Sports Betting News

NFL Headlines

Before You Bet: NBA, MLB and CBB Best Bets from Joe Osborne & Co.

This week's best baseball and basketball bets from Covers experts.

NFL Draft Odds 2024: Caleb Williams Destined for Chicago

Williams checks in at -20,000

2024-25 NFL MVP Odds: Mahomes Favored to win MVP No. 3

Mahomes favored to add to his trophy case.

NFL Playoff Odds: 49ers, Chiefs Heavily Favored to Make Postseason

49ers, Chiefs are heavy favorites to make the postseason.

Super Bowl Odds 2025: 49ers, Chiefs Lead, Texans on the Rise with Diggs Arrival

Which team can better their SB odds post-draft?

NBA Headlines

Kings vs Pelicans Predictions, Picks, Odds for Tonight's NBA Playoff Game

Ingram struggles to produce offense vs. Sacramento.

Bulls vs Heat Predictions, Picks, Odds for Tonight's NBA Playoff Game

Bam Adebayo picks up the slack.

Best Bulls vs Heat Player Props Tonight: Miami Puts Clamps on DeRozan

Can DeMar crack Heat zone?

NBA Playoff Predictions: Expert Picks for the 2024 NBA Playoffs and NBA Finals

The playoffs are, and the picks are in.

Lakers vs Nuggets Predictions, Picks, Odds for Tonight’s NBA Playoff Game

Davis comes up clutch in Game 1.

NCAAF Headlines

Before You Bet: NBA, MLB and CBB Best Bets from Joe Osborne & Co.

This week's best baseball and basketball bets from Covers experts.

2024 College Football Win Totals: Buckeyes Saddled With High Expectations

Buckeyes saddled with high expectations.

2024 Heisman Trophy Odds: Ewers Leads Crowded Pack

Texas signal caller leads Beck, Gabriel.

CFP National Championship Odds & Betting Lines 2025: Georgia Favored, Buckeyes Gaining Steam

Georgia opens as early CFP favorites.

NCAAF Odds: A Way Too Early Look at the 5 Biggest Games of 2024

Longhorns face early litmus test vs. Michigan.

NCAAB Headlines

Best March Madness Betting Promos and Bonuses 2025

We rank the best March Madness betting promos for 2025.

Next Kentucky Head Coach Odds and Predictions: Can't Bear to See It

Scott Drew may not be in Kansas anymore.

Purdue vs UConn Predictions, Picks, and Odds for Tonight's National Championship Game

Tristen Newton's playmaking helps UConn go back-to-back.

Purdue vs UConn Props and Best Bets for the National Championship Game: Edey Does It

Who to target in the National Championship Game.

Purdue vs UConn Odds, Injuries & Last Minute News for Bettors

Get in the know on tonight's final.

MLB Headlines

Today’s MLB Prop Picks and Best Bets: Hancock Struggles in Denver's High Altitude

The altitude in Denver is a different beast — especially for first-timers.

Blue Jays vs Padres Prediction, Picks, and Odds for Tonight’s MLB Game

Blue bats get to work against Friars.

Diamondbacks vs Giants Prediction, Picks, and Odds for Tonight’s MLB Game

Offenses tee off as Snell and Montgomery get acclimated.

Rays vs Yankees Prediction, Picks, and Odds for Tonight’s MLB Game

Tampa's Rosario stays hot to begin 2024.

Rangers vs Braves Prediction, Picks, and Odds for Tonight’s MLB Game

Ozuna stays hot against lefty pitching.

NHL Headlines

Stanley Cup Playoffs Scoring Props: Rack Em' Up, Mac

Avs superstar continues his impressive season.

Islanders vs Hurricanes Predictions, Picks, and Odds for Tonight’s NHL Playoff Game

Canes forward makes his mark in Game 1.

Los Angeles Kings vs Edmonton Oilers NHL Playoffs Series Odds, Picks & Preview

McDavid & Co. send L.A. packing again.

NHL Playoff Odds: Updated NHL Playoffs Series Odds and Betting Lines

Check back regularly for up-to-date NHL Playoff odds.

Toronto Maple Leafs vs Boston Bruins NHL Playoffs Series Odds, Picks & Preview

Can Toronto find a way to slay the dragon?

Soccer Headlines

Ballon d'Or Odds 2024: Jude Bellingham Leads the Pack

Bellingham's solid season at Madrid have him out in front.

Real Madrid vs Barcelona Predictions and Picks for Today’s La Liga Match

Defense gives Madrid a clear advantage on Sunday.

Euro 2024 Odds: England Slight Favorites Ahead of France

England among tournament betting favorites.

Fulham vs Liverpool Predictions and Picks for Sunday's EPL Matchup

Reds dead-set on redemption.

Wolves vs Arsenal Predictions and Picks for Today’s EPL Matchup

Plenty of motivation for attackers.

Golf Headlines

RBC Heritage Picks, Live Odds, and Field: Tracking the Action at Harbour Town

The World No. 1 continues his run at Harbour Town.

PGA Championship Odds & Updated Betting Lines: Top Dogs Head to Valhalla

Can Rory win at Valhalla as he did in 2014?

Masters Odds & Updated Betting Lines: Scheffler Secures Green Jacket, Favored to Go Back-to-Back

World No. 1 favored yet again at Augusta.

Masters 2024 Picks & Predictions: Outrights and Matchup Best Bets

We tee up our best golf picks, predictions for the Masters.

Masters Odds, Picks, and Predictions Ahead of Round 4: Home Sweet Homa

Homa is garnering attention for all the right reasons.

Horse Racing Headlines

Kentucky Derby Odds & Betting Lines 2024: Sierra Leone Leads the Way

Brown colt favored after Blue Grass victory.

Grand National 2024 Picks and Best Bets: Limerick Lace Leaps Out

This mare stands a chance vs. the boys.

Road to the Kentucky Derby Picks and Best Bets for April 6: Blue Grass Stakes and Wood Memorial

Can Cox capture Keeneland's Blue Grass Stakes?

Breeders' Cup Odds: White Abarrio Wins 40th Classic, Del Mar to Host in 2024

Race Day colt captures 40th renewal of Classic.

Road to the Kentucky Derby Picks and Best Bets for March 23: Louisiana Derby and Jeff Ruby Steaks

Louisiana Derby, Jeff Ruby Steaks are first 100-point preps.

UFC Headlines

Conor McGregor vs Michael Chandler Odds: Bout Finalized for UFC 303 on June 29

McGregor is set to make his return at UFC 303 in June.

UFC 300 Pereira vs Hill Odds, Picks, and Predictions: Belt Stays Put in Light Heavyweight Clash

Pereira hits heavy and ends things early.

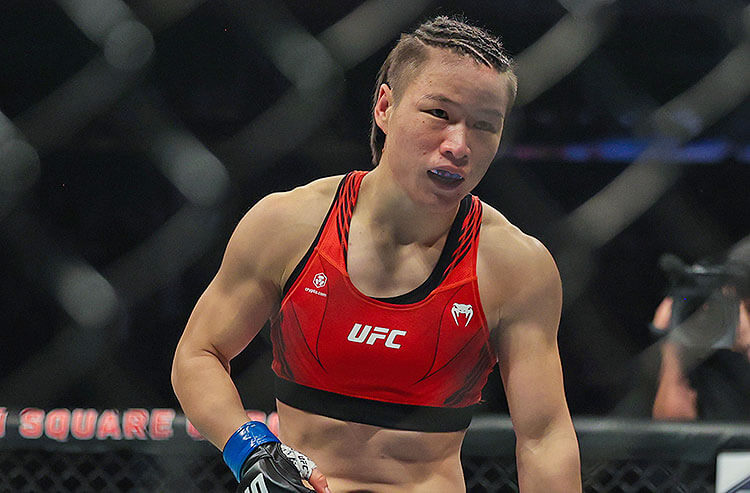

UFC 300 Weili vs Xiaonan Odds, Picks, and Predictions: Weili Won't Allow For Wild Upset

Weili overwhelms her opponent.

UFC 300 Prelim Picks and Predictions: Sterling Won't Settle For Silver

Aljamain Sterling headlines packed undercard.

UFC 300 Prochazka vs Rakic Odds, Picks, and Predictions: Rakic Says I Quit

Rakic's first fight in nearly two years doesn't end well.

Industry Headlines

$1.1 Million Lawsuit Filed By NHL Alumni Association Against PointsBet Canada

PointsBet argues current process cannot be sustained.

888 Holdings PLC Drives €431 Million in Revenue in Q1 2024

The retail segment was down 7% year-over-year while international dropped just 2%.

Jontay Porter Wasn’t on Road to NBA Stardom Before Betting Scandal Derailed Career

Mohawk Council and Canada Strike New Deal With Possible Online Gambling Implications

New MOU could have online gambling effects for Canada.

Alabama Gambling Bill Package Set for Next Round of Discussion

Legislation could bring the state’s first commercial casinos