Bettormetrics research has revealed that challenger brands are starting to make gains in the U.S. iGaming scene. UK-based bet365 came out on top in terms of pricing, while Fanatics took the uptime crown for the first four months of 2025.

Key Takeaways

- New Bettormetrics study explores top trading strategies of competing U.S. sportsbooks.

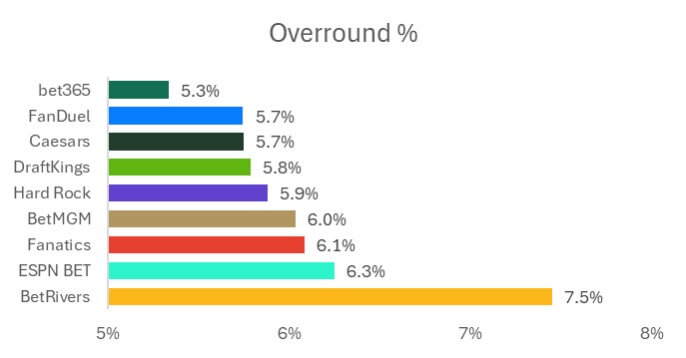

- Study shows that bet365, already known for its competitive pricing internationally, offered the lowest overrounds (5.3%).

- Fanatics beats DraftKings on uptime with a score of 87.1%, as competition hots up amongst rival sportsbooks.

Sports betting analytics specialist Bettormetrics claims bet365 now has the tightest pricing for all four of the top U.S. sports, as competitor operators begin to close the gap on the likes of FanDuel and DraftKings.

A new study released by the AI-driven company focused on metrics like uptime, overround, "Green Time," and "Shading Time" to establish which challenger brands look most likely to cause problems for the duopoly.

Bettormetrics concluded that bet365’s pricing strategies and market availability are the best in the business right now, suggesting the UK-based operator could well challenge FanDuel and DraftKings for dominance in the U.S. soon.

Researchers also found that several other less prominent sportsbooks are starting to make waves on key value for money metrics, with customers already taking notice.

Enjoying Covers content? Add us as a preferred source on your Google account

bet365 triumphs on pricing with overround of 5.3%

The Bettormetrics research analyzed a number of major players, from Hard Rock Digital, and Fanatics to BetMGM, Caesars, BetRivers, and ESPN BET, to shine a light on the strategies being used by operators most likely to challenge the dominant pair.

Four key metrics were analysed: overround, uptime, green time, and shading time. The research centered on the most popular sports events over the first four months of the year, with data from MLB, NFL, NBA, NHL, the Australian Open (tennis), and the English Premier League (soccer) all contributing to the study.

Bet365 was the clear winner on overround, a metric that’s critical in determining the value that customers are getting. It's determined as "the sum of the implied probabilities of each bookmaker’s market odds." Bet365’s overround was 5.3%, a score Bettormetrics said was in keeping with its “historical precedent outside of the U.S.”

Competitors weren’t far behind, with many challenger brands offering overrounds similar to those of FanDuel and DraftKings. The study found that FanDuel and Caesars both had average overround scores of 5.7%. In fourth place was DraftKings, at 5.8%. ESPN BET’s overround was 6.3%, while BetRivers came in last at 7.5%.

Fanatics, DraftKings reign supreme on uptime

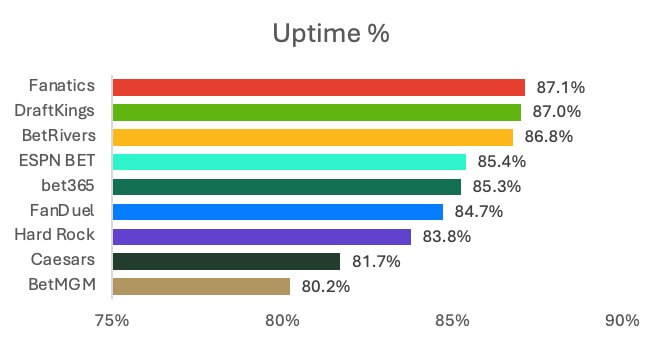

Uptime was another metric examined as part of the research. Defined by Bettormetrics analysts as “the proportion of the match that each bookmaker has odds available for at least one selection of the market,” it’s another crucial metric in establishing what sportsbooks have to offer, and how available they really are during the moments that matter most.

It was Fanatics that triumphed on availability, with an uptime of 87.1%. Market-leading operator DraftKings was 0.1 percentage points behind, however.

Interestingly, bet365’s uptime was higher than that of FanDuel. Bet365’s uptime was calculated at 85.3%, while Flutter-owned FanDuel had an uptime score of 84.7%. ESPN BET and BetRivers also offered better uptime than FanDuel over the first four months of 2025.

Shading Time vs. Green Time

Bettormetrics analyzed each operator’s "Shading Time" to establish what proportion of games studied saw pricing deviate far enough from the average to render at least one selection unprofitable.

ESPN BET took the top spot, with a score of 2.9%. Close runners up included DraftKings (3%), BetRivers (3.4%), and FanDuel (5.2%). Fanatics had a shading time of 6.4%, while bet365’s 8.8% and Caesars’ 8.9% put them at the bottom of the table.

Green Time gives an even clearer idea of the picture, by showing the availability of odds on at least one selection of a market, where no markets are priced at unprofitable rates. Simply put, it’s the percentage of a game during which operators offer good value for their customers.

DraftKings did well on both uptime and shading time, so it’s not surprising that the operator was placed first on Green Time, with a score of 84%. BetRivers followed closely behind though, offering a profitable price on at least one market for 83.4% of a game.

ESPN BET had profitable prices available for 82.5% of the games analyzed. Fanatics triumphed over FanDuel, with Green Time of 80.8%, versus FanDuel’s 79.6%. Bet365 also scored well, with at least one profitable price for 76.4% of the time.

Bettormetrics CEO: competitor operators closing the gap

Discussing the study, Bettormetrics CEO and co-founder Robert Urwin said the two major U.S. sports betting operators have carved out a dominance “rarely seen in regulated markets.”

“However, a lot of attention is being put on the brands closing the gap, so we looked at three distinct use cases – bet365 with its global experience, Hard Rock with its Florida monopoly, and Fanatics with its cross-sell acquisition opportunity through non-betting channels.”

“It does highlight that there is no one-size-fits-all approach to being a successful sportsbook, and analysing the range of different strategies allows us to really highlight strengths and weaknesses for each operator.”

Alfie Arrand, sports trading analyst at Bettormetrics, explained how the metrics examined in this study show exactly what rival operators are doing to attract new customers, as they look to position themselves as the next go-to sportsbook.

“While DraftKings and FanDuel are clearly well ahead in both performance and across our metrics, the U.S. market is hotting up as rival sportsbooks look to differentiate themselves to close the gap,” Arrand said.