New Bettormetrics research has revealed the diverse football trading strategies being used by the likes of Caesars, Hard Rock, bet365 and Fanatics.

Its latest study gives insight into operators’ use of NCAA and NFL markets to challenge the dominance of DraftKings.

Key Takeaways

- Early NFL trading has shown clear shifts in operator strategy

- Aggressive pricing strategies were seen at bet365

- DraftKings has continued to lead the field in NCAA football

Bettormetrics, the AI data company that provides insight into sports betting trading, has released new research on the top strategies sportsbooks are using to challenge the dominance of DraftKings and FanDuel.

The study, which centers on sportsbooks’ use of NCAA and NFL markets, highlights the approaches used by the likes of Caesars, Hard Rock and Fanatics as they pursue growth in highly competitive markets.

Metrics such as Uptime, Overround, Shading Time, and Green Time were used to calculate the competitiveness of different sportsbooks across NCAA and NFL markets, comparing progression from 2024 to 2025.

Bettormetrics defines these metrics as:

- Uptime – the proportion of the game that odds are live and available.

- Overround – the operator’s built-in margin, reflecting expected return on turnover.

- Shading Time – periods when a bookmaker’s odds diverge significantly from the market.

- Green Time – periods when odds are both live and deemed not to be unprofitable.

Caesars slashes margins on NFL trading

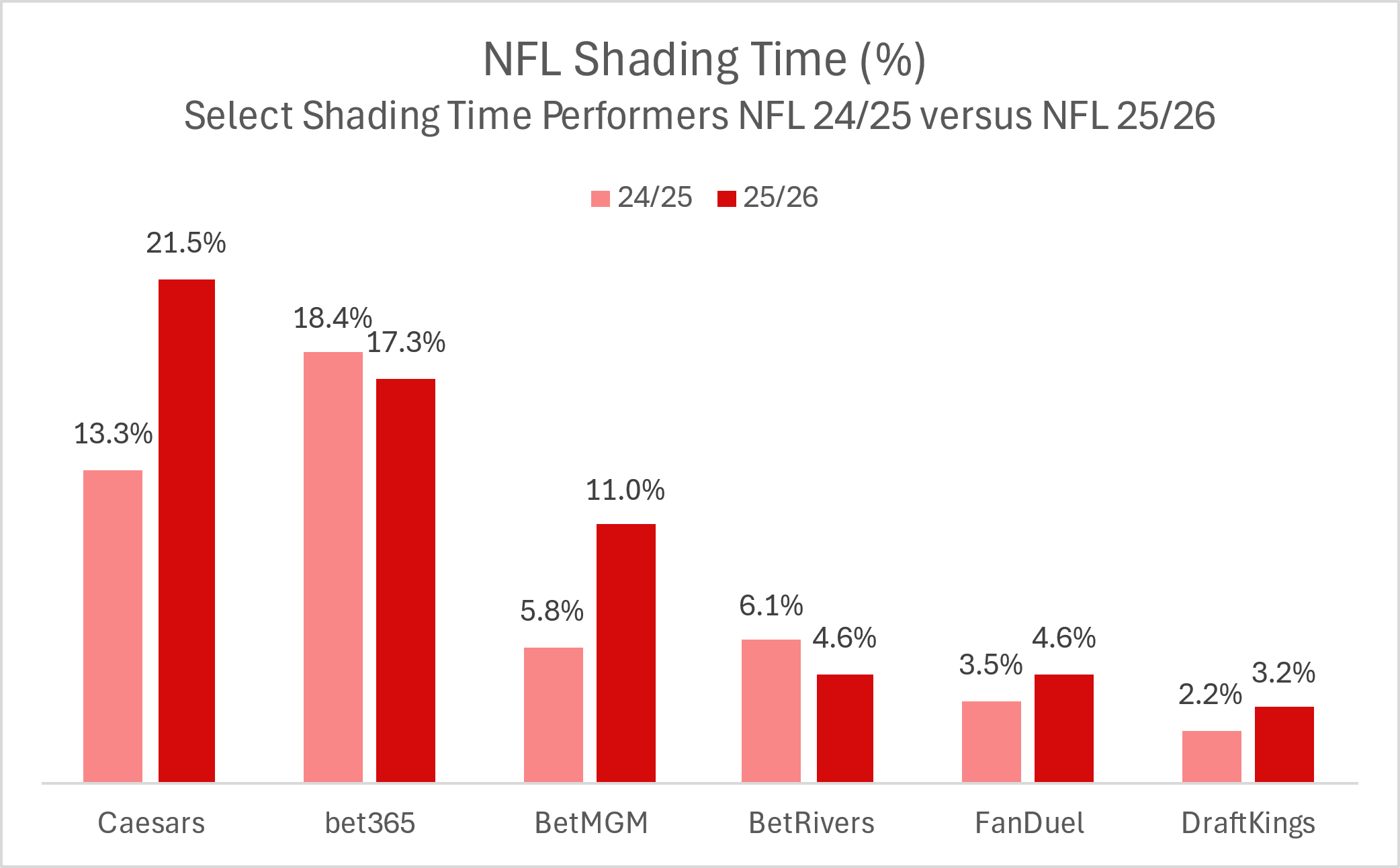

Caesars cut margins to just over 5% in early NFL trading, the highest reduction seen at any sportsbook this year. It came at a cost though, as the operator’s shading time topped 21%.

Uptime has been soaring at Hard Rock and Fanatics, as part of the operators’ efforts to draw the attention of DraftKings and FanDuel customers. We saw a different approach in play at bet365, though, with green time plummeting and shading time rising. This could indicate higher confidence at the company, given its dominance across global markets.

In terms of the best performance on both uptime and green time, the title stayed with DraftKings. A dominant force in NFL markets, DraftKings has remained the sportsbook best equipped to keep markets open for longer than the competition.

Top challengers cut shading time on NCAA markets

The landscape of NCAA football has shifted in recent months, increasing betting opportunities. And rival sportsbooks have responded, capitalising on expanded playoffs and high-profile matchups in a number of different ways.

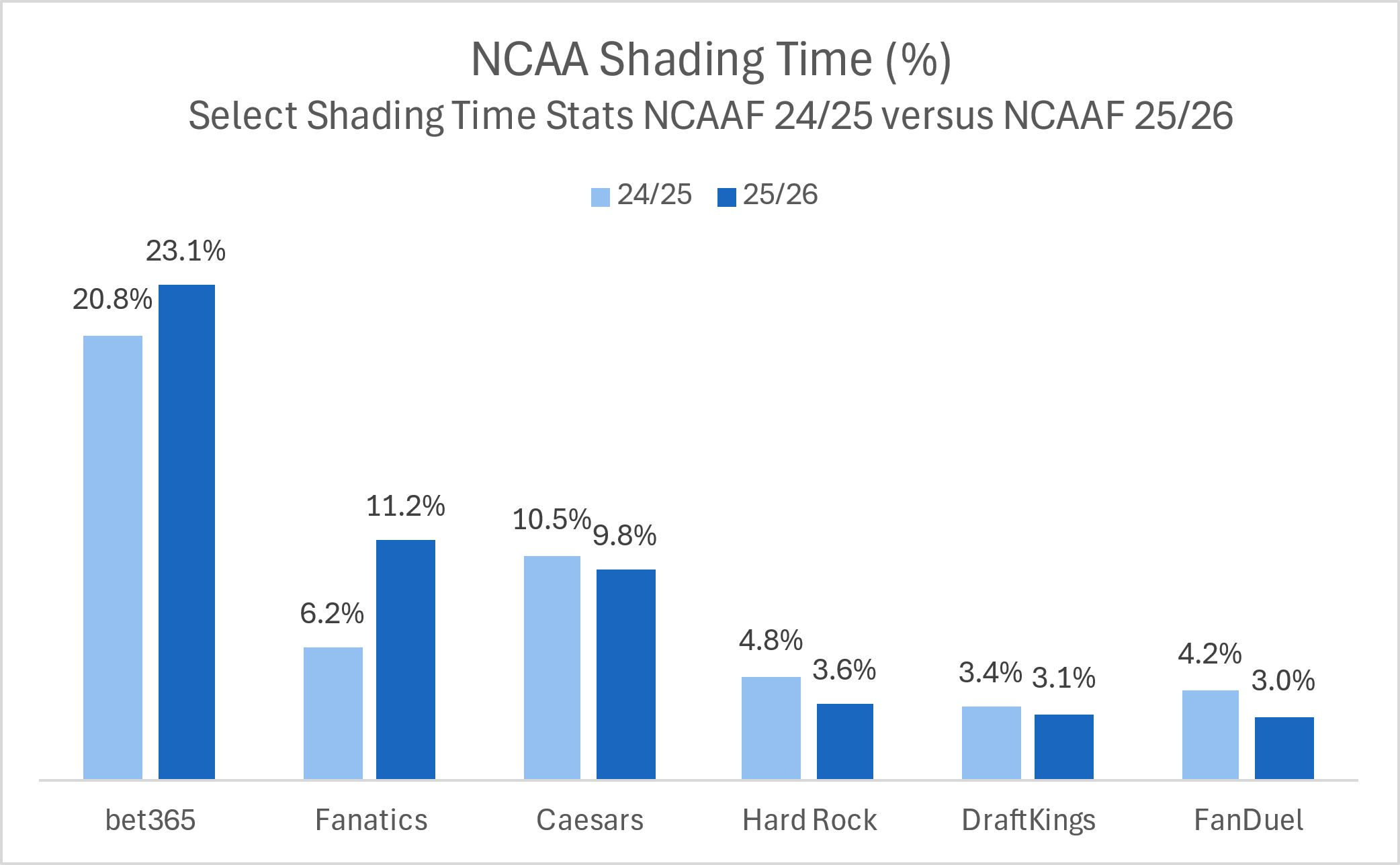

DraftKings has continued to dominate NCAA football trading this year, with top performances on green time and uptime. But challenger brands have been making real progress towards closing that gap.

Uptime improved by a massive 17% at BetRivers, with the sportsbook also recording the second-lowest shading time amongst operators in this study. It did see an 8.2% increase in overround, however, which could indicate some vulnerability as a result of its more aggressive approach this year.

An entirely different approach was used by bet365, with the sportsbook’s shading time almost hitting a quarter of its total availability. Hard Rock increased uptime while also reducing shading time on NCAA markets, but Fanatics’ uptime increase resulted in rising shading time.

“What makes this data fascinating is that improvement in one area often comes with trade-offs elsewhere,” said Alfie Arrand, Sports Trading Analyst at Bettormetrics.

“Caesars’ lower Overround looks good on paper, but it coincided with higher Shading Time. BetRivers, conversely, improved availability but allowed its margins to widen. It just goes to show how delicate the balancing act is when trading America’s most important sports,” Arrand added.

Tactics continue to shift as operators seek to close the gap

If we compare NCAA and NFL markets across all the sportsbooks included in this study, it’s clear that NFL remains the top performer for all brands.

Uptime is, on average, 10% lower for NCAA games across all operators. But this could soon change, given the increase in betting opportunities already seen over the course of this year.

Over the coming months we’re fully expecting challenger brands in particular to make better use of expanded playoffs and a greater likelihood of marquee matchups.

If they choose the right strategies at the right time, it’s entirely possible that these sportsbooks could start to close the gap and really threaten the dominance of DraftKings and FanDuel.

Commenting on Bettormetrics’ latest findings, “Football is where U.S. sportsbooks really live or die, so these shifts in trading performance really matter," Chief Revenue Officer Sabin Brooks said.

“DraftKings remains peerless on Uptime and pricing integrity, while FanDuel has carved out success with its solid margin profile. However, beneath that duopoly we’re seeing challenger brands adjust tactics – some tightening margins, others improving availability – as they look to close the gap,” Brooks added.