to activate the best possible promotion.

Low barrier to entry

I only need to wager $5 to unlock the full $150 in bonus bets, which keeps my upfront risk extremely low. It’s one of the most accessible sportsbook promotions on the market for new bettors, providing a chance to build their bankrolls.

Flexible bonus bet usage

I can use the bonus bets across a wide range of sports, leagues, and markets. This flexibility allows me to spread risk or target higher-value lines, rather than being locked into a single event. This makes it significantly easier to use.

Simple wagering mechanics

There’s no rollover on the bonus itself beyond placing the bets. Once the bonus wagers are settled, any winnings are immediately withdrawable.

What I don't like about the bet365 bonus code

The bet365 bonus code does have terms that are less than desirable:

Stake not returned on bonus bet

When I place a bonus bet, the stake itself is not included in the payout. This effectively reduces the true value of each wager.

Limited time to use the bonus

The bonus bets typically expire within a short window after being issued. That forces quicker betting decisions rather than allowing long-term line shopping.

New customers only restriction

Existing bet365 users are excluded from this promotion. If I’ve previously had an account, the bonus provides no value.

Lower ceiling than high-value deposit matches

While the risk is low, the upside is capped at $150 . High-stakes or volume bettors may find the total value underwhelming compared to larger deposit-match promotions.

bet365 Sportsbook review

bet365 Sportsbook — a three-time reigning 'Bookmaker of the Year' (2021-23) as chosen by SBC — is an internationally renowned online sports betting site that is used daily by our Covers betting experts. Below, I've highlighted several reasons you should check out bet365 today:

Three reasons to use bet365 Sportsbook today

- Thorough market coverage.

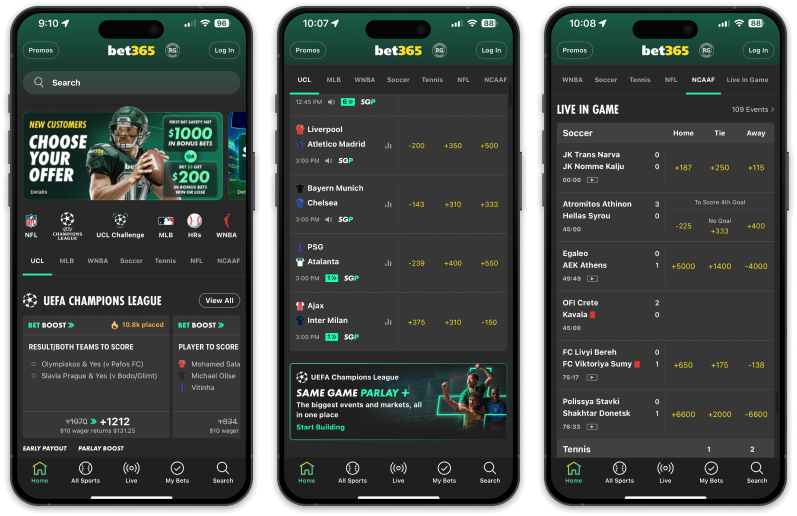

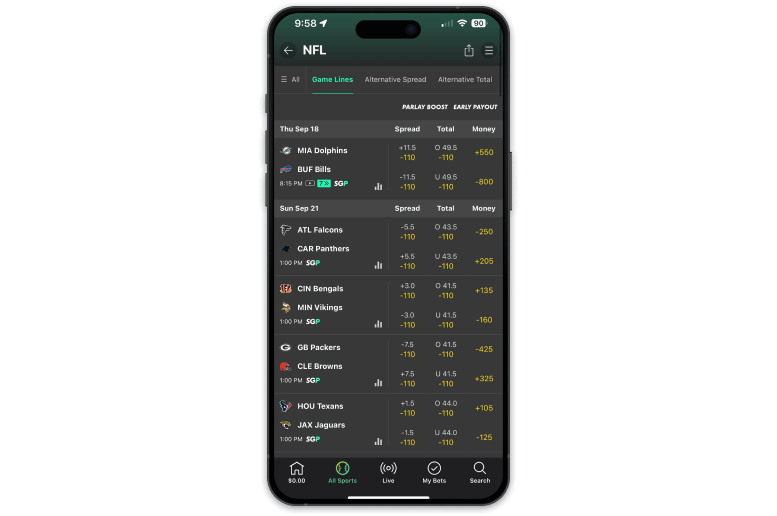

- User-friendly layout and navigation.

- World-class live betting.

| Betting features 🌟 | Covers Bet Smart Rating ✍ |

|---|---|

| 💰 Bonuses and promotions | 4.7/5 ⭐ |

| 🏦 Banking and payout speed | 4.4/5 ⭐ |

| ✨ Key features | 4.4/5 ⭐ |

| 🔒 Security and trust | 4.4/5 ⭐ |

| 📞 Customer support | 4.4/5 ⭐ |

| 👥 User experience | 4.5/5 ⭐ |

| 📊 Betting odds | 4.7/5 ⭐ |

| ✅ Overall rating | 4.7/5 ⭐ |

Why Covers experts use bet365 Sportsbook

bet365 is one of the premier online sportsbooks in the North American sports betting industry, thanks to a strong user experience, supreme navigation, detailed live betting options, a surplus of live streaming, and a sterling reputation as a legacy operator. bet365's current 'bet and get' welcome bonus also helps it stand out, as it is one of the most concise new user promotions in 2026.

I use 365 because there are plenty of odds boosts, a user-friendly interface, oodles of markets, and competitive, industry-best odds. It's everything that I look for in a reliable sportsbook.

Who's bet365 Sportsbook for?

I believe that bet365 is the ideal online sportsbook for all bettors, especially those seeking a comprehensive live betting experience. One of my favorite aspects of bet365 Sportsbook is the ability to watch and wager on most top sports leagues directly in its mobile app, including every NFL game throughout the season. We also appreciate bet365's coverage of niche sports, offering some of the industry's sharpest odds on markets for international soccer, baseball, and more.

bet365 Sportsbook review: Quick facts

| bet365 Sportsbook | |

|---|---|

| bet365 welcome bonus | Bet $5, Get $150 Win or Lose or $1,000 First Bet Safety Net |

| bet365 bonus code | COVERS or CVSBONUS |

| Top feature | Superb live betting & live streaming |

| Covers BetSmart Rating | 4.5/5 |

| Minimum deposit | $10 |

| Mobile app | iOS & Android |

| Casino | NJ, PA |

| Payout speed | Within 24 hours |

| Legal states | AZ, CO, IA, IL, IN, KS, KY, LA, MD, MO, NC, NJ, OH, PA, TN, VA |

| Live betting | Yes ✅ |

| Early cash out | Yes ✅ |

| Same-game parlays | Yes ✅ |

| Live streaming | Yes ✅ |

The pros and cons of bet365 Sportsbook in February 2026

bet365 top features

| Top features🏆 | Why Covers experts love it ❤️ |

|---|---|

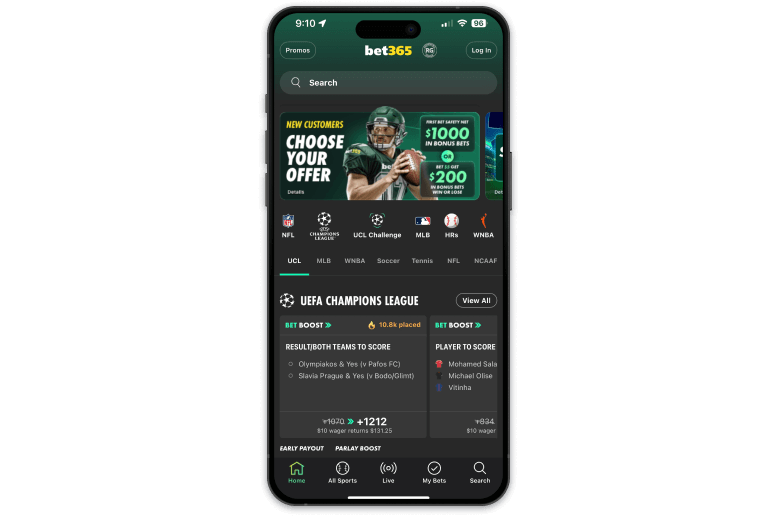

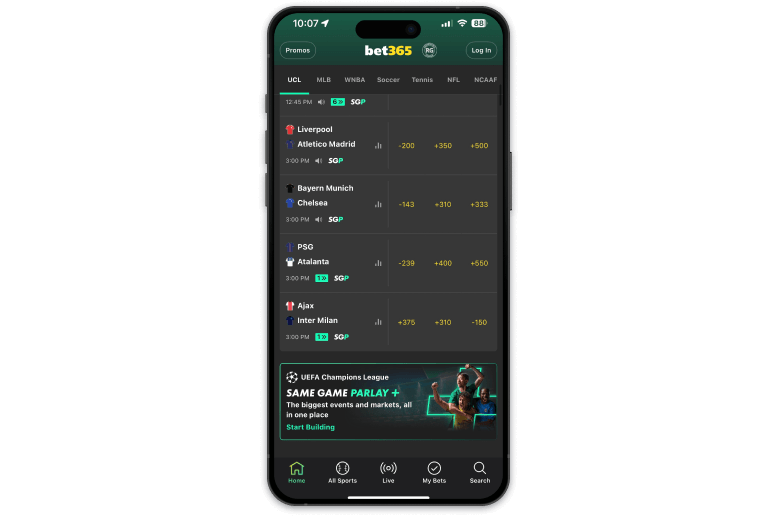

| 📳 Live betting |

Live betting is definitely a huge attraction for us at bet365. The dedicated in-play section covers over 30 major sports markets and always has plenty of betting options to check out. You can place bets while the matches are going on and pounce on opportunities as the odds fluctuate and you feel there is an edge to gain. bet365 has won best 'Live Betting Product' as chosen by SBC. |

| 📺 Live streaming |

Live streaming at bet365 has become our favorite feature, as you can check out thousands of events every year, streamed directly on the site for no extra charge. Simply look for the 'Play' button beside them, which indicates whether live streaming is available. In some cases, you'll be required to place a qualifying bet in order to view the live event. We find the quality of the stream to be surprisingly great with minimal lag, and placing live bets while on the same screen is simple. |

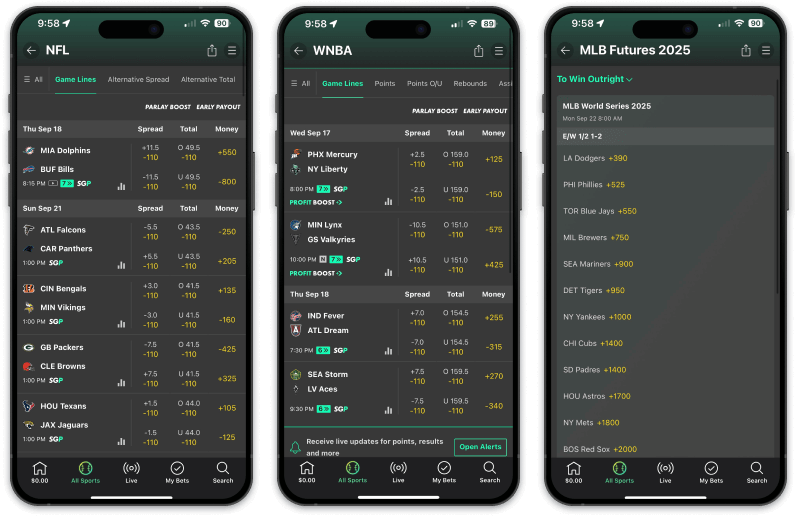

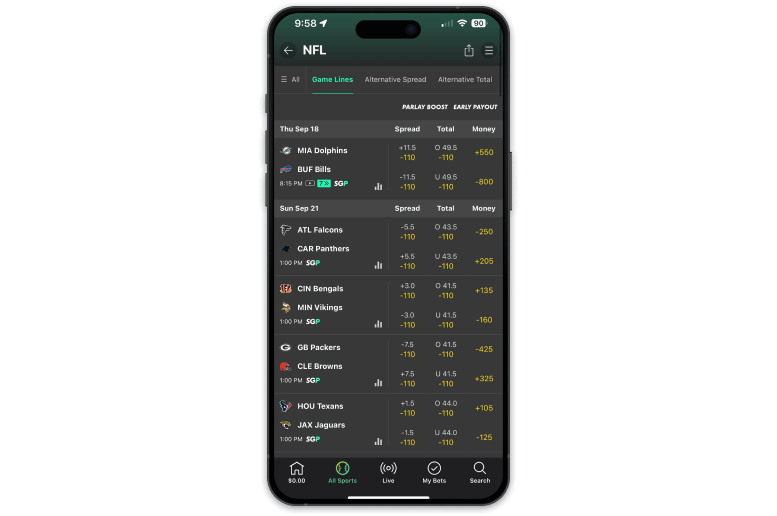

| 🔗 Same-game parlays |

Not only can you craft your own SGPs easily by selecting the 'Same-Game Parlay' section in each sporting event, but bet365 also offers daily boosts to its premade parlays, earning it a well-deserved spot on our list of the best parlay betting sites. |

| 💰 Early cash outs |

bet365 supports early cash outs for a wide range of sports events and markets in which you can choose when to take your bet back — in full — both for single bets and parlays. One cash-out element we commend is when we make a particular wager by mistake, bet365 will immediately offer us a full refund. Some other operators will only offer a fraction of your stake, which can be extremely frustrating. |

List of sports you can bet on with bet365

When it comes to offering a wide variety of markets, bet365 is among the best in the world. If you're looking for international markets or obscure divisions, chances are you'll find them at bet365.

Naturally, you have access to all of the major North American sports leagues, including:

bet365 also boasts a wide range of additional sports, such as darts, cricket, rugby, horse racing, college football, cycling, and lacrosse, and is amongst the top esports betting sites in 2026. bet365 ranks highly on our best UFC betting sites and top F1 betting sites lists. bet365 market depth is second to none.

Soccer fans will be ecstatic to hear that bet365 recently became the official sports betting partner of the UEFA Champions League. One thing we noticed is that bet365 stands out from its competitors in soccer markets, offering player props such as "Passes Attempted," which are not commonly found on other betting sites. I also love that live sporting events are located in a convenient tab for those placing wagers on desktop.

bet365 bet types

In addition to the wide range of betting markets, bet365 is also filled with the most popular bet types in 2026, including:

| Bet Type | Explaination |

|---|---|

| Moneyline |

A moneyline bet lets you pick the outright winner of a game. Favorites are shown with a minus (-) sign, while underdogs have a plus (+) sign. For example, if you took the Knicks moneyline at (+130) odds, you'd win $13 on a $10 wager. |

| Spread betting |

Wagering on the point spread involves betting on the margin of victory or defeat. For example, if a team is favored at -2.5, they must win by at least three points for your bet to succeed. On the other side, if you bet on the opponent, they must keep the game within two points or win outright. |

| Over/Under (totals) |

In an Over/Under bet, you predict if the game’s total score will be higher or lower than a set number. bet365 offers Over/Under options for the full game, specific halves, quarters, innings, and even individual team totals. For example, if you take Dallas Stars/Edmonton Oilers Over 5.5, you need the two teams to combine for six or more goals to win. |

| Prop bets |

Prop bets focus on specific outcomes within a game. bet365 allows you to wager on events like the total catches by a wide receiver or the number of passing touchdowns by a quarterback in a game. For example, you could take Patrick Mahomes Over 266.5 passing yards. If he gets 267+ passing yards, you would win this wager. |

| Parlay |

bet365 is amongst the best parlay betting sites in 2026, letting you combine multiple bets on a single slip for a higher payout if all selections win. |

| Live betting |

If you have strong insights while watching a live game, bet365 offers live betting across most markets, allowing you to capitalize on favorable odds in real time. |

| Futures |

In futures betting, you can place bets on long-term outcomes, like who will win the Super Bowl or NBA Finals. |

bet365 odds and restrictions

bet365's odds are provided in-house and are well above average, earning a 4.7/5 on our Covers BetSmart Rating system.

bet365 offers highly competitive odds across major sports, often matching or beating industry averages. The platform also provides deep markets with early lines and live odds that update quickly during games.

bet365 sets a maximum winnings cap at $5 million, excluding the initial stake and any bonuses. The platform also reserves the right to impose betting limits on users suspected of placing multiple bets on identical selections. This includes wagers spread across different days, activities involving various accounts, or collaborations with other users.

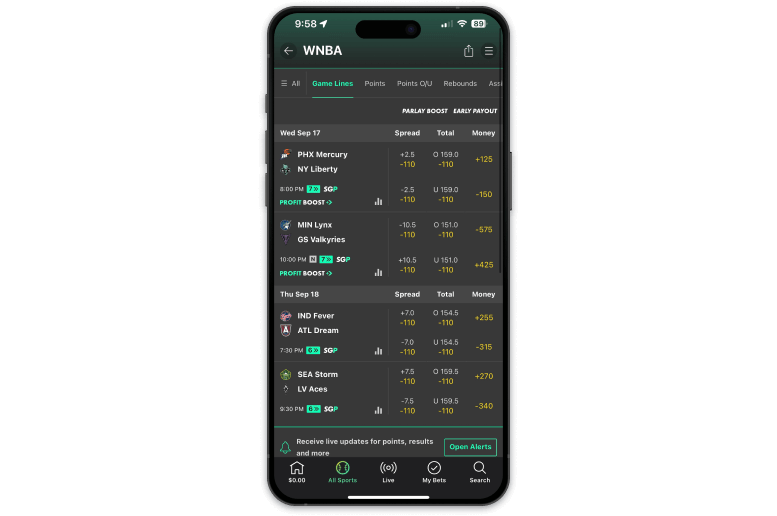

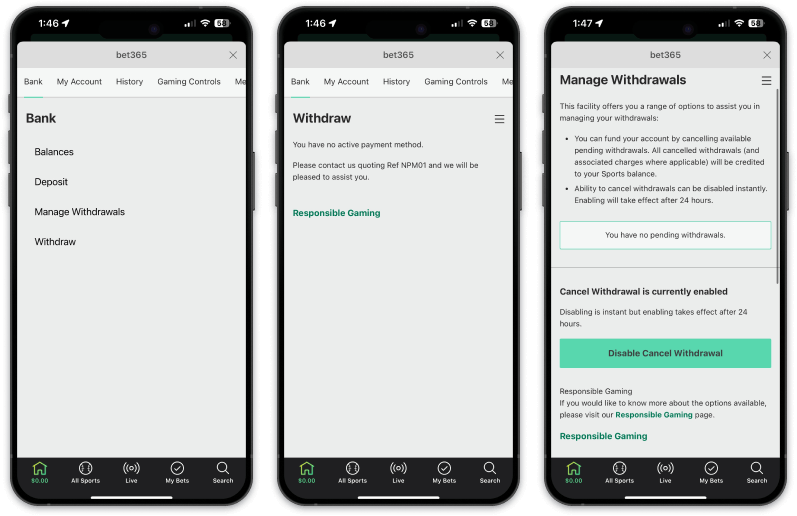

bet365 payment methods

bet365 supports most of the popular banking methods, including credit cards — like Visa and Mastercard — PayPal, debit cards, Apple Pay, bank transfer, and more. Sports bettors can deposit instantly with no fees and enjoy a surplus of withdrawal options.

| Method 🏦 | Deposit 💰 | Withdrawal 💸 | Payout speed 🕒 |

|---|---|---|---|

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 1 hour | |

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 24 hours | |

| ✅ | ✅ | Within 1 hour | |

| ✅ | ❌ | N/A | |

| ✅ | ✅ | Instant |

bet365 security and trust

Multiple security measures are in place to protect you when you use bet365. The online sportsbook uses 256-bit SSL encryption from Thawte to ensure all data remains secure. This functionality applies to personal details during registration and to sensitive banking information when making deposits. Additionally, bet365 employs multiple firewalls to enhance protection against unauthorized access.

bet365 customer service

bet365 has a wide range of support options, including a dedicated customer service team available 24/7. They offer live chat, email support, and social media support on X (formerly Twitter). Offering customer service in so many languages is an impressive feature.

💬 Live chat: 24/7 - Click here

📧 Email: support-eng@customerservices365.com

☎️ Phone: N/A

🌎 Support languages: English + 19 additional languages

📱 X (Twitter): @bet365

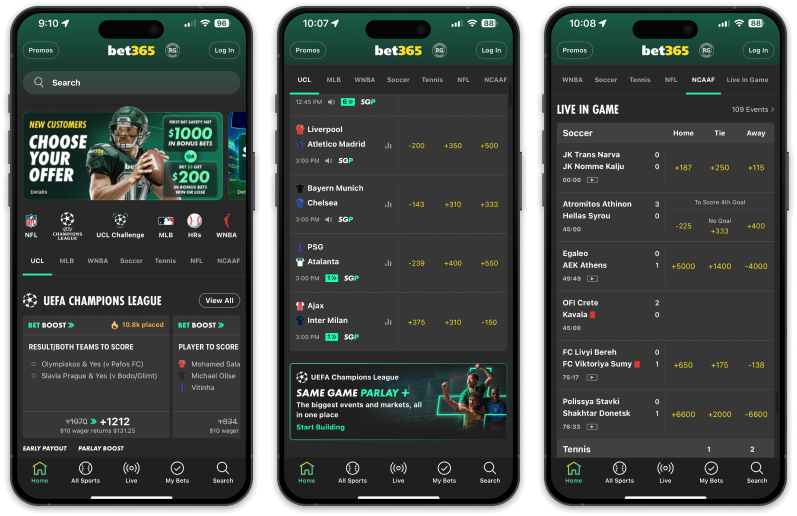

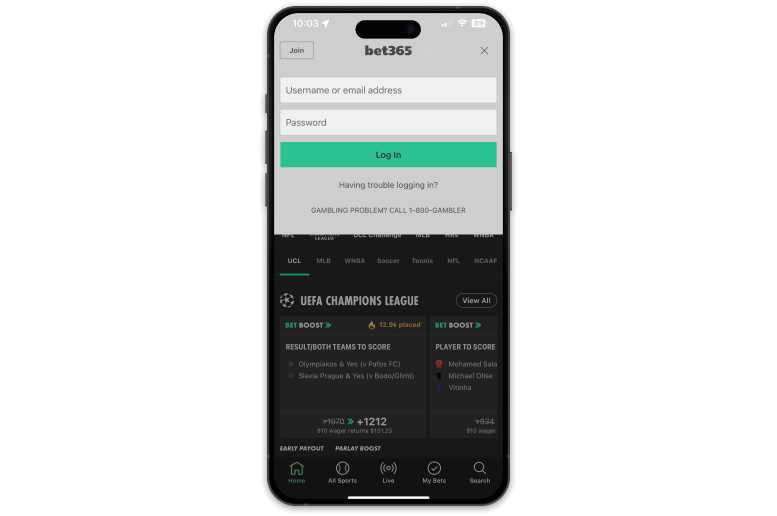

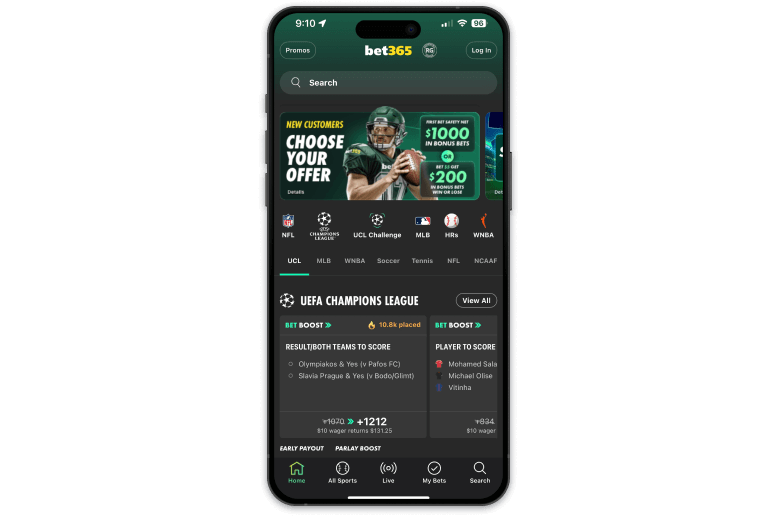

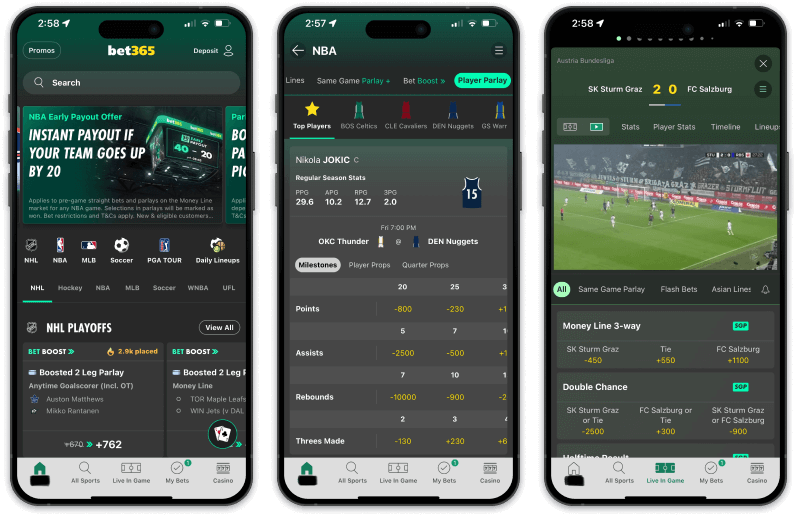

bet365 app review

bet365 is one of the best betting apps in 2026, as its mobile platform features and markets are the same as those on the website. The bet365 app supports biometric authentication, including facial recognition and fingerprint authentication, for seamless entry. However, the app may sometimes crash, especially when switching between applications, requiring users to restart and log in again. Ultimately, the mobile bet365 sportsbook offers an exceptional user experience and excels in same-game parlay scoring and live SGP availability, making it one of the best expected Missouri sports betting apps to launch later this year.

bet365 iOS app

🍎 bet365 iOS app

The bet365 app (size 52.3 MB) is highly rated on the App Store, where it can be downloaded for free, with a 4.7/5 rating. You can click here to download the bet365 Sportsbook iOS app.

🤖 bet365 Android app

Google Play Store users share a similar sentiment about the bet365 Sportsbook app, rating it 4.7/5. You can access the bet365 Sportsbook app on the Google Play Store by clicking here.

📱 bet365 app design

I've heard the bet365 app's design described as 'bland,' but I prefer to call it highly functional, with no unnecessary bells and whistles. In my opinion, the design and layout are the best in the business, as we can intuitively navigate the different sections to my desired markets. Additionally, bet365 Sportsbook's app features a well-designed homepage layout, which provides top daily sport-specific promos, the latest matches, and pre-built same-game parlays as soon as you log in to the mobile sportsbook.

📈 bet365 app improvements

I've observed continuous updates, bug fixes, and performance enhancements since installing the bet365 Sportsbook app, which have steadily improved my overall experience. The bet365 Sportsbook app was most recently updated in February 2026 to address bugs and improve based on user feedback, bringing it to Version 8.378.0. Other recent updates include the addition of a free-to-play fantasy contest and a revamped live betting layout.

A few years ago, the online sportsbook revamped its live betting layout to improve the user experience and navigation. I also noticed more push notifications since we downloaded the mobile app, including alerts about when my bonus bets were released or when a message was sent. This always keeps me fully informed, enhancing the overall experience.

bet365 review conclusion

All in all, bet365 Sportsbook definitely deserves its spot near the top of our leaderboard. It is an extremely well-rounded platform and provides a safe and secure online betting environment.

Superb coverage

There are over 35 sports betting markets to wager on, including all the major leagues and more obscure international markets as well. I have peace of mind knowing that nearly every match is available, along with a truly remarkable amount of live betting options.

When it comes to futures, markets, and in-play betting, bet365 has you covered from top to bottom. There are so many options to choose from.

Great pricing and odds

bet365 has a proven legacy as a respected bookmaker with sharp odds and excellent pricing across the board. The lines often come with reduced juice to give punters competitive betting options at all times.

When I am comparing odds between all of the big operators, bet365 comes out on top as often as any of them. I always recommend doing your due diligence and evaluating multiple betting lines, but if you don't have the time, you can wager with confidence at bet365, knowing you'll receive fair odds.

Immaculate site layout

bet365 has spent decades honing in on an ideal site layout and organization that makes locating betting markets a breeze. Once you've selected a particular game, toggling between the betting lines, team props, player props, SGPs, and boosts is extremely straightforward, as they are all clearly identified.

Even the 'Profile' tab has far and away the best design I've encountered, as I can access my betting history, activity, and personal preferences within seconds.

Room for improvement

bet365 is very close to being the ideal online sportsbook, but there are a few key developments that would make a world of difference. From my experience, the platform does tend to crash more than I would like, especially when I'm switching between applications for additional betting information. I find the bet authenticator on desktop — while increasing security — works inconsistently and is overall a barrier to placing wagers efficiently.

As a slightly profitable bettor, I have already seen my account limited in terms of my maximum wagers. Experienced and winning bettors may find a better opportunity for value elsewhere.

I use bet365 more than any other mobile app and would love to see them implement a comprehensive loyalty program. I feel as though I am missing out on rewards by doing the majority of my betting without a tiered ranking system to climb.

bet365 vs the competition

Dive into our sportsbook comparisons to see how bet365 measures up with the best legal sportsbooks in the U.S.

bet365 user reviews

“I've used this app for many years, perhaps 20. I thought it was the best betting app; developments (changes for changes sake?) make is LESS friendly. Punters often make decisions rapidly so you need to be familiar with the system, but constant changes need adaptation. Another reviewer suggested more useful info. I DO use other apps, but most of my activity is still here.”

- Sussexsmiley, App Store reviewer, 23 January 2026

"App is okay, but contacting a human is impossible. I didn't receive a bonus bet I was entitled to, and the help section was totally AI. I have up after 15 minutes of getting the same nonsense reply. Deposits and withdrawals are very good. The app is a little slow to log in compared to other sites."

- Martin T, Google Play Store user, 30 January 2026

bet365 in the news

bet365 sign-up eligibility requirements

Before you can claim a bet365 promo code, you must review the eligibility requirements, which are outlined below. These parameters will ensure you can register with one of the best sports betting apps of 2026:

You are at least 21 years old, except if you are in Kentucky, where the legal age for betting is 18.

You do not have to live in a state where bet365 is legally licensed to operate — AZ, CO, IN, IA, IL, KS, KY, LA, MD, MO, NC, NJ, OH, PA, TN, and VA. That said, you must be physically located within their borders when using the operator.

The bet365 welcome bonus is available only to new users of the bet365 app. You are ineligible to receive the promo if you previously claimed a promotion or used a desktop.

You are not directly involved — athlete, coach, referee, owner, etc. — with the sports team or league that you are wagering on.

You are ineligible to use bet365 if you are on any self-exclusion lists for gambling. If you are struggling, please refer to bet365's responsible gaming features for assistance.

Is bet365 Sportsbook legal?

Yes, bet365 Sportsbook is legal in 16 states. Use our exclusive bet365 bonus code 'COVERS' or 'CVSBONUS' to claim a welcome bonus or early registration promo in any of the states listed below. This is one of the most reputable platforms available, boasting expansive betting markets and valuable promotions.

Most recently, bet365 entered the online sports betting markets in Maryland and Kansas.

| State | Sign-up bonus | Regulator |

|---|---|---|

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Arizona Department of Gaming | |

|

Bet $5, Get $150 Win or Lose |

Colorado Division of Gaming | |

|

Bet $5, Get $150 Win or Lose |

The Illinois Gaming Board | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Indiana Gaming Commission | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Iowa Racing and Gaming Commission | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Kansas Racing and Gaming Commission | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Kentucky Horse Racing Commission | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Louisiana Gaming Control Board | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Maryland Lottery and Gaming | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Missouri Gaming Commission | |

|

Bet $5, Get $150 + + 50 Spins Win or Lose |

New Jersey Division of Gaming Enforcement | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

North Carolina Education Lottery | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Ohio Casino Control Commission | |

|

Bet $5, Get $150 Win or Lose + 50 Spins |

Pennsylvania Gaming Control Board | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Tennessee Sports Wagering Advisory Council | |

|

Bet $5, Get $150 Win or Lose $1,000 First Bet Safety Net |

Virginia Lottery |

Are you interested in finding out which states bet365 may be launching in next? Check out our states with legal sports betting page for the latest updates.

bet365 bonus code for Canada and International

bet365 earns top marks from international and Canadian sports bettors. Our exclusive bet365 bonus code 'COVERS365' unlocks an amazing product experience for new customers. Plus, bet365 boasts one of the best sports betting apps in Canada.

We also have an exclusive bet365 bonus code for UK players.

bet365 Casino offer

Use bet365 Casino bonus code 'CVSBONUS' to claim a 100% Match up to $1,000 + up to 500 Spins after creating a new account and depositing $10. You can spin the bonus wheel once every 24 hours for 10 days and must be on the following games: Curse of the Bayou, Magic Forge, Maximum Vegas, or Super Mega Ultra Wheel.

Make a minimum deposit of $10.

This bet365 Casino bonus spins element does not carry a wagering requirement.

You have seven days to use your bonus spins.

More sportsbook sign-up bonuses

Explore the top sportsbook sign-up bonuses available in the U.S. in 2026 below. Sign up for each promo to build your bankroll, as you can take advantage of multiple promos. Don't miss out on this chance to add to your balance.

Why trust bet365?

Why trust bet365?

bet365 is a long-standing global sportsbook and gaming operator that has grown into one of the largest and most recognized online betting brands in the world. With operations spanning more than 100 countries and tens of millions of customers, it is widely viewed as a trusted, legacy provider known for financial stability, reliable payouts, and industry-leading technology. Its reputation is reinforced by decades of consistent performance, strong regulatory compliance, and a track record of delivering a secure, high-quality betting experience.

Want to know more about the analyst who reviewed this sportsbook? Meet Christian, the expert behind our rating →

bet365 responsible gambling features

bet365 sportsbook provides a number of tools and resources to promote responsible gambling. Users can set daily, weekly, or monthly limits on deposits and spending, as well as establish limits for individual wagers. These are tools to help players keep themselves in check. The legal betting age is also clearly displayed during the registration process.

To further combat problem gambling, bet365 offers educational resources that help identify warning signs of harmful gaming behaviour. Bettors can also take a free self-assessment test to evaluate their gambling habits.

Time limits

One particularly proactive feature is the option to set time limits on your betting profile. This allows users to control the time spent on the platform during a specific period, helping them stay within their budget while keeping the experience enjoyable. Online sportsbooks that clearly promote time limits represent the pinnacle of responsible gaming.

There are also additional responsible gaming resources available at bet365. Click the link below to learn more.

bet365 bonus code FAQ

Yes, bet365 sportsbook is fully-licensed and therefore completely legal in the United States (Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, and Virginia only), Canada, and several European countries.

After placing a minimum $5 bet on any market, you will receive $150 in bonus bets when you use bet365 bonus code 'COVERS'. Bettors in Colorado, Illinois, Missouri, New Jersey, Pennsylvania, and Tennessee can use bet365 bonus code 'CVSBONUS' during registration. PA bettors will also receive 50 casino spins.

Use bet365 bonus code 'COVERS' to claim bet365's new user reward.

Any new users who are at least 21 years old and reside in Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, and Virginia can use the bet365 bonus code. Kentucky bettors 18 years and older can sign up with bet365.

Deposit $10 and place a $5 wager, and you'll qualify for $150 in bonus bets. Be sure to claim this offer within 30 days of registering. Users in Colorado, Illinois, Missouri, New Jersey, Pennsylvania, and Tennessee can activate $150 in bonus bets using bet365 bonus code 'CVSBONUS'.

The bet365 bonus expires within seven days of registration if not activated. Once the bonus bets are activated, they expire within seven days (168 hours).

Yes, the bet365 Sportsbook app is available to download on your mobile device for Apple and Android.

Yes, bet365 has NFL live streaming for select 2025-26 NFL regular season games. Check for the ▶ icon in the game details to see if live streaming is available.

A seasoned Editor at Covers, specializing in the North American sports betting and iGaming industries. Since joining in 2022, Christian has played a key role in managing, editing, and publishing commercial content that informs and engages bettors of all levels, with a particular focus on Stake, bet365, BetMGM, and Fanatics.

Having personally reviewed over 35 sportsbooks and DFS sites, Christian brings a sharp, user-focused perspective to the betting landscape, committed to delivering insightful, high-quality content. Outside of work, he serves on the board of an amateur athletics club, championing community engagement through sport.