Entering the 2025 football season, Louisiana is looking to defend its crown.

It won’t be in the college ranks, where despite an impressive Week 1 victory, the LSU Tigers have still not reached the levels of their undefeated 2019 championship season. It also won’t be for the New Orleans Saints, who have one of the NFL’s lowest projected win totals entering the 2025 season.

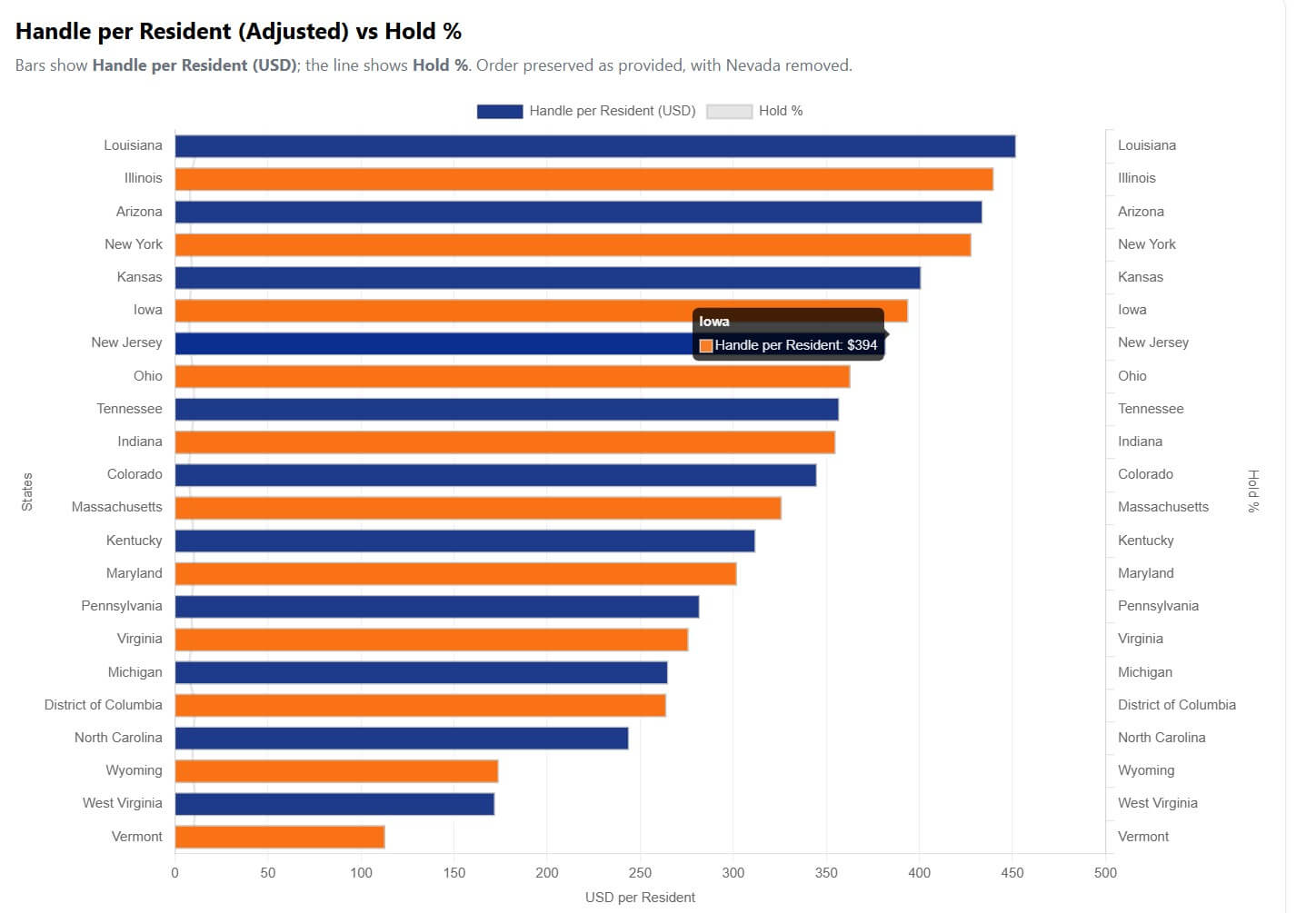

It will be for the most bet last fall, per person, on an income-adjusted basis.

- Louisiana bettors wagered more last fall than any other jurisdiction surveyed, considering the state's median household income in relation to the national average.

- Illinois, Arizona, New York, and Kansas rounded out the Top 5.

- Vermont, Wyoming, and West Virginia were among the lowest-grossing states, even when adjusted for income.

When adjusted for national median household incomes, Louisiana bettors wagered more money per person during the 2024 football season than any other state in an analysis run by Covers. This report looked at all 21 states (plus Washington, D.C.) that had three or more legal national sportsbooks live between September and December of last year.

Though New York and New Jersey topped the list in total football season handle per capita, Louisiana was the leader when those numbers were adjusted for the state’s median income level.

Louisiana remains football hotbed

Despite the relatively unsuccessful 2024 seasons from its most prominent teams, Louisiana’s sports betting figures show football is still king in the Bayou.

Louisiana bettors wagered just over $1.55 billion between September and December of last year, covering all the 2024 college football regular season and all but one week of the NFL regular season. That averages out to $339 wagered per person during that four-month stretch, which would place it 11th of the 22 qualifying states in the analysis.

But Louisiana’s per capita income is significantly lower than the national median household average. When adjusting Louisiana’s income levels against the national 50-state average, the $339 is more akin to $452, which tops the nation.

Equally football-crazy Texas surely plays a notable factor in the betting totals in Louisiana, the nearest state for most Texans to place a legal mobile sports bet. But even considering the out-of-state influence, Louisiana remains a hotbed of football betting entering 2025.

The Bayou State is also one of the best football season environments for the state’s legal sportsbooks. Louisiana’s 12.38% hold percentage, the amount books win off bettors, was the highest in the country.

This means that not only are Louisianians betting more than anyone else, they are also losing at a higher rate.

Rounding out to the top 5

It doesn’t have nearly the college football pedigree as Louisiana – or even the ability to bet legally on in-state teams – but Illinois takes the No. 2 spot in last year’s football season betting rankings.

Illinois’ median income is just below the national average, meaning its $440 in adjusted per capita football season betting spend is right around its actual per capita total. The state, the second-most populated with legal statewide mobile sports betting behind New York, accepted nearly $5.78 billion in football season betting handle last year, which was also second most behind New York’s nearly $9 billion during that time.

Illinois is also second-highest in per capita bets, unadjusted for income, behind only New Jersey, which has a higher median household income.

The Chicago Bears remain massively popular in the Chicagoland area and across the state, a major driver in the state’s betting interest. With high expectations heading into the season behind second-year quarterback Caleb Williams and first-year head coach Ben Johnson, Illinois is poised to top last year’s handle and per capita spend.

The Bears are set to be the only in-state football team, pro or college, to draw significant betting interest from in-state bettors. Illinois is one of a handful of states that prohibits bets on in-state programs, meaning bettors in the Prairie State will remain without an opportunity to wager on Big Ten teams from Northwestern or Illinois in 2025.

Arizona, New York, and Kansas round out the Top 5.

Kansas’ high per capita spending last year was undoubtedly boosted by another Super Bowl run from the Kansas City Chiefs. The Sunflower State’s 2025 betting handle could take a hit when Missouri’s first legal sportsbooks start taking bets Dec. 1.

Bottom Five

Vermont is renowned for its autumn foliage. Its fall betting is far less noteworthy.

Bettors in Vermont wagered $119 between September and December, the lowest per capita figure of any state. With a median household income roughly that of the national average, Vermont still had the lowest total among the 22 jurisdictions.

The Green Mountain state has no professional teams or major college football programs, factors that hurt Vermont’s sports betting interest. A subpar 2024 season by the New England Patriots, the state’s ostensible home team, also likely played a factor.

West Virginia and Wyoming finished second and third-to-last, respectively. Neither has a professional sports NFL team or college programs with particularly strong 2024 seasons.

North Carolina and Washington, D.C. rounded out the bottom five. Poor seasons by the Carolina Panthers and the state’s in-state college football programs could have played a factor in a state better associated with college basketball fanaticism.

D.C. surprised given the unexpected 2024 success of the Washington Commanders, far and way the most popular college or pro team in the District. It fell down the rankings of adjusted spending due to its nation-leading median household income, but it would have finished middle-of-the-pack just accounting for unadjusted per capita spend.

Notably, fall 2024 was the first time Washington D.C. had a full football season with a legal, competitive mobile sports betting market.

The Nation’s Capital is also unusual in that it sees hundreds of thousands of Maryland and Virginia residents pass through the city but don’t live there, which could impact its handle. Still, both Maryland and Virginia where in the bottom half when adjusted for per capita spend.

Other notes

The observation of September through December 2024 betting totals considered several factors when evaluating football interest.

- Few states break out handle by specific sport, but bookmakers across-the-board acknowledge football is far-and-away the most wagered upon sport. It’s safe to project that a sizeable majority of autumn betting handle comes from football.

- To try to even comparisons, only states with at least three mobile sportsbooks from major national brands were included in the analysis. States with two or fewer options have significantly lower per-capita spend totals, making the comparison unfair against a competitive market.

- Nevada was not included because it only has two major national brands, Caesars and BetMGM. America’s gambling capital also has disproportionate gambling spend, largely from tourists. If Nevada was included, its adjusted per capita betting spend would have been more than double Louisiana’s.