DraftKings and FanDuel are about to learn how loyal their customers in the Land of Lincoln really are, and whether a couple of quarters will cause bettors to wager less or look for a new bookmaker.

The two sportsbook operators will charge Illinois bettors a 50-cent fee on all mobile wagers starting in September, which is in response to state lawmakers approving a new per-bet tax.

That new tax kicks in next month, and will cost online sportsbooks 25 cents a bet for the first 20 million wagers they take. The tax then goes up to 50 cents a bet after 20 million wagers.

A new tax in Illinois is in addition to the tax hike local lawmakers hit online sportsbooks with last year on their revenue, raising the levy to as high as 40% for operators in Illinois.

Facing those added costs, the two biggest online sportsbooks in Illinois now intend to have their customers share the pain.

However, the decision by DraftKings and FanDuel (and perhaps others, too) could prompt punters to change their gambling habits. That, at least, is what the findings of a survey conducted by Covers suggest.

- An online survey conducted by Covers suggests the 50-cent fee that DraftKings and FanDuel are planning to charge in Illinois could curb wagering by some customers.

- The fee is being imposed by the two online sportsbook operators in response to a new per-bet tax passed by Illinois lawmakers.

- While the new per-bet fees and tax could tamp down wagering, it's also possible the two bookmakers come out ahead financially no matter what.

Covers received more than 500 responses from Illinoisans to the online survey as of Monday morning.

Out of those respondents, 50.2% said they were female, 47.3% said male, and 2.6% said non-binary. More than 75% of the respondents said they were between the ages of 25 and 54.

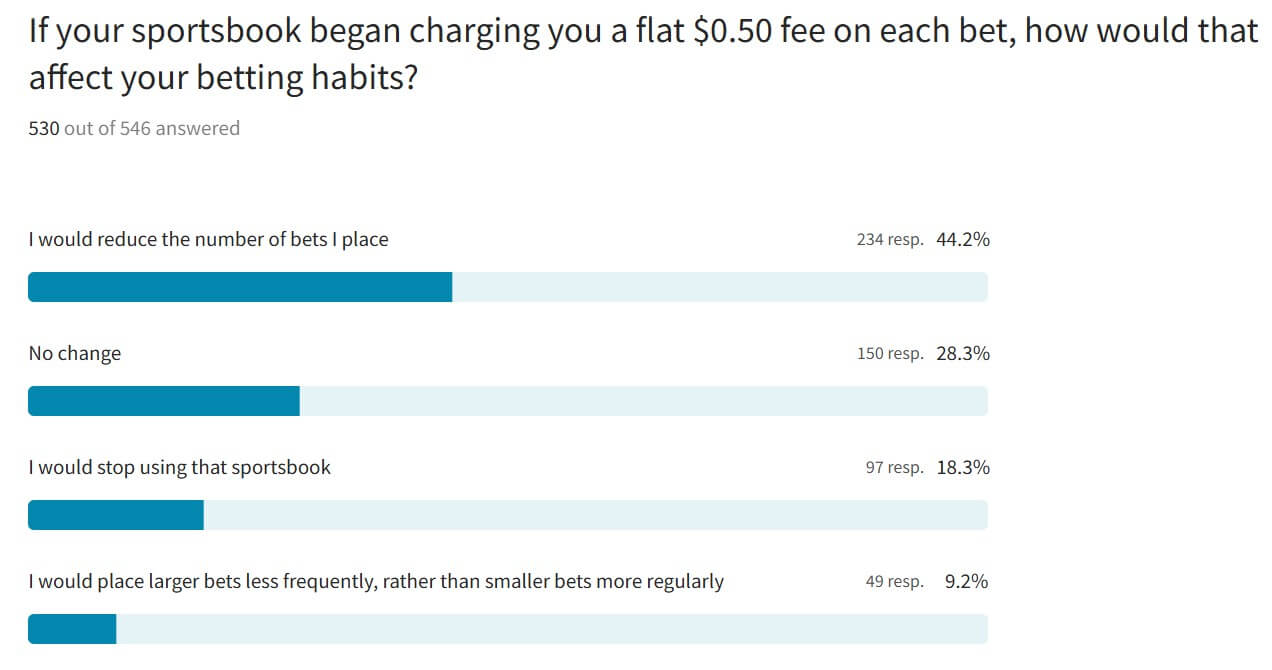

Out of the overall group, 44.2% (or 234 respondents) said they would reduce the number of bets they would place if a sportsbook started charging them a flat 50-cent fee for each bet.

Another 18.3% of respondents said they would stop using a sportsbook that charges them 50 cents a bet, and 9.2% answered they would place larger bets with less frequency rather than smaller bets more regularly. Finally, 29.3% of respondents said they would make no change to their wagering habits.

Asked if a 50-cent fee per bet would prompt them to consider switching to another sportsbook that doesn't charge a fee, 66.5% of respondents said yes, 21.3% said maybe, and 12.2% said no.

You gotta do what you gotta do

To sum it up, then, a majority of the Illinois residents who responded to Covers said that a 50-cent fee would cause them to adjust their regularly scheduled sports betting. The majority also said the new fee could nudge them toward another sportsbook.

That may be something DraftKings and FanDuel are already well aware of, but willing to risk as they try to offset the increased cost of doing business in Illinois.

There are 10 online sportsbooks in Illinois, yet DraftKings and FanDuel are by far the leaders in terms of total wagering. No other operator has announced a surcharge in response to the state's per-bet tax.

And while both DraftKings and FanDuel have said they would scrap their proposed surcharges if Illinois lawmakers reverse themselves, that looks unlikely, at least for the foreseeable future.

“We are disappointed that the Illinois Transaction Fee will disproportionately impact lower wagering recreational customers while also punishing those operators who have invested the most to grow the online regulated market in the state,” said Peter Jackson, CEO of FanDuel-parent Flutter Entertainment, in a statement last week. “We also believe the introduction of the Illinois Transaction Fee will likely motivate some Illinois-based customers to bet with unregulated operators.”

Jackson’s comments about “lower wagering recreational customers” and the unregulated market are worth noting.

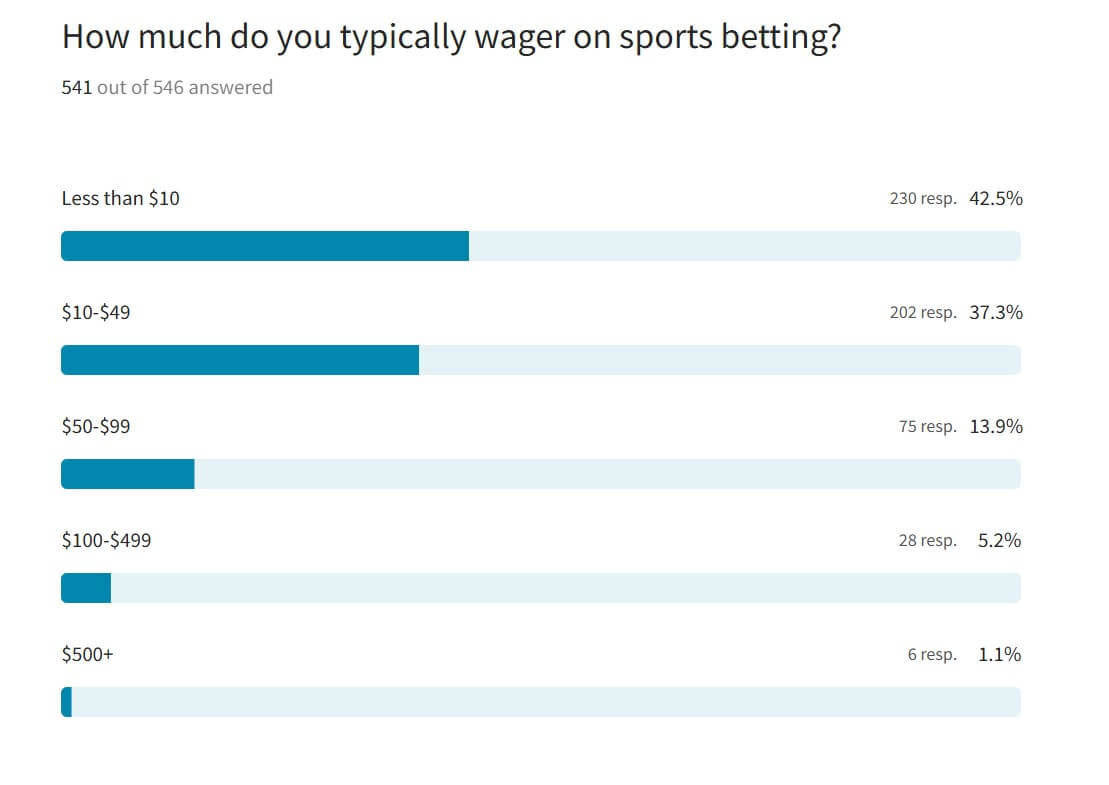

Covers' survey (done via Prolific) found 42.5% of respondents typically wager less than $10 and that 37.3% bet between $10 and $49. In other words, more than three-quarters of respondents said they are making regular wagers of less than $50, and each of those bets will cost an added 50 cents come September.

Another 13.9% of respondents said they typically bet between $50 to $99, 5.2% between $100 and $499, and 1.1% more than $500. So, most bettors may be keeping their wagers relatively small, and it's those customers who could bear the brunt of the new transaction fees.

Well, there it is: DraftKings says it will implement a 50-cent transaction fee in Illinois on all online sports wagers starting in September, just as FanDuel is already planning to do. pic.twitter.com/FicZelc5iP

— Geoff Zochodne (@GeoffZochodne) June 12, 2025

Asked how much fees, odds, and promotions affect their choice of sportsbook, 34.8% of respondents to the Covers survey said "a lot," while 29.2% said "somewhat," 18.5% said "a little," 9.2% said it was "the most important factor," and 8.3% said it had no bearing on them.

Nevertheless, while a 50-cent fee might have some bettors considering a new sportsbook, that sportsbook could still be a regulated one rather than an offshore, unregulated entity.

Asked if they'd consider using an offshore sportsbook to avoid betting fees, 29.4% of respondents to the Covers survey said yes. However, another 40% said no, 28.8% were unsure, and 1.9% said they were already using one.

Enjoying Covers content? Add us as a preferred source on your Google account

And that's the bottom line

Some bank analysts don’t seem to be too worried about the decision by the two online sportsbooks. At least one even sees some upside to the new Illinois sports betting tax.

David Katz, analyst at investment bank Jefferies, wrote in a note to clients on Friday that the 50-cent transaction fee “should act as a small headwind to handle growth” in Illinois. In other words, a surcharge might prompt bettors to bet less.

Katz also wrote that DraftKings and FanDuel could increase their net revenue by $5 million with their new fees. This is because the operators plan to charge a flat 50-cent fee for all wagers, even though the first 20 million bets they take will only be subject to a 25-cent tax.

“We believe that this additional revenue would fall to [earnings before interest, taxes, depreciation, and amortization] at nearly 100%, given that there are no incremental expenses associated with the move,” Katz said. “In theory, the transaction fee should act as a small headwind to handle growth in the state. However, this incremental EBITDA will, in our view, mostly offset any potential handle loss from the transaction fee.”

Some interesting numbers from Citizens and @juice_reel, apropos of the 50-cent fee DraftKings and FanDuel plan to charge bettors in Illinois.

— Geoff Zochodne (@GeoffZochodne) June 13, 2025

Whether it's a single or a parlay, the data suggests bettors are usually wagering somewhere around $3 to $100 a pop. pic.twitter.com/14jMEaLy67

There is a good chance many bettors just bite the bullet in Illinois.

Investment bank Citizens, citing data from bet-tracker Juice Reel, said the average sports betting wager size is $35 to $40, "implying the average bettor in Illinois should be largely unmoved by the $0.50 surcharge."

The data compiled by Juice Reel found the average bet size among its users over the past year was $48 for singles and $24 for parlays, with the average bet size overall around $38.

Of the bets logged by Juice Reel, 4.4% were between a penny and 50 cents, 5.9% between 41 cents and a dollar, 9.9% between $1.01 and $3, 15.6% between $3.01 and $5, 32% between $5.01 and $20, 25.7% between $20.01 and $100, and 6.6% were more than $100.

Citizens estimates that wagers under $3 have higher margins, because it means players are betting a little to win a lot on longshots that will more likely lose. Even so, the bank sees a reduction in those kind of wagers getting offset by the flat 50-cent fee.

In a "worst-case scenario," wherein no one makes a bet with FanDuel under $3 when the company's new surcharge goes into effect, FanDuel would lose around $15 million of revenue, Citizens said.

The hit, though, would be lessened by more than $5 million because the first 20 million bets taken by FanDuel would be subject to a 25-cent tax, but a 50-cent transaction fee.

"We know these players would not all leave the market or find another sportsbook (onshore or offshore), and, more likely than not, the average bet size would move up, more than offsetting the -$10M net impact," Citizens analyst Jordan Bender wrote last week. "Overall, we expect close to no impact on the underlying consumer and FanDuel as a result of the surcharge."