Sports Betting News

NFL Headlines

NFL Draft Betting Odds 2024: Jayden Daniels Penciled in at No. 2

Commanders appear set on Daniels at No. 2.

2024 NFL Mock Draft Version 4: Maye, McCarthy, Daniels Jockey After Williams Goes No. 1

Everything in flux after obvious No. 1

NFL Rookie of the Year Odds 2024: The Future is Bright in the Windy City

Can Williams make an immediate impact in the Windy City?

2024-25 NFL Coach of the Year Award Odds: Harbaugh Favored in Chargers Return

Harbaugh favored as he looks to re-invent the Chargers.

Before You Bet: NBA, MLB and CBB Best Bets from Joe Osborne & Co.

This week's best baseball and basketball bets from Covers experts.

NBA Headlines

Mavericks vs Clippers Predictions, Picks, Odds for Tonight’s NBA Playoff Game

Can Harden replicate his Game 1 performance?

Pacers vs Bucks Predictions, Picks, Odds for Tonight’s NBA Playoff Game

Dame Time doesn't go according to plan.

Suns vs Timberwolves Predictions, Picks, Odds for Tonight’s NBA Playoff Game

Karl-Anthony Towns lends a hand in Game 2.

NBA Odds, News & Notes: Let's Talk About Game 2s

Indiana looks much more comfortable in Game 2.

NBA Playoff Odds: Updated NBA Playoffs Series Odds and Betting Lines

Get updated betting odds for the 2024 NBA Playoffs.

NCAAF Headlines

Before You Bet: NBA, MLB and CBB Best Bets from Joe Osborne & Co.

This week's best baseball and basketball bets from Covers experts.

2024 College Football Win Totals: Buckeyes Saddled With High Expectations

Buckeyes saddled with high expectations.

2024 Heisman Trophy Odds: Ewers Leads Crowded Pack

Texas signal caller leads Beck, Gabriel.

CFP National Championship Odds & Betting Lines 2025: Georgia Favored, Buckeyes Gaining Steam

Georgia opens as early CFP favorites.

NCAAF Odds: A Way Too Early Look at the 5 Biggest Games of 2024

Longhorns face early litmus test vs. Michigan.

NCAAB Headlines

Best March Madness Betting Promos and Bonuses 2025

We rank the best March Madness betting promos for 2025.

Next Kentucky Head Coach Odds and Predictions: Can't Bear to See It

Scott Drew may not be in Kansas anymore.

Purdue vs UConn Predictions, Picks, and Odds for Tonight's National Championship Game

Tristen Newton's playmaking helps UConn go back-to-back.

Purdue vs UConn Props and Best Bets for the National Championship Game: Edey Does It

Who to target in the National Championship Game.

Purdue vs UConn Odds, Injuries & Last Minute News for Bettors

Get in the know on tonight's final.

MLB Headlines

Mariners vs Rangers Prediction, Picks, and Odds for Tonight’s MLB Game

Texas pitcher dazzles the Arlington crowd.

2024 MLB Home Run Title Odds: Ozuna Looks to Sustain Power Production

Is Marcell Ozuna being undervalued?

A's vs Yankees Prediction, Picks, and Odds for Tonight’s MLB Game

New York's offense wakes up after shutout loss.

2024 MLB Playoff Odds: Dodgers Don't Need to Push Panic Button

Dodgers hardly look like world-beaters in the early going.

Blue Jays vs Royals Prediction, Picks, and Odds for Tonight’s MLB Game

Gausman, Wacha silence the bats early.

NHL Headlines

Predators vs Canucks Predictions, Picks, and Odds for Tonight’s NHL Playoff Game

Lack of shots not sustainable in this series.

Avalanche vs Jets Predictions, Picks, and Odds for Tonight’s NHL Playoff Game

Jets use Avs goaltending woes to their advantage.

Stanley Cup Predictions 2024: Who Will Win NHL Championship?

Get the low down on the upcoming NHL playoffs.

Lightning vs Panthers Predictions, Picks, and Odds for Tonight’s NHL Playoff Game

This Bolt breaks out in Game 2.

Capitals vs Rangers Predictions, Picks, and Odds for Tonight’s NHL Playoff Game

Rangers outclass Capitals once again.

Soccer Headlines

Arsenal vs Chelsea Predictions and Picks for Today’s EPL Matchup

Blues bumble through midweek match.

2024 Copa America Odds & Betting Favorites: Argentina's Odds Shortening

Defending the crown won't be easy.

2023-24 EPL Title Odds: City Remain the Team to Beat

Arsenal lead the EPL, still second betting choice.

Premier League Predictions, Odds, and Schedule This Week

Arsenal, Liverpool and Man City all looking for three points.

Everton vs Liverpool Predictions and Picks for Today’s EPL Matchup

Liverpool make quick work of Everton.

Golf Headlines

U.S. Open Odds & Updated Betting Lines: Golf's Toughest Test Heads to Pinehurst

The toughest test in golf heads to Pinehurst in 2024.

LIV Golf Adelaide Picks & Odds: Rahm Trending Down, Still Favored Down Under

Will this be the week of Rahm's first LIV win?

Zurich Classic Picks, Odds, and Field: Schauffele-Cantlay Duo Favored in New Orleans

Schauffele, Cantlay the guys to beat at TPC Louisiana.

Zurich Classic Sleeper Picks and Predictions: Horschel-Alexander Pairing Deserves More Love

There's a lot to love about Billy Horschel's team this week.

PGA Championship Odds & Updated Betting Lines: Top Dogs Head to Valhalla

Can Rory win at Valhalla as he did in 2014?

Horse Racing Headlines

Pari-Mutuel Betting Guide: Learn How to Bet on Horse Racing Like a Pro

Learn how to bet on horse racing like a pro.

How to Bet on the Kentucky Derby: Bet Types, Tips & More

Learn how to wager on the first jewel of horse racing's Triple Crown.

Kentucky Derby Horses Lineup: 2024 Field, Expert Rankings & More

Ranking all of the top three-year-olds in racing.

Kentucky Derby Odds & Betting Lines 2024: Sierra Leone Leads the Way

Brown colt favored after Blue Grass victory.

Kentucky Derby Betting Pool Ideas

Looking for fun ways to enjoy the Kentucky Derby?

UFC Headlines

Conor McGregor vs Michael Chandler Odds: Bout Finalized for UFC 303 on June 29

McGregor is set to make his return at UFC 303 in June.

UFC 300 Pereira vs Hill Odds, Picks, and Predictions: Belt Stays Put in Light Heavyweight Clash

Pereira hits heavy and ends things early.

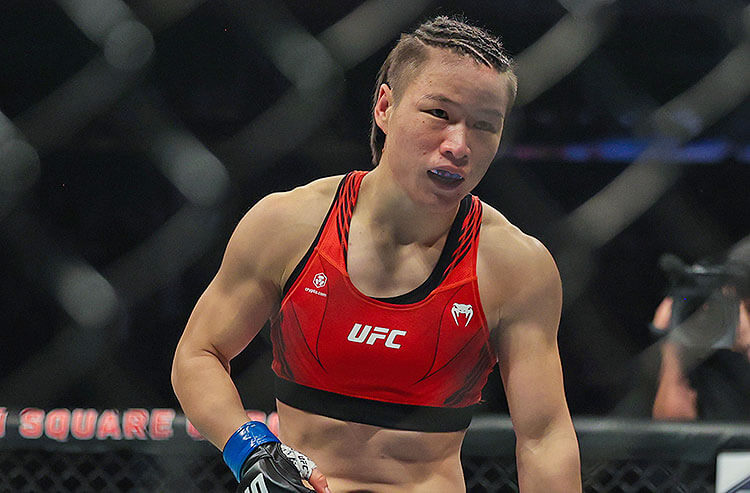

UFC 300 Weili vs Xiaonan Odds, Picks, and Predictions: Weili Won't Allow For Wild Upset

Weili overwhelms her opponent.

UFC 300 Prelim Picks and Predictions: Sterling Won't Settle For Silver

Aljamain Sterling headlines packed undercard.

UFC 300 Prochazka vs Rakic Odds, Picks, and Predictions: Rakic Says I Quit

Rakic's first fight in nearly two years doesn't end well.

Industry Headlines

Major Sports Betting Compliance Companies Complete Merger, Rebrand as Integrity Compliance 360

Rebranded as Integrity Compliance 360.

Massachusetts Sees 20% Increase in March Sports Betting Handle Compared to Previous Month

The latest monthly handle is the second highest in Bay State history.

Kentucky Regulators Reviewing NCAA Request for College Player Prop Betting Ban

Regulators still undecided about the fate of player props.

NFL Reinstates Eagles' Isaiah Rodgers Following Gambling Suspension

Rodgers joins five others reinstated last week.

Quebec Online Gaming Coalition Calls For Regulatory Model for Sports Betting in Province

Coalition argues for similar model to Ontario.